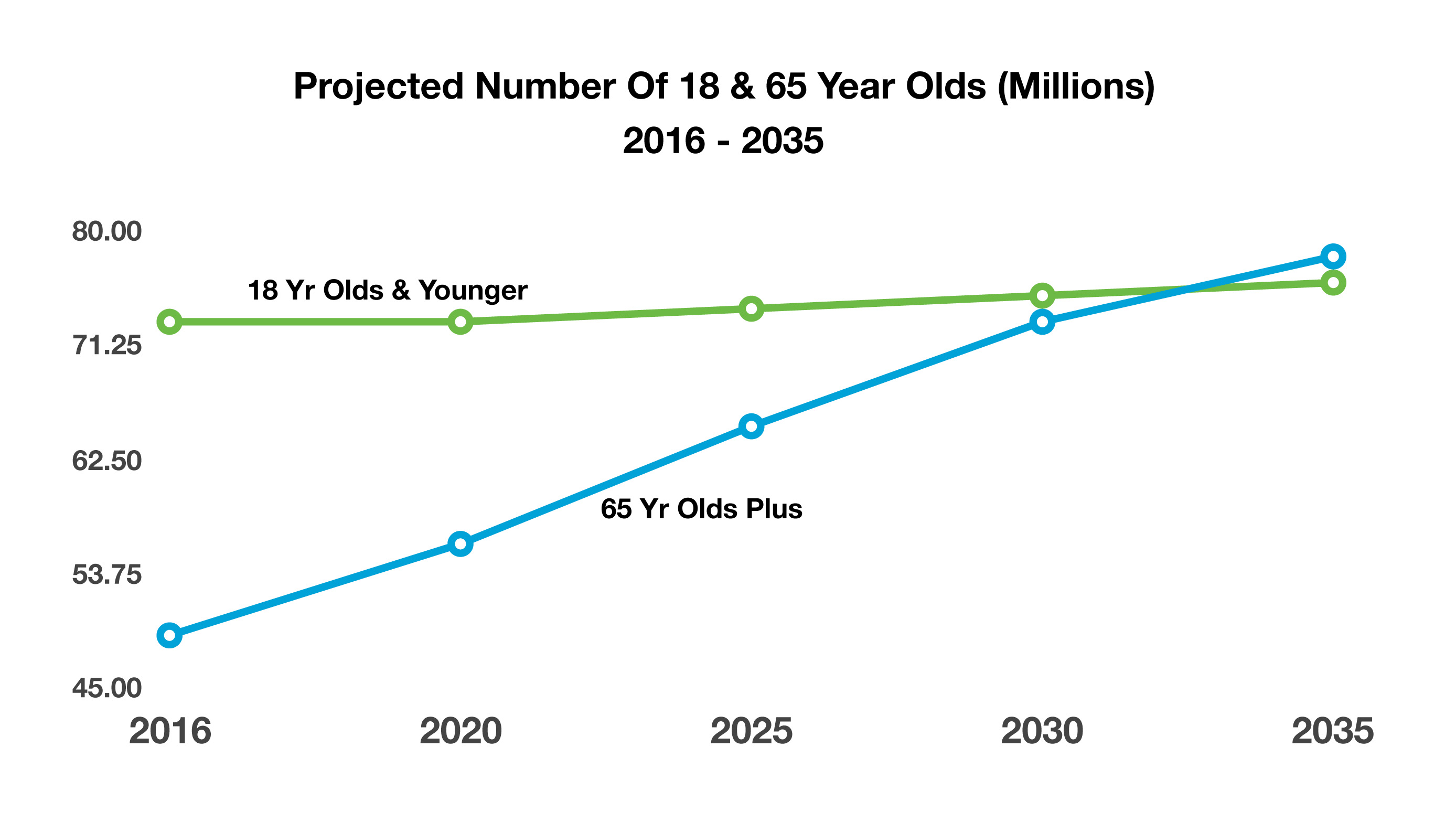

65 Year Olds Projected To Exceed 18 Year Olds – Demographics

Demographics and population data are carefully tracked by the Census Bureau in order to better determine what the United States may look like in the future.

Over 73 million minors, under 18 years of age, currently out number 49 million older Americans, 65 and over. Younger citizens help spur economic growth and provide essential workers for the l

The Census Bureau estimates that by 2035, those age 65 and older will begin to out number 18 and under. The number of 65 year olds and older will rise much faster than those 18 and younger creating a strain on the U.S. job market and economy. The shrinking pool of minors will eventually lead to lower population growth thus creating a drag on economic growth. A growing elderly population is expected to impact already strained Medicare and Social Security benefits. (Source: U.S. Census Bureau)

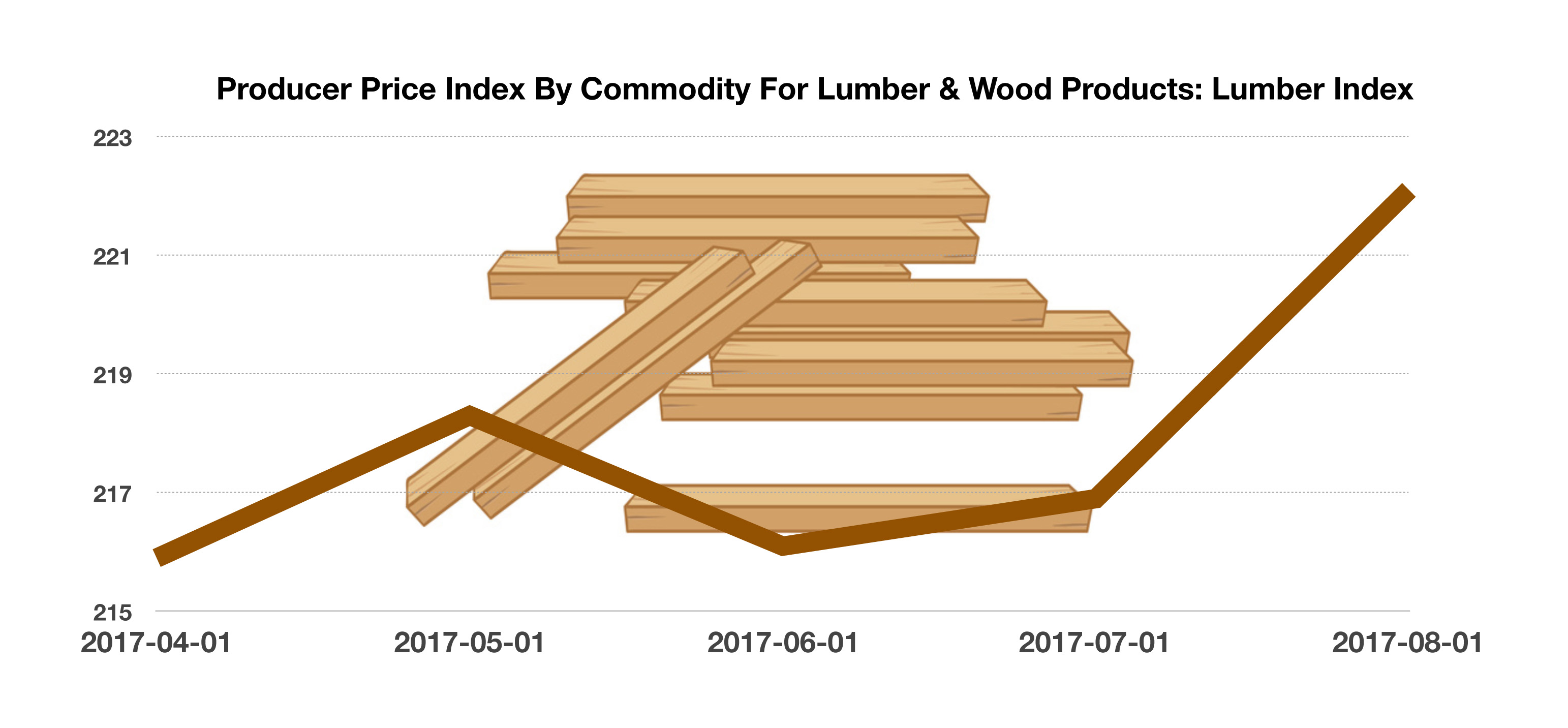

Lumber Supplies Pose Challenge For Housing – Housing Update

The fierce storms that ravaged Texas and Florida last year, in addition to the horrendous fires in Northern California, have led to a rise in demand for construction materials including lumber. Homebuilders use a multitude of raw and finished materials for the construction of homes, including wiring, plastic tubing, and lumber. The increase in demand has decre