20860 N. Tatum Blvd Suite 220 / Phoenix, AZ 85050

2021 Midwest Road Suite 200 / Oak Brook, IL 60523

888.494.4440

www.windsoradvisor.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Tranquility that fell upon markets as volatility receded in April was interrupted by a return of uncertainty surrounding trade negotiations between China and the United States.

Incomplete trade discussions with China are still a threat to global markets as an agreement regarding tariffs and intellectual property rights has yet to be finalized. U.S. government revenues from tariffs already in place on Chinese imports stand at about $5 billion per month.

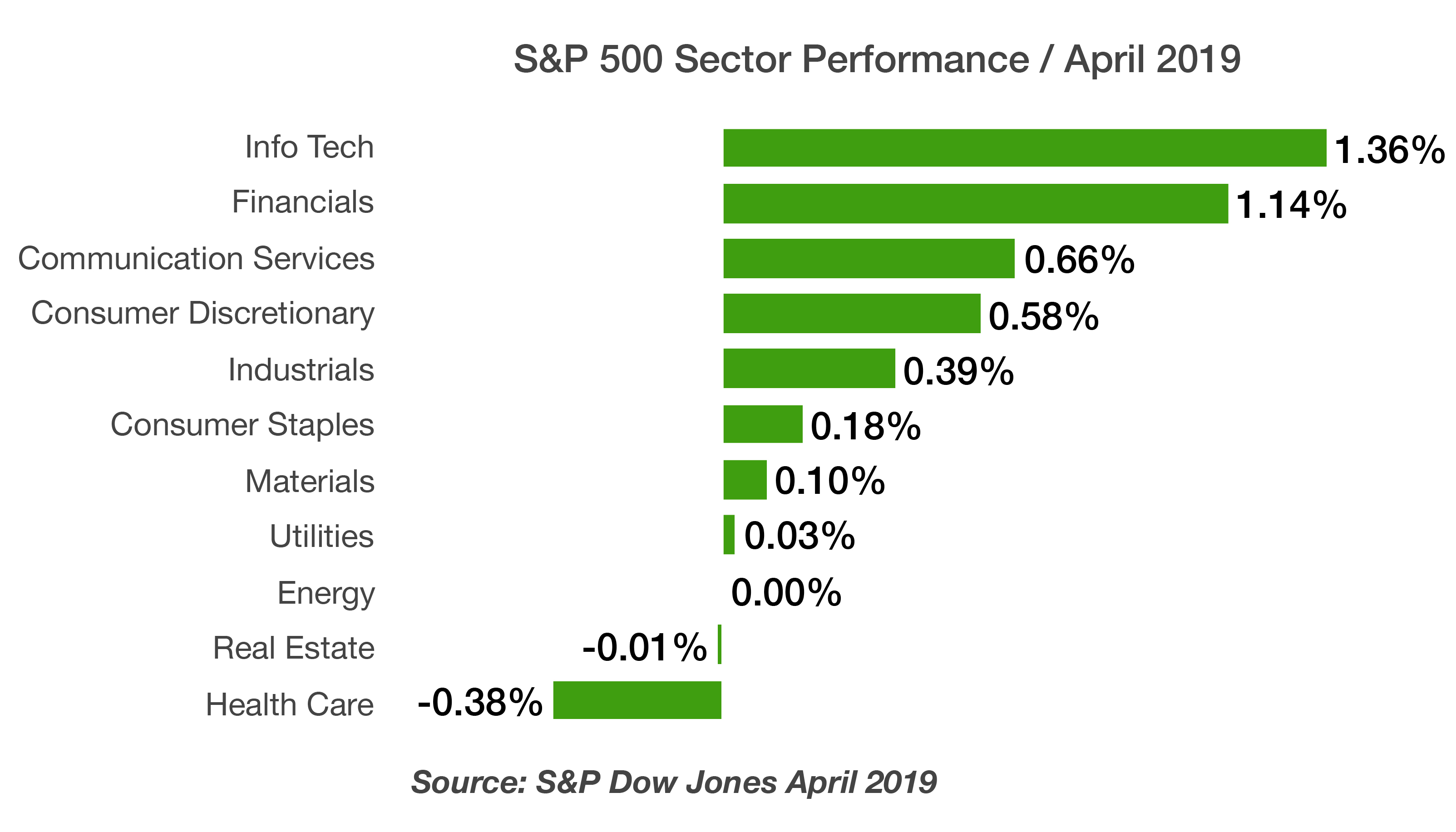

Equity markets reached higher levels in April as trade fears ebbed and rising rate expectations remained modest. The Federal Reserve signaled that it would be patient in raising rates further, which instilled a calm over financial markets. Markets have become increasingly data sensitive trying to decipher what reaction the Fed may have following the release of economic data.

Data released by the Bureau of Economic Analysis (BEA) showed a slowdown in consumption since the beginning of the year, attributable to the government shutdown, poor weather, and market volatility in December.

Oil prices reacted when the U.S. eliminated a waiver for countries buying oil from Iran, which had sanctions imposed this past year. Domestic crude oil, priced as West Texas Intermediate (WTI) surpassed $66 per barrel in April, among the highest levels in 8 months.

Market analysts and economists attribute low inflation and a low probability of recession as the reasons behind persistent slow economic growth. This dynamic is known as secular stagnation, a condition of negligible or no economic growth in a market-based economy.

During a hearing before the House Committee on Oversight & Government Reform, the Postmaster General said that the USPS is considering reducing mail delivery to 5 days per week. A decline in first class mail volume has created a financial burden for the USPS, which ended fiscal 2018 with a $3.9 billion loss.

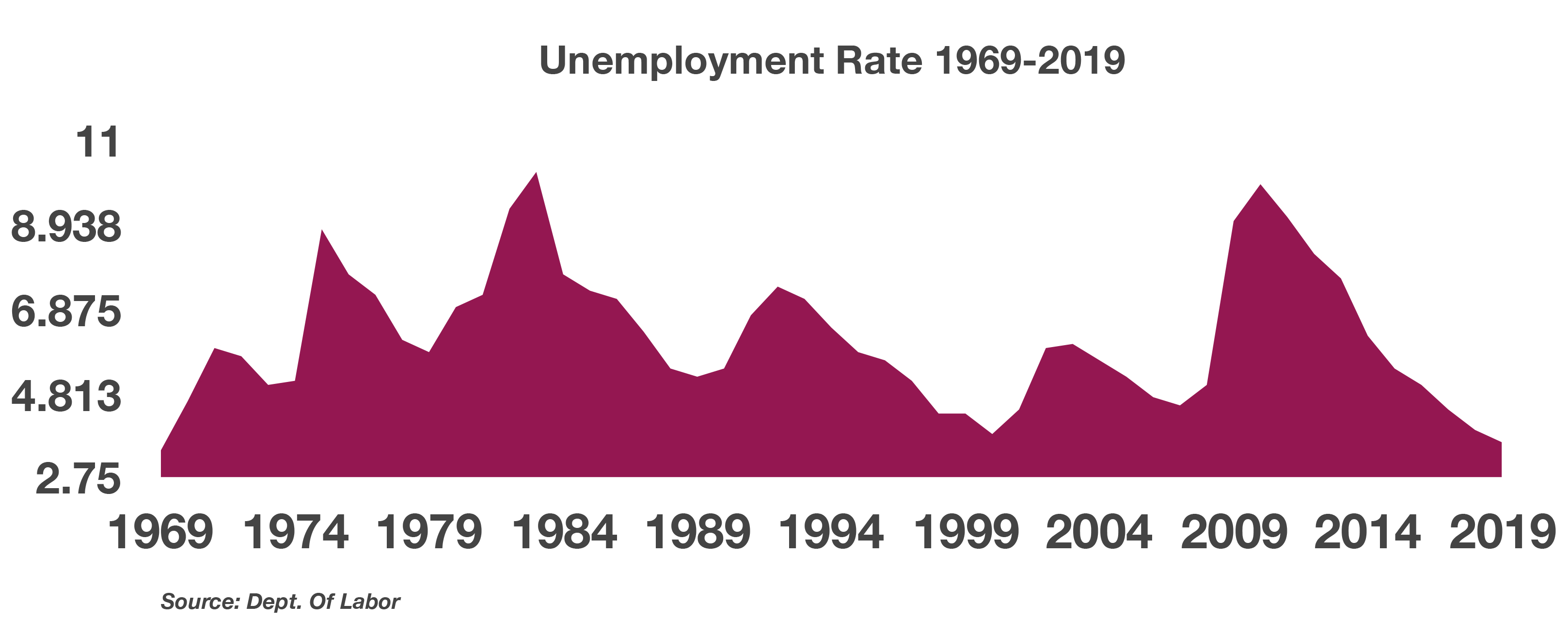

The unemployment rate fell to a 50-year low of 3.6% in April, the lowest since 1969. Even with such low unemployment, wage growth is still weak with some blaming a shrinking pool of qualified workers and an older aged work force demanding less pay increases than their younger counterparts. (Source: Federal Reserve Bank of St. Louis, Dept. of Commerce, USPS, Labor Dept)