Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Markets continued on a volatile course in April following announcements regarding tariffs, rising rates, and geopolitical tensions, yet some economists and analysts expect that a tax cut driven rebound is possible.

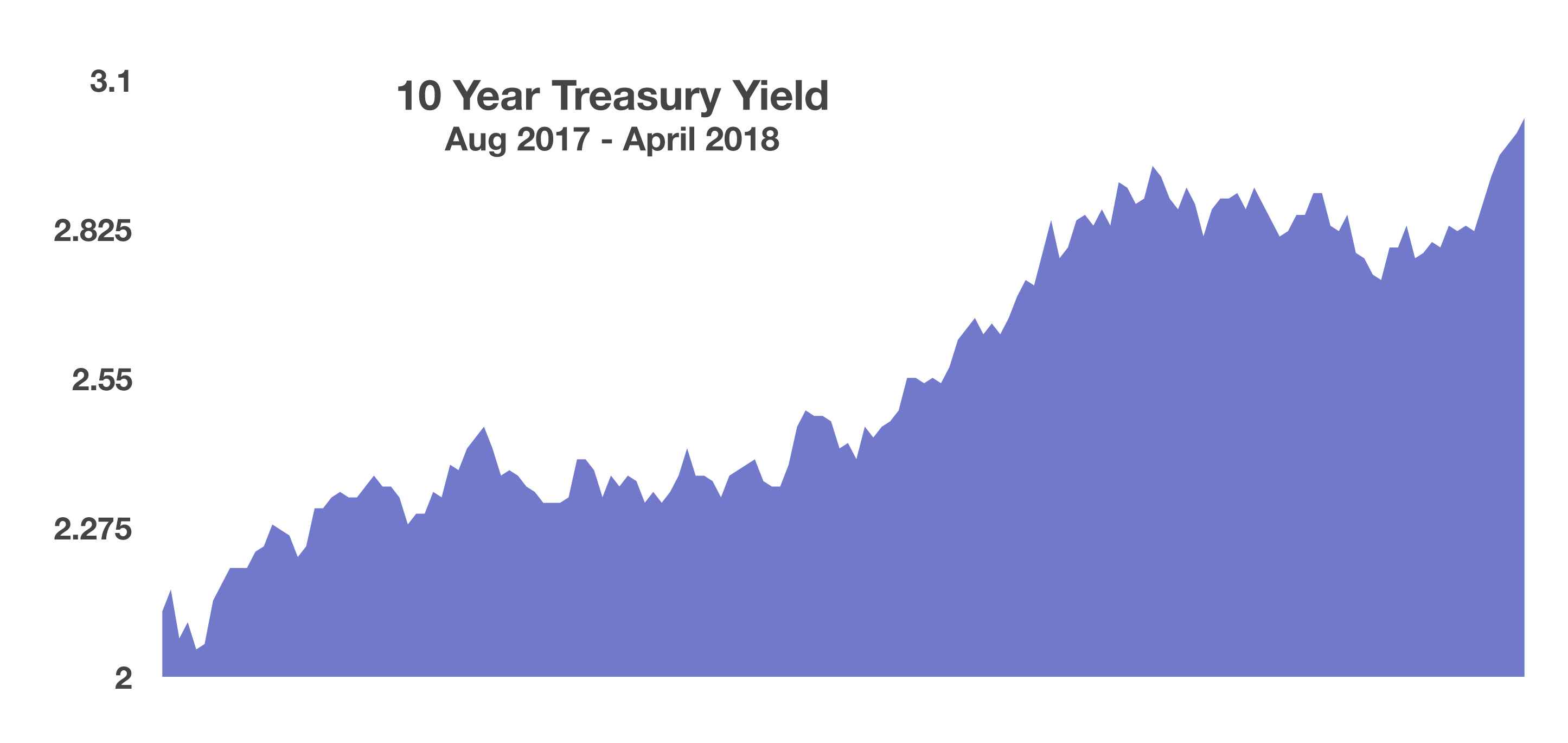

The 10-year Treasury bond yield reached 3% for the first time since January 2, 2014, elevating inflationary fears and the onslaught of rising loan costs. The 3% mark represents a psychological hurdle that influences the dynamics of various fixed income sectors.

The market is concerned that the Fed and other central banks may need to take additional actions in order to alleviate a rapid rise in prices and wages should it materialize. Federal Reserve members voted not to raise rates during their May 1-2 meeting, yet are still on track to raise rates in June and perhaps twice more before year end.

Stocks have been trading in what traders call a trading range, meaning that prices move down and up but stay within certain levels. The release of earnings has become a key determinant of prices as the market looks for fundamental validations for pricing stocks. Company earnings in certain sectors have increased the most since 2010 while the environment for selecting stocks has become tactical and very selective, shying some investors away from the major indices.

The U.S. Treasury issued $488 billion in government bonds for the first quarter of 2018, the most since 2008. The issuance is in anticipation of a drop in tax revenue from the recent tax cuts. Some economists believe that the benefits of the tax plan have not been realized yet as it may take months for visible benefits to appear.

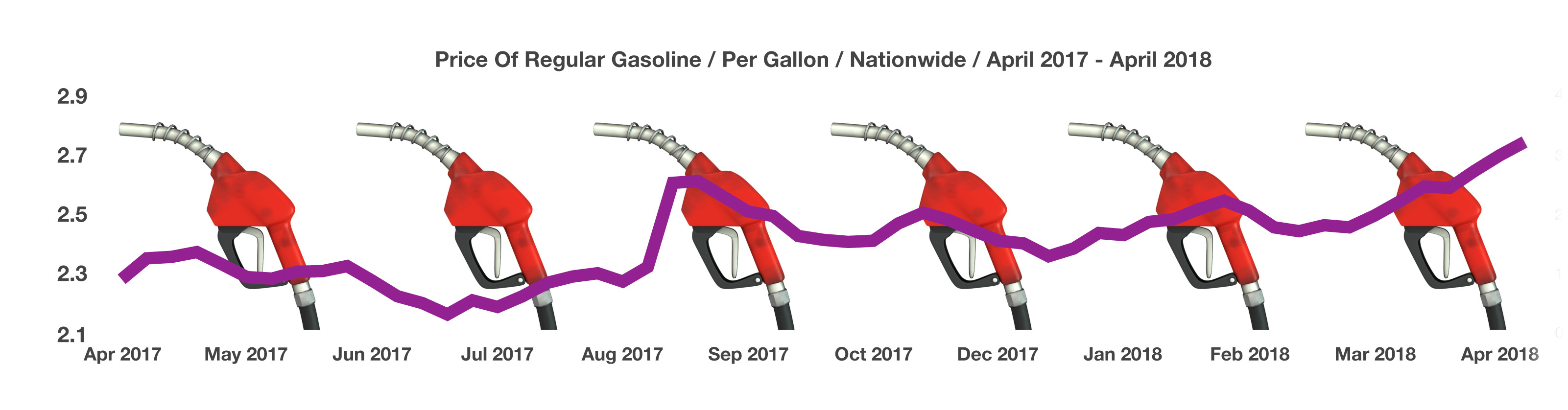

Oil prices reached their highest levels in more than three years as geopolitical tensions drove uncertainty. Shrinking supplies and the approaching summer driving season are expected to heighten gasoline prices across the country.

The most recent data from the Department of Commerce revealed that GDP grew at an annual rate of 2.3% for the first quarter of 2018, a deceleration from the 3% growth that occurred in the final 9 months of 2017. Encouraging data released by the University of Michigan reveals that consumer sentiment rose in April driven by favorable views on personal finances and incomes. (Sources: Dept. of Commerce, Fed, U.S. Treasury, BLS)

Stocks Enter A Trading Range – Equity Markets Update

Stocks Enter A Trading Range – Equity Markets Update

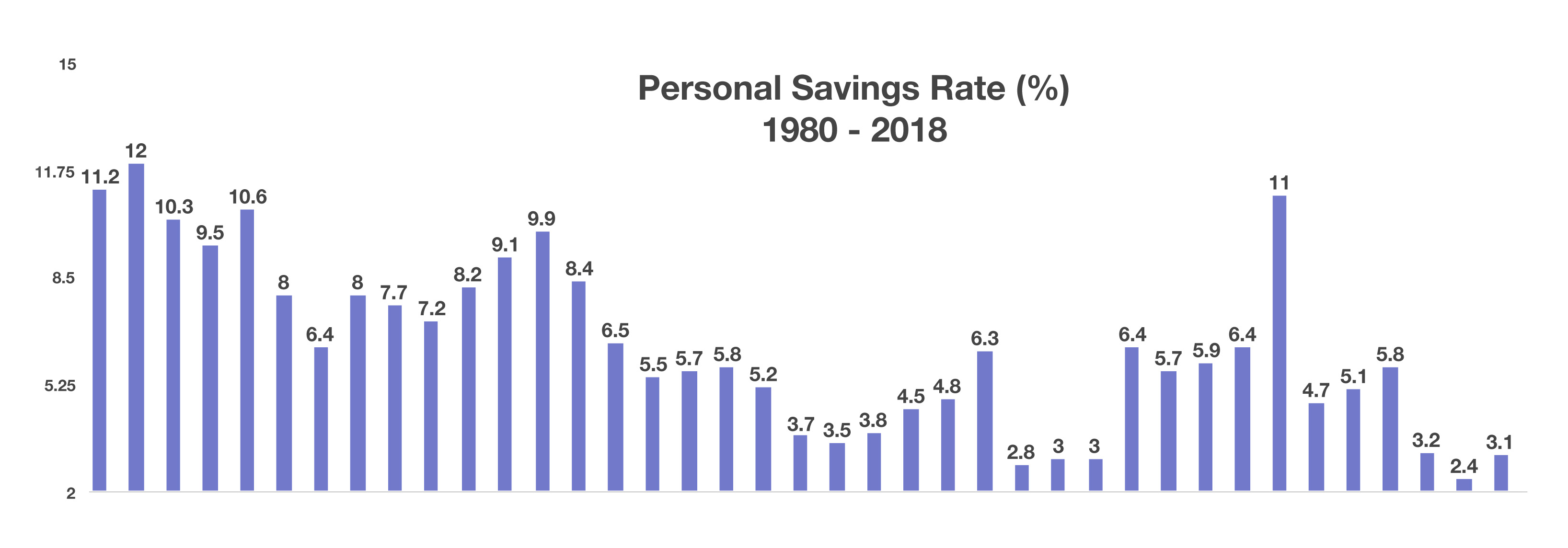

Cash is king (again)…

Cash is king (again)…

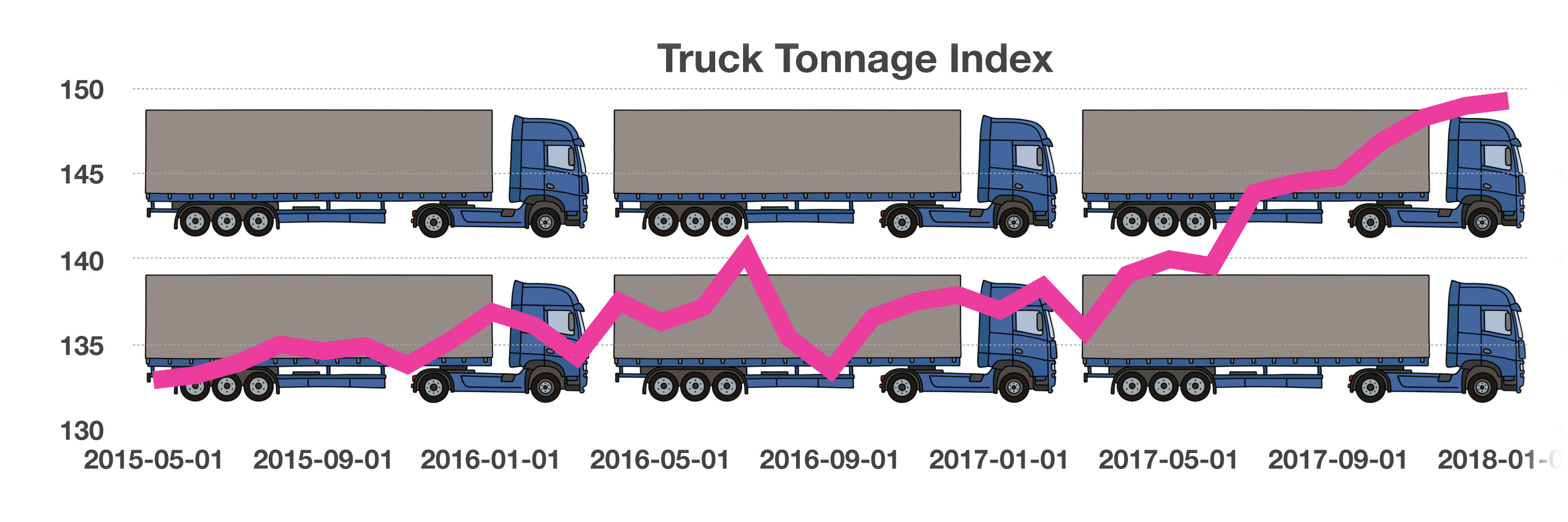

Trucks Delivering More – Economic Dynamics

Trucks Delivering More – Economic Dynamics