Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Stimulus payments from the second pandemic relief package were received in January and February, lifting economic activity and increasing personal incomes and expenditures. Some economists, however, believe that the rise in incomes and expenditures are short-lived. An anticipated third round of stimulus payments is expected to produce additional consumer activity throughout the economy. In addition to stimulus cash payments, extended unemployment benefits as well as revised funding for small businesses are planned.

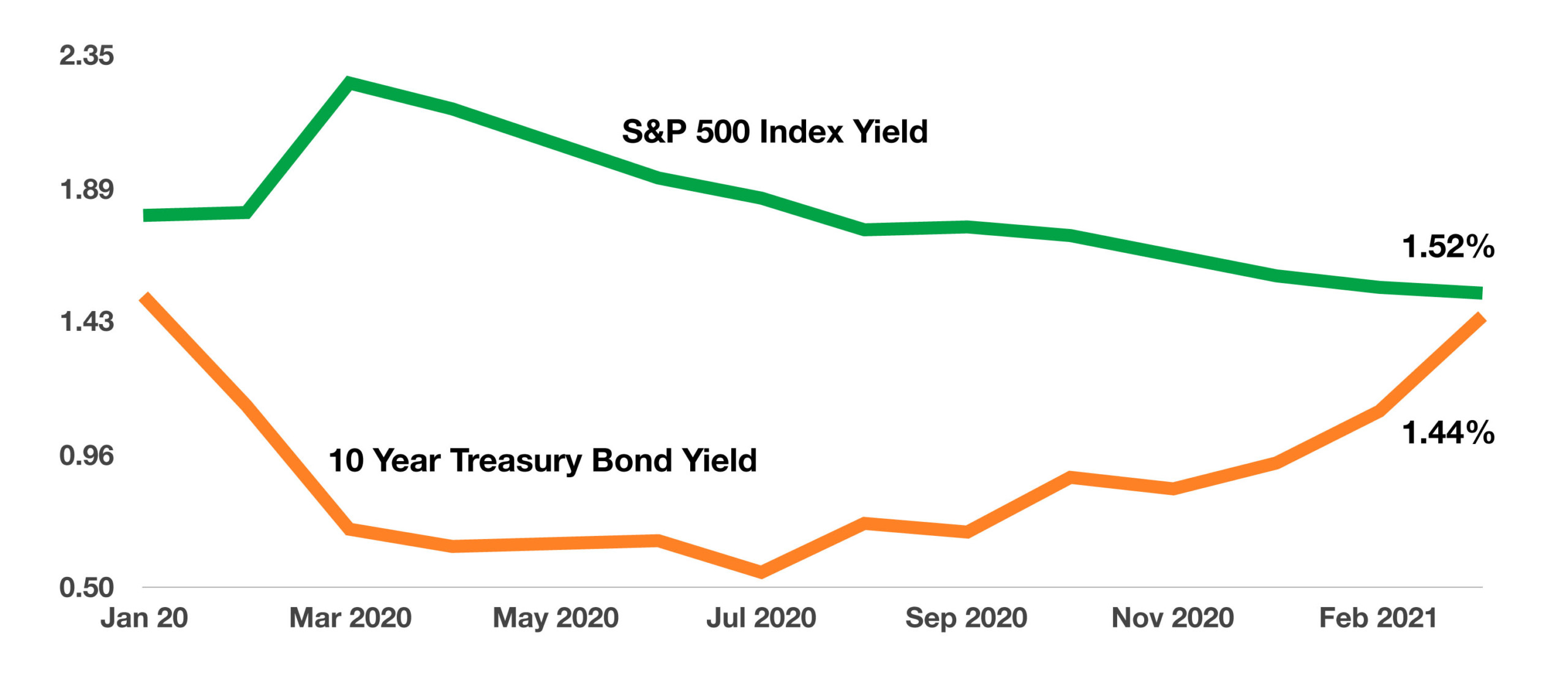

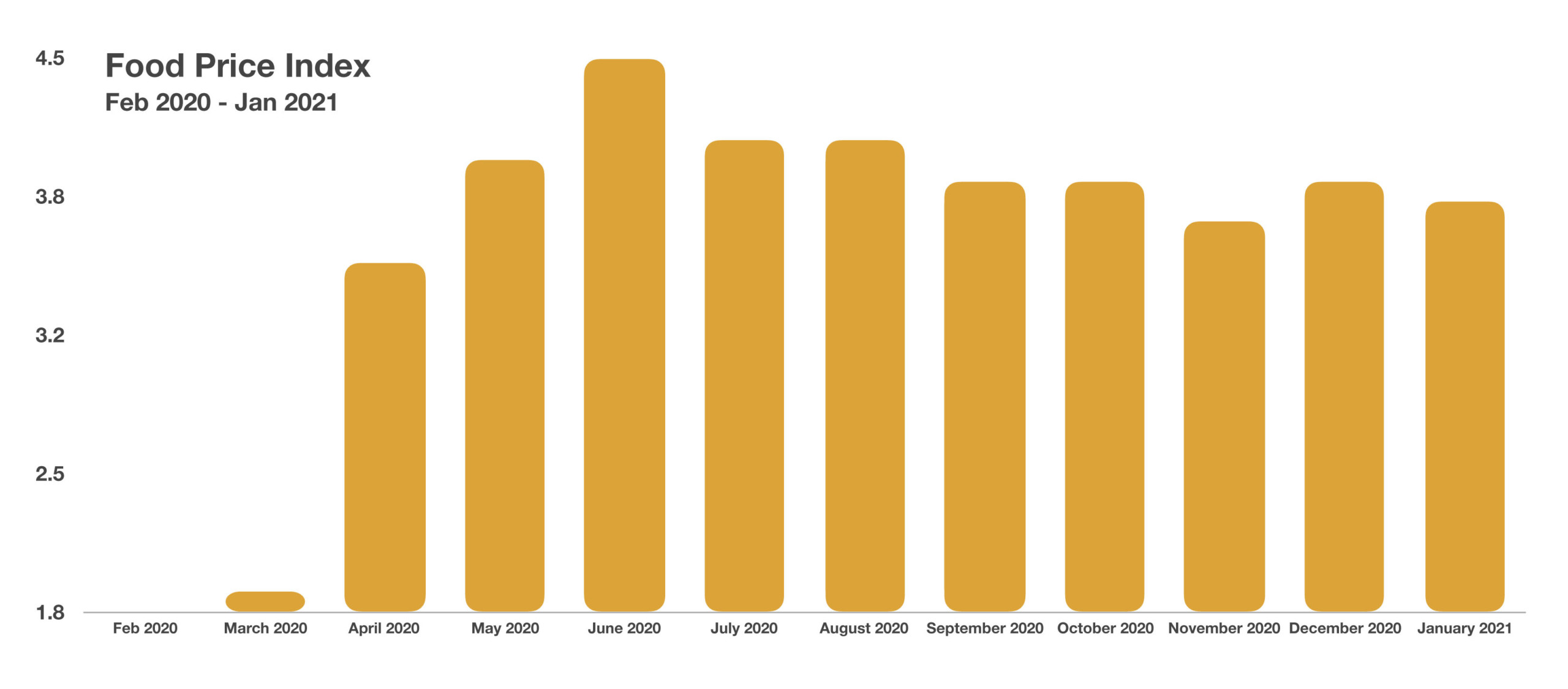

Continued optimism regarding vaccinations and stimulus funds reaching consumers propelled growth estimates higher, along with inflationary expectations. Inflation has become a key concern among economists and market analysts as interest rates and food prices rise. Historically, rising interest rates have been indicative of improving economic activity, while higher prices for goods and services are considered inflationary.

Over 72.8 million Americans received a COVID-19 vaccination as of the end of February, as reported by the Centers for Disease Control and Prevention (CDC). Those who were vaccinated with a first dose made up 14.6% of the U.S. population as of February 27th, with 7.1% having received a second dose. The recent approval of a single-dose vaccination may help speed up the vaccination process for millions of Americans over the next few months.

The IRS began accepting and processing tax returns for tax year 2020 in February, later than usual because of delays related to pandemic relief programs executed in December. Taxpayers, eager to receive delayed tax refunds, have filed returns at a higher-than-average rate thus far.

Stocks influenced by rapid communication by online users and traders, also referred to as “meme stocks,” fluctuated in price dramatically in February as speculation drove trading high volume. Traditional investors largely scrutinized the recent phenomenon as a fad induced by speculative behavior.

Pentagon officials reported that roughly a third of all U.S. troops that who were been offered the COVID-19 vaccination have declined it. Vaccinations are still voluntary for military personnel, but may eventually become mandatory as the FDA approves additional vaccines.

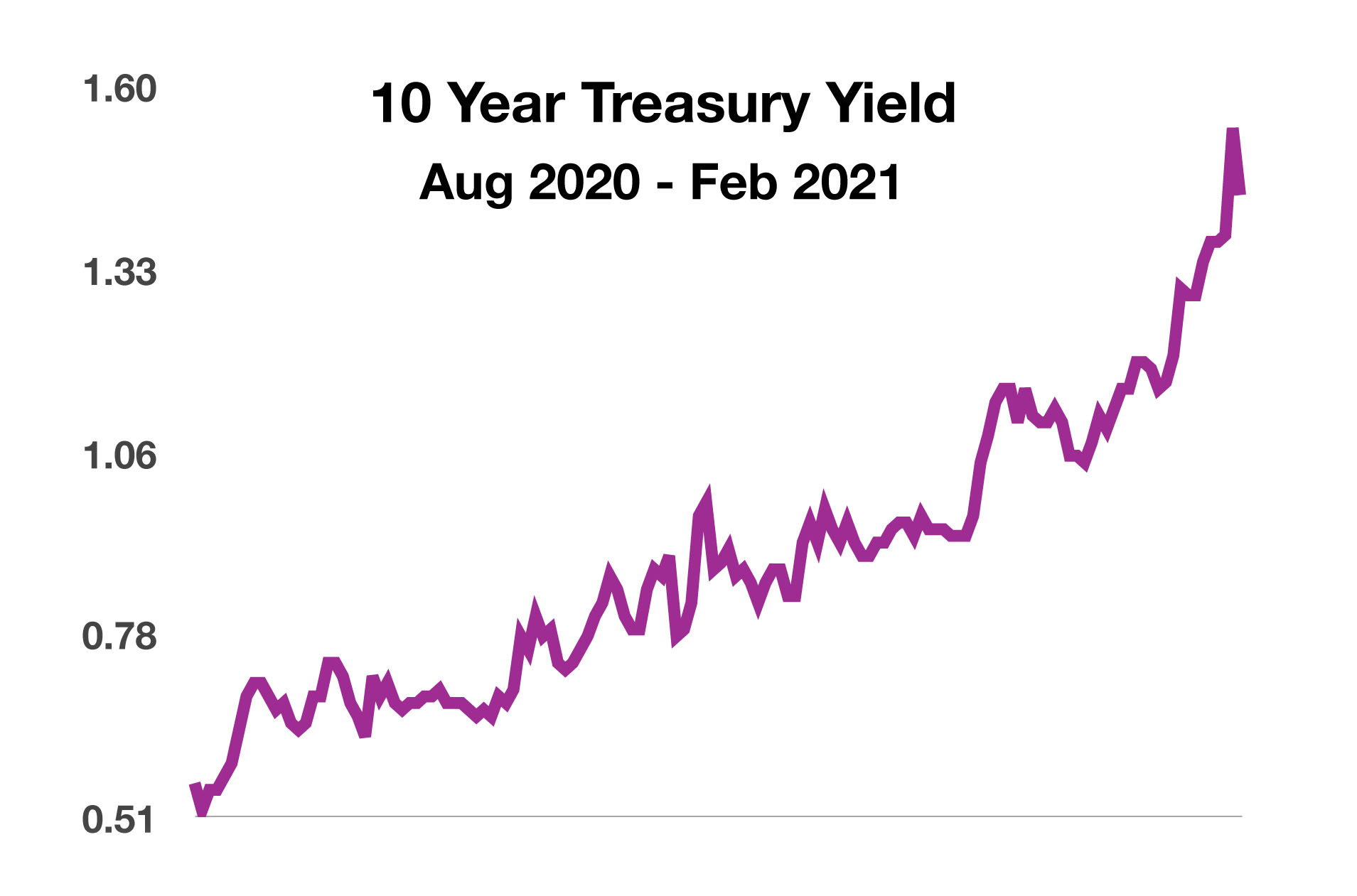

Rising rates in February affected mortgage and various consumer loans as the yield on the 10- year Treasury bond surpassed 1.5%, nearly three times the yield from its low of 0.52% in August 2020. The 10-year Treasury bond yield is closely followed by markets as a gauge for economic expansion and inflation expectations. (Sources: CDC, defense.gov, U.S. Dept. of Agriculture, Treasury, Federal Reserve)