Ocean Park Capital Management

2503 Main Street

Santa Monica, CA 90405

Main: 310.392.7300

Daily Performance Line: 310.281.8577

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Portfolio Overview

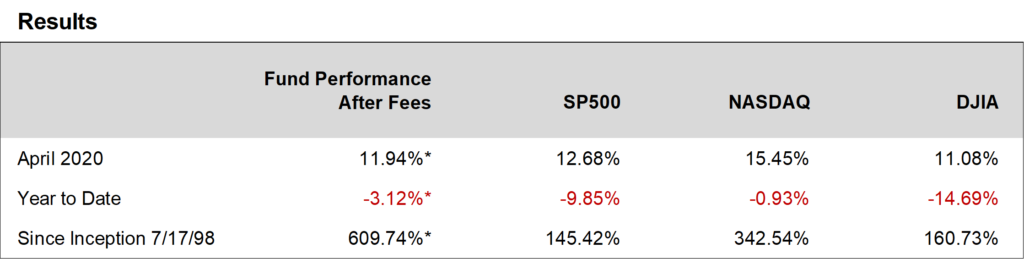

The Ocean Park funds rebounded sharply in April. We ended the month down 3.12%* for the year, significantly outperforming most of the major indices as well as the HFRI Equity Hedge Index, which was down 8.08%. Our performance is largely the result of a decision we made to keep the bulk of our portfolio intact, despite analysts broadly lowering estimates due to the shutdown of the economy. We determined that the first quarter consensus earnings bar had been set low enough that most of our stocks were still likely to surprise to the upside. In addition, we determined that the market had already gone down far enough that equities would not be punished for missing expectations by small margins. As a result, we avoided selling at the market bottom.

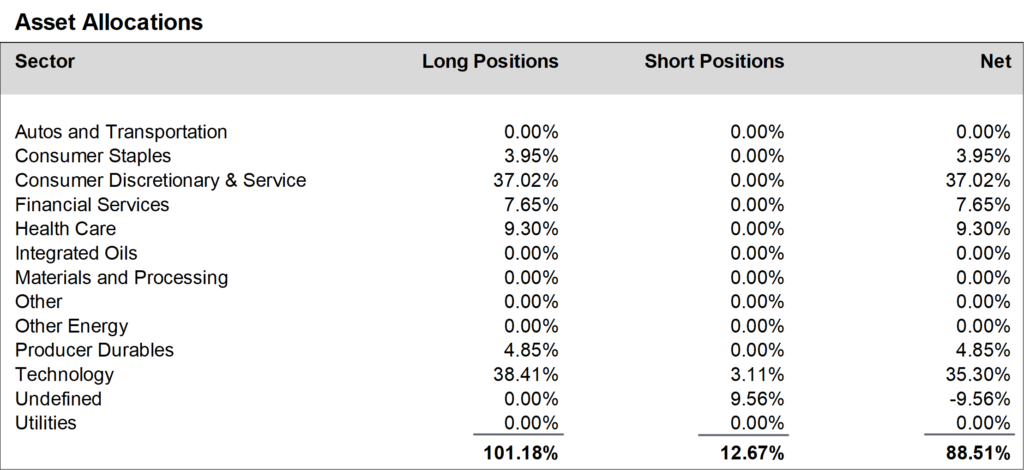

Going forward however, we have chosen to be more cautious because the market has rebounded substantially and there are red flags that we feel the market has not yet absorbed. Consequently, we initiated a substantial hedge by shorting SPYs and QQQs, which is reflected in the Asset Allocation chart in the Undefined category.

During April, we reduced positions in the technology sector and added to positions in the consumer discretionary and service sector. We finished the month at about 89% net long, down from about 95% at the end of March.

Daily updates on our activity are available on our Results Line, at 310-281-8577, and current information is also maintained on our website at www.oceanparkcapital.com. To gain access to the site enter password opcap.

*These results are pro forma. Actual results for most investors will vary. See additional disclosures on page 4.

Past performance does not guarantee future results.