Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Dear Friends,

Investing is tricky with higher prices and lots of uncertainty – which is where we are now with trade disputes and slowing growth. Recent GPD numbers show the country maxed out our productivity at 3% growth, and now are pulling back to 2.5%. Short term investments are having to compete with relatively good returns in money markets and short-term CD’s and I have been advising many clients to take advantage of this opportunity. This is the new normal, and behind the headlines I do expect markets to grind higher over time. But it will continue to be anything but a boring ride. Keep in mind, however, that in an average year we have several events that cause selloff of more than 5% for very good reasons- at that time. Long-term risk is still rewarded in our opinion.

So please, enjoy this issue and then go outside and remember what is important to you.

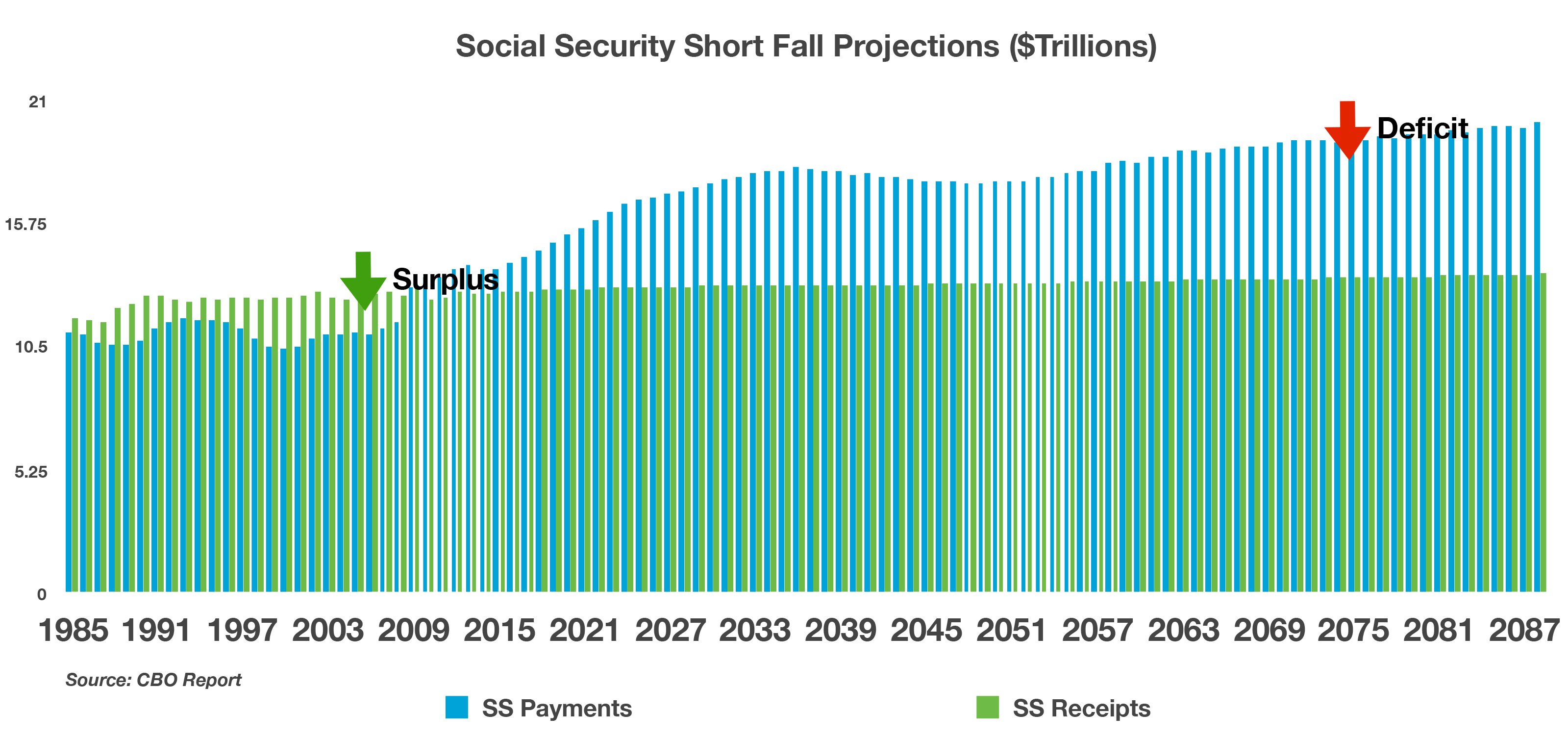

Bozeman 2019 CPA Symposium Roundup

For the past 9 years, we have been hosting local CPA’s for an afternoon of continuing education. Did you know that CPA’s are required to spend a full 40 hours per year to maintain their license! McCormick Financial Advisors provided a 4 speaker event that was maybe our best yet :from State Legislative Updates, to Social Security (page 4), to hearing how current tax law can save you significant tax money here in Montana. I would like to thank our excellent speaker lineup including: Pete Richardson of our local SSA office; Justin Bryan of Bryan Law Firm PC, Bridget Wilkenson of the Bozeman Area Community Foundation, and Katy Sparks of Sparks Law.