Doug Kinsey

Artifex Financial Group

2305 Far Hills Avenue, Suite 206

Dayton, OH 45419

855.752.6644

Stock Indices:

| Dow Jones | 47,716 |

| S&P 500 | 6,849 |

| Nasdaq | 23,365 |

Bond Sector Yields:

| 2 Yr Treasury | 3.47% |

| 10 Yr Treasury | 4.02% |

| 10 Yr Municipal | 2.74% |

| High Yield | 6.58% |

YTD Market Returns:

| Dow Jones | 12.16% |

| S&P 500 | 16.45% |

| Nasdaq | 21.00% |

| MSCI-EAFE | 24.26% |

| MSCI-Europe | 27.07% |

| MSCI-Emg Asia | 26.34% |

| MSCI-Emg Mkt | 27.10% |

| US Agg Bond | 7.46% |

| US Corp Bond | 7.99% |

| US Gov’t Bond | 7.17% |

Commodity Prices:

| Gold | 4,253 |

| Silver | 57.20 |

| Oil (WTI) | 59.53 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.32 |

| Yen / Dollar | 156.21 |

| Canadian /Dollar | 0.71 |

Macro Overview – May 2017

Fiscal policy has taken center stage as President Trump’s tax proposals will begin a drawn out process for legislative approval. Individuals, small businesses, and large corporations are expected to benefit from the various proposals.

Geopolitical risks weighed on global financial markets during early April as investors sought fixed income. Regardless, global equity markets achieved higher levels as confidence returned.

French voters are a focal point in the international markets as they decide the probable fate of the European Union (EU) and the euro’s acceptance. A leading candidate, Marine Le Pen, is an advocate of France exiting the EU, which the British voted for last year.

Mexico and Canada breathed a sigh of relief as President Trump suggested that perhaps the U.S. could renegotiate NAFTA rather than abandoning it. Trade has been a leading agenda item for the President as suggestions to impose tariffs on imports has raised anger among U.S. trading partners.

Contrary to popular belief, the U.S. dollar has actually fallen after recent Fed rate hikes. Some economists see this as a signal that rates may actually stay close to where they are and not rise much until stronger economic numbers are in.

The Fed gave no indication of slowing tightening plans this year, even though U.S. economic growth slowed to 0.7% in the first quarter of 2017, the slowest quarter in three years. Consumer sentiment, though, remained at elevated levels in April as the University of Michigan’s Consumer Sentiment Index rose again. It is up 9% from April 2016 to April 2017.

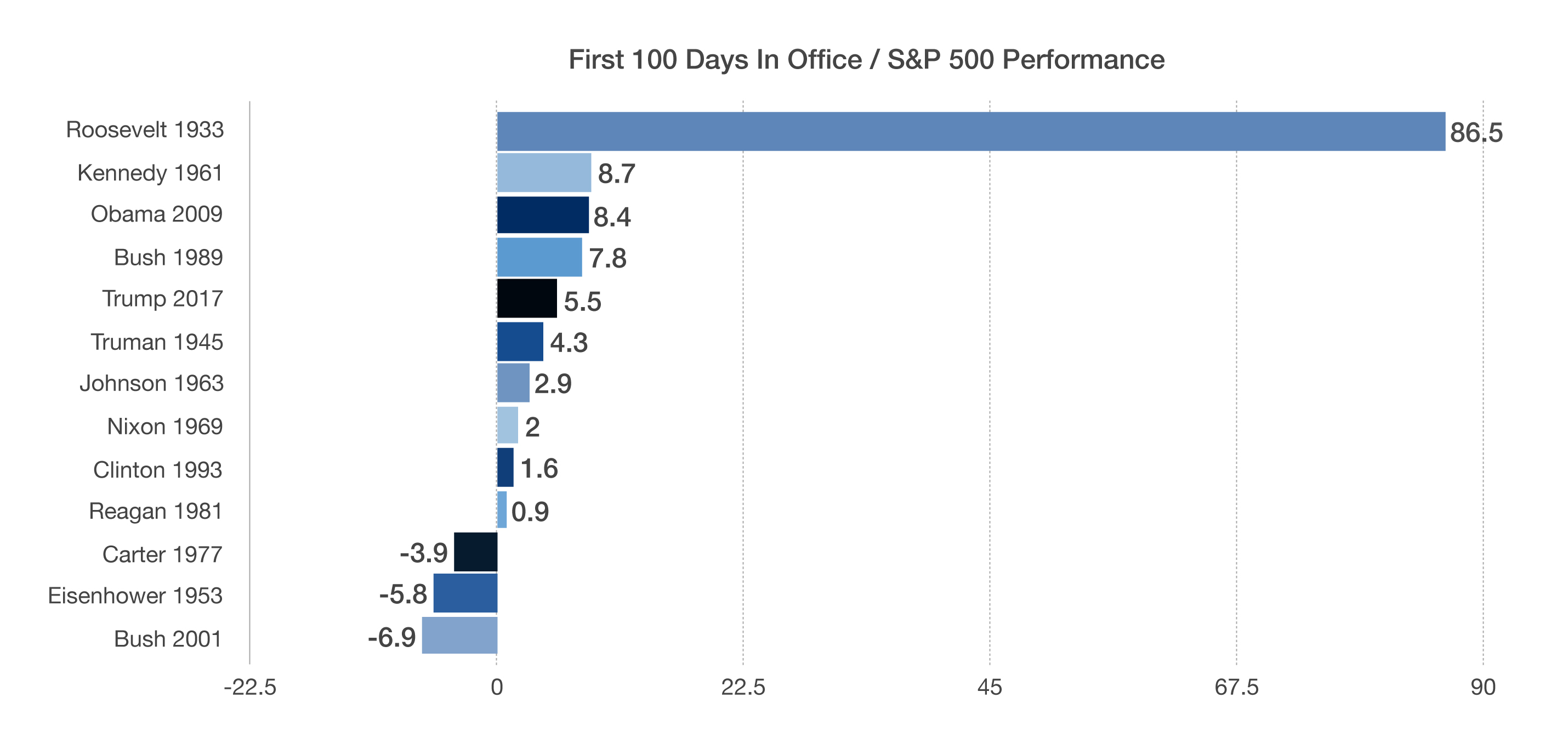

The S&P 500 Index finished up 5.5% during President Trump’s first 100 days in office. Timing has become a must when achieving an attractive first 100 days. Roosevelt began his term in the midst of the depression with a rebounding market from collapse in 1933, while Bush saw his first 100 days during the middle of the dot-com bust. (Sources: Eurostat, S&P, Bloomberg, Fed, Univ. of Michigan)