Domestic & International Oil Prices Divert – Commodities Update

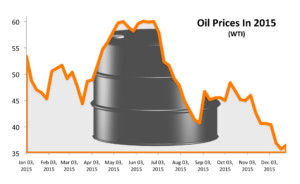

The price of oil declined 1.5% during August to $95.87 (WTI) and the more widely used global oil benchmark, Brent crude, declined 3.2% to $103.07.

WTI represents the price that U.S. oil producers receive and Brent represents the prices received internationally. The two prices have been diverting due to a recent surge in production in the United States that has caused a buildup of crude oil inventories at Cushing, Oklahoma, where WTI is stored and priced. Before this increase in U.S. oil production, the two crudes had historically traded in line with each other.

Fears of a slowdown in demand also occurred in August as Chinese manufacturing activity weakened to a 3-month low, with the preliminary HSBC China Manufacturing Purchasing Managers Index slipping to 50.3 compared with 51.7 for July.

Oil prices declined despite the ongoing geopolitical tensions in many parts of the oil producing world. The Russian-Ukraine situation, the Israel-Gaza conflict, and the rise of ISIS in Iraq and Syria all remained unresolved as of the end of the month but material disruptions in supply have not occurred, at least at levels high enough to offset the reduction in demand due to slowing global economic growth.

Another constant pressure on oil prices from the demand side is the great changes we have seen in automotive technology. Rapid advances in engine and vehicle design are creating more fuel efficient cars and the materials used to make cars are getting lighter and stronger. Electric and hybrid cars, as well as those powered by natural gas will also have an effect on demand for oil. Analysts have calculated that if the fuel efficiency of cars and trucks improves by an average of 2.5% a year, it will be enough to measurably constrain oil demand. The U.S. government continues to push for higher Corporate Average Fuel Economy (CAFE) standards through comprehensive regulations on the auto industry. Proposals today developed by the EPA and NHTSA impose fleetwide standards which would raise aver

Sources: U.S. Energy Information Administration

Equity Update

Major domestic stock indices were essentially flat for the month of April after U.S. equities reached record levels not hit since July 2015, sending the Dow Jones Industrial Average to the 18,000 level.

Defensive stocks pulled back in April, a signal that buyers are less risk averse and leaning towards more aggressive growth company stocks. Other optimistic sector trends evolved in April as small caps, cyclicals, and multi-nationals outperformed more conservative large cap and defensive equities. Some investors celebrated the seventh year of the bull market that began in March 2009. Even with the volatility and pullbacks over the 7-year period, it is still considered the second longest bull market in the market’s history.

Sources: Dow Jones, S&P, Bloomberg

Competitive devaluation of a nation’s currency, also known as a currency war, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency.

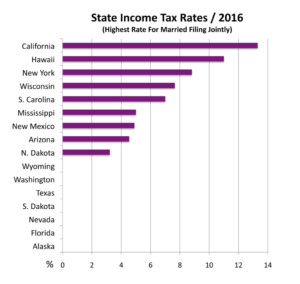

Competitive devaluation of a nation’s currency, also known as a currency war, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. Individual state income taxes are a major source of revenue for states, accounting for nearly 35% of state tax collections nationwide. Forty-three states currently impose a state income tax, in addition to a Federal income tax, with only seven states imposing no state tax at all.

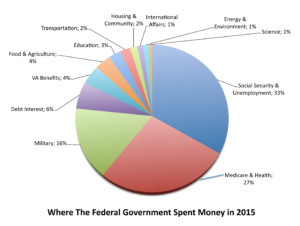

Individual state income taxes are a major source of revenue for states, accounting for nearly 35% of state tax collections nationwide. Forty-three states currently impose a state income tax, in addition to a Federal income tax, with only seven states imposing no state tax at all. For fiscal 2015, the federal government took in over $3.2 trillion in tax payments, a record year compared to previous fiscal years. The federal budget for fiscal year 2015 ran from October 1, 2014, to September 30, 2015. The total figure amounts to approximately $21,833 for every person in the United States.

For fiscal 2015, the federal government took in over $3.2 trillion in tax payments, a record year compared to previous fiscal years. The federal budget for fiscal year 2015 ran from October 1, 2014, to September 30, 2015. The total figure amounts to approximately $21,833 for every person in the United States.