Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Scheduling more Clients’ and Friends’ dinner seminars is still on our to-do list. Watch your email inbox for an invitation. Frequently, clients request a one-on-one meeting to review their account, either before or after an event. If you would like to schedule an account review, the first step in our process is to evaluate your current risk tolerance. We recently implemented a web based risk analysis tool for this purpose. You can access our risk analysis tool from the APPROACH page on our web site: www.texaseliteadvisory.com. Just click the FREE RISK ANALYSIS button and follow the instructions.

Macro Overview – May 2017

Fiscal policy has taken center stage as President Trump’s tax proposals will begin a drawn out process for legislative approval. Individuals, small businesses, and large corporations are expected to benefit from the various proposals.

Contrary to popular belief, the U.S. dollar has actually fallen after recent Fed rate hikes. Some economists see this as a signal that rates may actually stay close to where they are and not rise much until stronger economic numbers are in.

The Fed gave no indication of slowing tightening plans this year, even though U.S. economic growth slowed to 0.7% in the first quarter of 2017, the slowest quarter in three years. Consumer sentiment, though, remained at elevated levels in April as the University of Michigan’s Consumer Sentiment Index rose again. It is up 9% from April 2016 to April 2017.

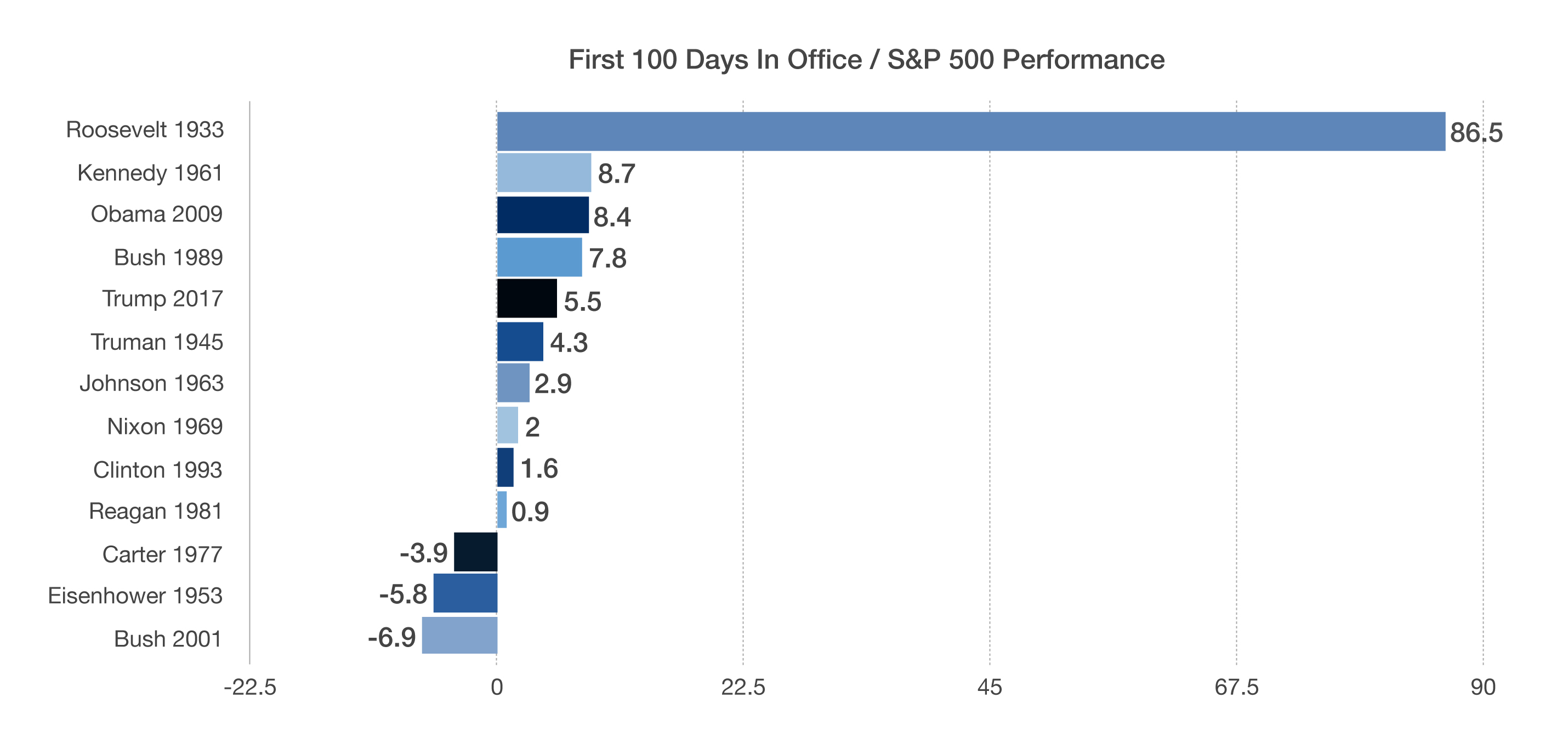

The S&P 500 Index finished up 5.5% during President Trump’s first 100 days in office. Roosevelt began his term in the midst of the depression with a rebounding market from collapse in 1933, while Bush saw his first 100 days during the middle of the dot-com bust. (Sources: Eurostat, S&P, Bloomberg, Fed, Univ. of Michigan)