Wright Financial, LLC

395 Taylor Blvd., Suite 107

Pleasant Hill, CA 94523

925.246.7982

Macro Overview – May 2016

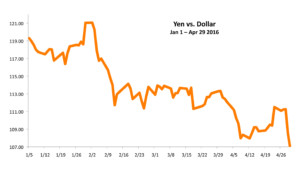

The prospect of a delayed tightening by the Fed, a weaker dollar, and a rebound in commodities helped stabilize equities in April. A falling U.S. dollar along with central banks in Europe and Asia trying to stem the rise of the euro and yen, is indicative of a currency war looming in the shadows. A weaker dollar makes U.S. products cheaper and the U.S. more competitive internationally, a concern to both European and Asian exporters.

Commodity related currencies from countries as Australia, Russia, Canada, and Brazil saw rebounds against the dollar in April, elevating assurances that a demand for commodities is still intact. Economists view this as a measure of a global economic revival.

Following years of debate and assistance, the IMF is considering letting its support for Greece go and cease participating in any further Greek bailouts. Such a possible move would force countries with dire fiscal constraints to reassess their financial policies.

The Labor Department reported that jobless claims for unemployment benefits fell to their lowest level since 1973, historically representative of a strong labor market. Employment data also revealed that there is a growing number of part-time workers rather than full-time workers encompassing the labor force. Various research reports have suggested that the implementation of the Affordable Care Act, whose major provisions were phased in by January 2014, encouraged employers to shift workers to more part-time positions in order to avoid having to cover them under the newly mandated health insurance requirements.

Records maintained and released by the IRS have identified a sharp rise in 1099 income filings as of 2014. 1099s are issued for any income generated over $600 during the tax year. Many economists believe that such dynamics is a validation of full-time employee positions being replaced by part-time independent contractors.

A strengthening Japanese yen over the past few weeks has led some analysts to believe that risk aversion may be a cause. A stronger yen and a weaker dollar has historically signaled less confidence in U.S. growth and a heightened attentiveness to global dynamics.

Sources: Labor Dept., IMF, IRS

Equity Update

Major domestic stock indices were essentially flat for the month of April after U.S. equities reached record levels not hit since July 2015, sending the Dow Jones Industrial Average to the 18,000 level. Defensive stocks pulled back in April, a signal that buyers are less risk averse and leaning towards more aggressive growth company stocks. Other optimistic sector trends evolved in April as small caps, cyclicals, and multi-nationals outperformed more conservative large cap and defensive equities. Some investors celebrated the seventh year of the bull market that began in March 2009. Even with the volatility and pullbacks over the 7-year period, it is still considered the second longest bull market in the market’s history.

Sources: Dow Jones, S&P, Bloomberg