Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Manager’s Comments – May 18, 2018

The Q1-2018 Earnings Season has nearly concluded. Thus far, the quality of corporate sales and earnings has been tremendous. And the news could not have come at a better time. Various risks have emerged over the past few months that have caused extreme volatility and an overall market decline. This current earnings season has restored some level of market calm at least for now.

According to Thomson Reuters over 80% of the S&P 500 constituents have reported Q1-2018 results and the growth in earnings from the same period in 2017 has exceeded 25%. As well, nearly 80% of reported earnings have exceeded industry expectations. Additionally, sales have increased over 8% with over 75% of reports beating expectations. These are the strongest results achieved in many years. Looking forward, industry expectations support continued strength for the rest of 2018. This implies a very good economy. However, despite a healthy economy, several risks now seem to threaten future market growth:

Inflation – overall producer input (raw materials) costs are fairly stable as are wages. Crude oil and gasoline prices have increased but their representation in the inflation indices is relatively insignificant. Inflation is not yet a severe threat but if wage pressures build then such a trend will be difficult to suppress. Once inflation takes hold, accelerating interest rate increases will become the norm.

Interest Rates – A rapid rise in rates remains my primary concern, yet I’ve also presumed that a rapid rise would represent a reaction to higher inflation evidence. So far, the latter hasn’t materialized. Therefore, the slow rise in rates is most likely due to the Fed’s (and other Central Banks) well-telegraphed and well-orchestrated pursuit of gradual monetary tightening. If market participants didn’t expect economic conditions to remain solid, then recent rate rises wouldn’t be happening. Therefore, if inflation remains at bay, gradual rises in interest rates shouldn’t severely undermine earnings or market growth.

Trade Tensions – President Trump’s tariff announcements were somewhat abrupt and unexpected despite his critical campaign rhetoric regarding China and Mexico. Tariffs are always industry-specific and while some sectors may be hurt temporarily, the overall market should not suffer much. Frankly, I expect positive outcomes regarding both the Chinese and NAFTA negotiations. Talk of trade wars and nationalism generally, has stalled growth in some foreign markets but this is not a worry. The strength of US manufacturing export growth and global trade volumes generally demonstrate that economies worldwide are in good shape.

Geo-Political – The North Korean and Iran sagas while fascinating should have a negligible impact on global markets regardless of whether or not real progress is made. Obviously, markets everywhere would breathe a sigh of relief if a more conciliatory tone surrounded either situation. But it is doubtful any reconciliation will spur immediate market advances.

One risk that is mentioned but with little vigor is the Mueller Investigation. This should conclude soon – probably just in time to materially impact the mid-term elections ironically. If President Trump is implicated, then market volatility will increase and a sell-off would be expected. If not, then a modest relief rally will probably occur, if only temporarily.

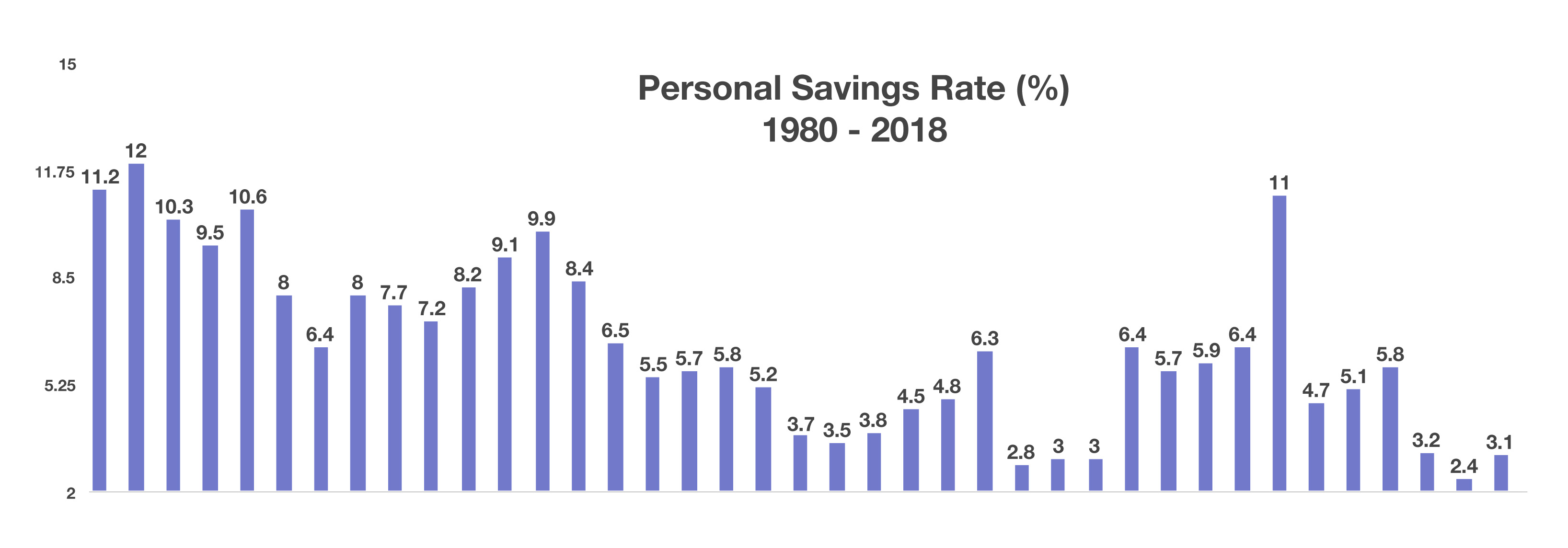

Historically, Americans tend to save more as economic times become more difficult, and tend to spend during prosperous periods. Past slow downs such as in the mid 1970s and the early 1980s saw an increase in the savings rate, a barometer of consumer sentiment. The expansion during the mid-to-late 1990s saw a gradual drop in savings, as consumers spent more confidently as their incomes rose.

Historically, Americans tend to save more as economic times become more difficult, and tend to spend during prosperous periods. Past slow downs such as in the mid 1970s and the early 1980s saw an increase in the savings rate, a barometer of consumer sentiment. The expansion during the mid-to-late 1990s saw a gradual drop in savings, as consumers spent more confidently as their incomes rose.