Macro Overview

April 2016 Equity markets rebounded in March as rate hike fears eased and healthy domestic economic data revealed consistent conditions, resulting in a resounding turnaround from the market lows experienced in February. The concern of a rapid rate increase by the Federal Reserve subsided towards the end of the 1st quarter, as Fed Chairperson Janet Yellen helped tame prior remarks made by fellow Federal Reserve members. Subdued inflation and economic growth expectations led the Fed to curtail its stance on predetermined rate hikes. The Fed identified global economic and financial developments continue to pose risks. Labor Department data released for the first week in March showed that merely 253,000 Americans filed for unemployment, the fewest number since 1973. Economists view the lessening amount of unemployment applicants as a validation that the labor market continues to steadily strengthen. Additionally, the Labor Departments monthly employment report for March showed a 215,000 increase in jobs, with an increase in the unemployment rate to 5% from 4.9%, signaling that more people have entered the labor force. Some analysts believe that oil may have found a bottom around $26 per barrel

Sources: Fed, Dept. of Labor, Eurostat, ECB, Dept. of Energy

Equity Overview

Global Stock Markets U.S. equity markets fared better than other developed country stock markets as European, Japanese, and U.K. equities were negative for the first quarter. The S&P 500 Index and the Dow Jones Industrial Average Index turned positive for the year in March, alleviating some angst that was prevalent earlier in the year. The S&P 500 Indexs gain in March was the most since October 2015. Overall, global equity markets rebounded resoundingly from a negative 11% in mid-February, rallying to a barely positive quarter. Spill over from the rally in emerging market stocks benefited domestic companies with exposure in the expanding developing sectors. Dividend paying stocks outperformed non-dividend paying stocks in the quarter, as lower bond yields and a return to equities drove demand for dividends. Analysts see Fed rate hikes as an advantage to larger capitalized companies with strong balance sheets because they wont need to borrow money at higher rates as credit tightens.

Sources: Standard & Poors, Dow Jones, Bloomberg

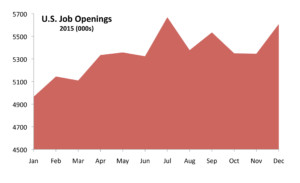

job openings on a national level. Certain positions tend to require higher skill sets, thus increasing the time that positions remain open until employers find qualified workers. Separations, also known as employee turnover, have not changed much in the past year. Separations include employees that have quit, layoffs, and discharges. This is also a measure of the labor markets health, such as when companies have fewer layoffs and when companies incentivize employees to stay. So, no increase in separations is essentially a positive sign for the labor market.

job openings on a national level. Certain positions tend to require higher skill sets, thus increasing the time that positions remain open until employers find qualified workers. Separations, also known as employee turnover, have not changed much in the past year. Separations include employees that have quit, layoffs, and discharges. This is also a measure of the labor markets health, such as when companies have fewer layoffs and when companies incentivize employees to stay. So, no increase in separations is essentially a positive sign for the labor market.