Dan Groben

Phillip Menard

Servant Advisors

1028 Oakhaven Road

Memphis, TN 38119

901.922.6001

Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

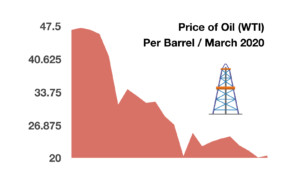

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

To our valued clients:

Over the past 3 to 4 weeks the world certainly feels like a different place; most of us are “sheltering in place” at our homes and getting use to our new normal.

The outbreak of the Corona virus has also created a bit of volatility in the financial markets; causing the VIX (volatility index) to set new records along the way. While this can be uncomfortable, it also creates opportunities. Along these lines, we have added new positions to our accounts and will continue to do so in a cautious manner as good values present themselves. Below is our latest monthly news letter recapping the last month at a macro level and sharing some insights.

Macro Overview

Equities Technically End Eleven Year Bull Market Run – Domestic Stock Market Overview

Equity markets experienced volatility in March not seen since the 1930s, with daily declines so sharp that rarely-used mechanisms to halt trading were activated by the exchanges on multiple occasions. The S&P 500 Index saw an average daily change of 5.2% in March, the most extreme volatility since November 1929.

Stocks fell into bear market territory and then out of it in technically the shortest bear market in history. The last time the Dow Jones Index went from its bear market low to a bull market in only three days was in October 1931. Stocks had their worst quarter in years, with the S&P 500 Index losing 20% for the quarter ending March 31st, and the Dow Jones Industrial Index surrendering 23%. The bull market that began in March 2009, officially came to an end in March, after an 11-year run. The Dow Jones Industrial Index went from its high on Feb 12th to bear market territory in only19 trading sessions.

Signs of resilience at the end of March suggest that equities may regain their footing sometime soon. Overall valuations on stocks have fallen to levels that warrant accumulation of certain companies and industries. Eyes will be on earnings and quarterly performance releases over the next few weeks, as analysts determine how much of an impact the pandemic has thus had.

Sources: S&P, Dow Jones, Bloomberg

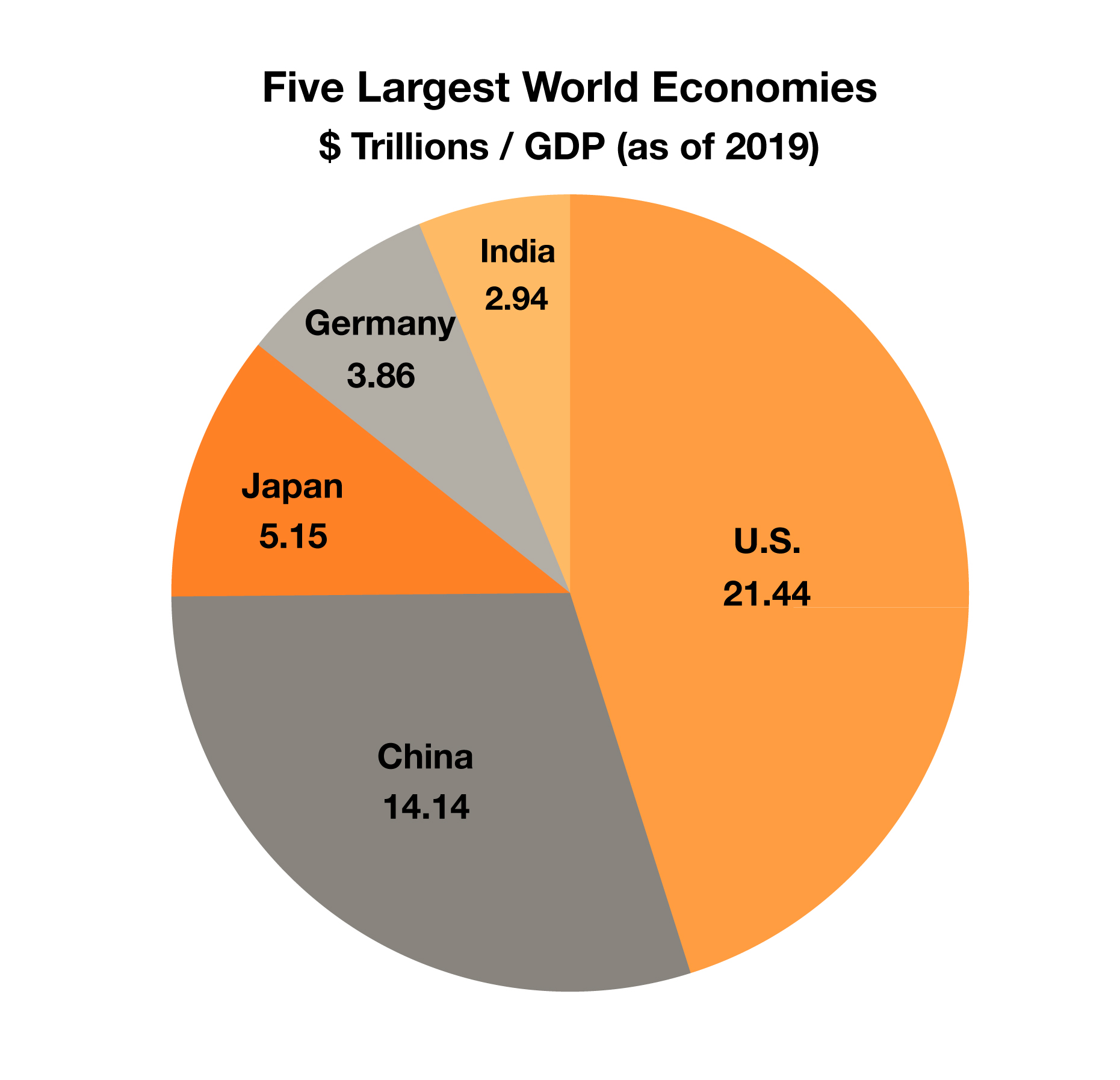

China is referred to as “the world’s factory,”producing a broad range of items from shoes and socks to hammers and computers. The country’s enormous manufacturing base allows it to export massive volumes of goods globally, meeting demand from nearly every consumer in the world. China has experienced exponential growth over the past few decades, from a GDP of $305 billion in 1980, to over $14 trillion this past year, making it the second largest economy after the United States. The difference in GDP between the two nations’ economies has been shrinking over the years, as Chinese economic growth has consistently outpaced that of the United States. (Source: World Bank)

China is referred to as “the world’s factory,”producing a broad range of items from shoes and socks to hammers and computers. The country’s enormous manufacturing base allows it to export massive volumes of goods globally, meeting demand from nearly every consumer in the world. China has experienced exponential growth over the past few decades, from a GDP of $305 billion in 1980, to over $14 trillion this past year, making it the second largest economy after the United States. The difference in GDP between the two nations’ economies has been shrinking over the years, as Chinese economic growth has consistently outpaced that of the United States. (Source: World Bank)