Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Markets continued on a volatile course in April following announcements regarding tariffs, rising rates, and geopolitical tensions, yet some economists and analysts expect that a tax cut driven rebound is possible.

The 10-year Treasury bond yield reached 3% for the first time since January 2, 2014, elevating inflationary fears and the onslaught of rising loan costs. The 3% mark represents a psychological hurdle that influences the dynamics of various fixed income sectors.

The market is concerned that the Fed and other central banks may need to take additional actions in order to alleviate a rapid rise in prices and wages should it materialize. Federal Reserve members voted not to raise rates during their May 1-2 meeting, yet are still on track to raise rates in June and perhaps twice more before year end.

Stocks have been trading in what traders call a trading range, meaning that prices move down and up but stay within certain levels. The release of earnings has become a key determinant of prices as the market looks for fundamental validations for pricing stocks. Company earnings in certain sectors have increased the most since 2010 while the environment for selecting stocks has become tactical and very selective, shying some investors away from the major indices.

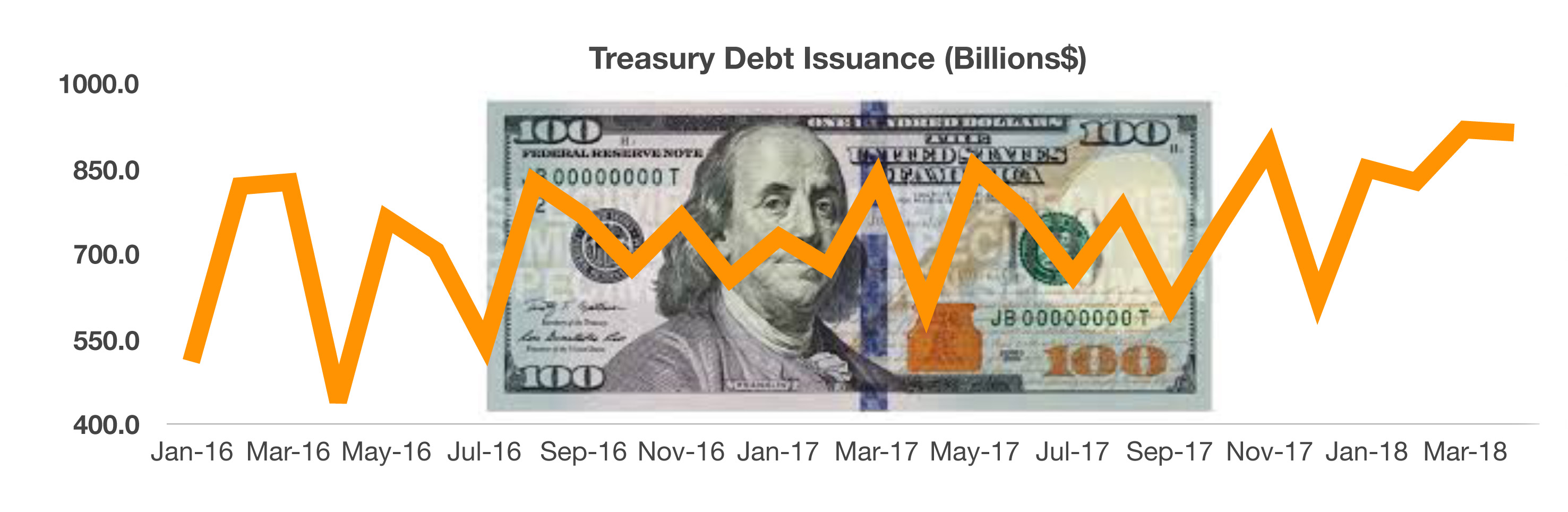

The U.S. Treasury issued $488 billion in government bonds for the first quarter of 2018, the most since 2008. The issuance is in anticipation of a drop in tax revenue from the recent tax cuts. Some economists believe that the benefits of the tax plan have not been realized yet as it may take months for visible benefits to appear.

Oil prices reached their highest levels in more than three years as geopolitical tensions drove uncertainty. Shrinking supplies and the approaching summer driving season are expected to heighten gasoline prices across the country.

The most recent data from the Department of Commerce revealed that GDP grew at an annual rate of 2.3% for the first quarter of 2018, a deceleration from the 3% growth that occurred in the final 9 months of 2017. Encouraging data released by the University of Michigan reveals that consumer sentiment rose in April driven by favorable views on personal finances and incomes.

Sources: Dept. of Commerce, Fed, U.S. Treasury, BLS

ces. If you are a stubborn long, it would be wise to look into insurance at this point.

ces. If you are a stubborn long, it would be wise to look into insurance at this point.

sents the Nasdaq (QQQ) and as you can see on nearly the exact date the yield curve began to fall, the QQQ began the famous “melt-up” going from $60 to $109 in six months. The Nasdaq hit that high on 3/31/2000, the exact day the yield curve bottomed at -54 basis points. The divergence between the 2 could not be more obvious, and as the QQQ went on to fall from $109 to $20 the yield curve went from -54 basis points to over 300. While not as pronounced, you can see that as the yield curve began to fall again in 2004, the Nasdaq began to climb from $36 to $51 in 2007 only to play out the same scenario as the yield curve rose steeply the QQQ lost 40% of its value falling to under $30. Now look at the where we are today – The QQQ is at $169, just below an all time high of $174 we reached in March and the yield curve has taken a nosedive. The difference this time is the length of time the yield curve has been falling and stocks rising and how much more massive the divergence is now compared to previous bear markets. The logical explanation for this has been the massive amount of central bank interference as global central banks have piled on trillions in debt to purchase financial assets (stocks and bonds). This yield curve relationship is perhaps the most reliable indicator of where the markets are headed in the future and investors should position themselves accordingly.

sents the Nasdaq (QQQ) and as you can see on nearly the exact date the yield curve began to fall, the QQQ began the famous “melt-up” going from $60 to $109 in six months. The Nasdaq hit that high on 3/31/2000, the exact day the yield curve bottomed at -54 basis points. The divergence between the 2 could not be more obvious, and as the QQQ went on to fall from $109 to $20 the yield curve went from -54 basis points to over 300. While not as pronounced, you can see that as the yield curve began to fall again in 2004, the Nasdaq began to climb from $36 to $51 in 2007 only to play out the same scenario as the yield curve rose steeply the QQQ lost 40% of its value falling to under $30. Now look at the where we are today – The QQQ is at $169, just below an all time high of $174 we reached in March and the yield curve has taken a nosedive. The difference this time is the length of time the yield curve has been falling and stocks rising and how much more massive the divergence is now compared to previous bear markets. The logical explanation for this has been the massive amount of central bank interference as global central banks have piled on trillions in debt to purchase financial assets (stocks and bonds). This yield curve relationship is perhaps the most reliable indicator of where the markets are headed in the future and investors should position themselves accordingly. yield. These bonds were unsecured with almost no covenants to protect bondholders. These bonds have steadily declined in price and are now trading at $87.92 for a paper loss of 12% (excluding coupon payments). This is not meant to be a commentary of the quality of Tesla cars, they may actually be the greatest car ever produced as many owners seem to believe but to illustrate the complete disregard for risk of institutional investors who have been forced to chase yield at any cost. This was a $1.8 billion dollar issue meaning there are $216 million in losses on the balance sheets of the institutional holders (this was a private placement and therefore unavailable to retail investors). At the current price the bonds are yielding 7.45%, if you read our previous newsletters we wrote that in our opinion the bonds should have been issued at over 10% to reflect the risk and in less than a year we are halfway there. The bonds have been downgraded Moody’s to Caa1 and have a recovery rating of 3 (meaning they believe investors would recover 60% of par value in liquidation). We believe that due to the downgrade in an normally functioning market these bonds would be trading between 12-15% which means they would have to fall another 21 points from current levels before they would accurately reflect the risk of default. It doesn’t help to have a CEO who hangs bankruptcy signs around his neck as an April fools joke and routinely refuses to answer tough questions on conference calls and ridicules analyst that ask questions he doesn’t like. Amazingly, the stock has held steady in the $300 range. Generally, the bond market gets it right and is ahead of stock traders on valuations so this precipitous price drop could be signaling dark days ahead for TSLA shareholders.

yield. These bonds were unsecured with almost no covenants to protect bondholders. These bonds have steadily declined in price and are now trading at $87.92 for a paper loss of 12% (excluding coupon payments). This is not meant to be a commentary of the quality of Tesla cars, they may actually be the greatest car ever produced as many owners seem to believe but to illustrate the complete disregard for risk of institutional investors who have been forced to chase yield at any cost. This was a $1.8 billion dollar issue meaning there are $216 million in losses on the balance sheets of the institutional holders (this was a private placement and therefore unavailable to retail investors). At the current price the bonds are yielding 7.45%, if you read our previous newsletters we wrote that in our opinion the bonds should have been issued at over 10% to reflect the risk and in less than a year we are halfway there. The bonds have been downgraded Moody’s to Caa1 and have a recovery rating of 3 (meaning they believe investors would recover 60% of par value in liquidation). We believe that due to the downgrade in an normally functioning market these bonds would be trading between 12-15% which means they would have to fall another 21 points from current levels before they would accurately reflect the risk of default. It doesn’t help to have a CEO who hangs bankruptcy signs around his neck as an April fools joke and routinely refuses to answer tough questions on conference calls and ridicules analyst that ask questions he doesn’t like. Amazingly, the stock has held steady in the $300 range. Generally, the bond market gets it right and is ahead of stock traders on valuations so this precipitous price drop could be signaling dark days ahead for TSLA shareholders.