20860 N. Tatum Blvd Suite 220 / Phoenix, AZ 85050

2021 Midwest Road Suite 200 / Oak Brook, IL 60523

888.494.4440

www.windsoradvisor.com

Stock Indices:

| Dow Jones | 42,330 |

| S&P 500 | 5,762 |

| Nasdaq | 18,189 |

Bond Sector Yields:

| 2 Yr Treasury | 3.66% |

| 10 Yr Treasury | 3.81% |

| 10 Yr Municipal | 2.63% |

| High Yield | 6.66% |

YTD Market Returns:

| Dow Jones | 12.31% |

| S&P 500 | 20.81% |

| Nasdaq | 21.17% |

| MSCI-EAFE | 12.90% |

| MSCI-Europe | 12.10% |

| MSCI-Pacific | 13.80% |

| MSCI-Emg Mkt | 16.80% |

| US Agg Bond | 4.44% |

| US Corp Bond | 5.32% |

| US Gov’t Bond | 4.39% |

Commodity Prices:

| Gold | 2,657 |

| Silver | 31.48 |

| Oil (WTI) | 68.27 |

Currencies:

| Dollar / Euro | 1.11 |

| Dollar / Pound | 1.33 |

| Yen / Dollar | 142.21 |

| Canadian /Dollar | 0.73 |

Macro Overview

Markets were encouraged with the announcement of reopening plans by various states and the probability of reigniting economic activity. Individual states started to ease restrictions and allow certain businesses to reopen for the first time since a state of emergency was declared on March 14th. Analysts and economists agree that it may be a drawn-out process of reopening the economy as normalcy is gradually restored.

Congress voted to inject an additional $484 billion into the original Paycheck Protection Program passed in March. The program ran out of its initially allocated $350 billion in stimulus funds in mid-April with over 1.6 million loans having been approved. Smaller businesses with less than 500 employees are the target for the stimulus payments, not larger corporations. Funds critical to keeping small businesses open have been failing to reach smaller neighborhood establishments in time, prompting the increasing possibility of a multitude of bankruptcies and business closures.

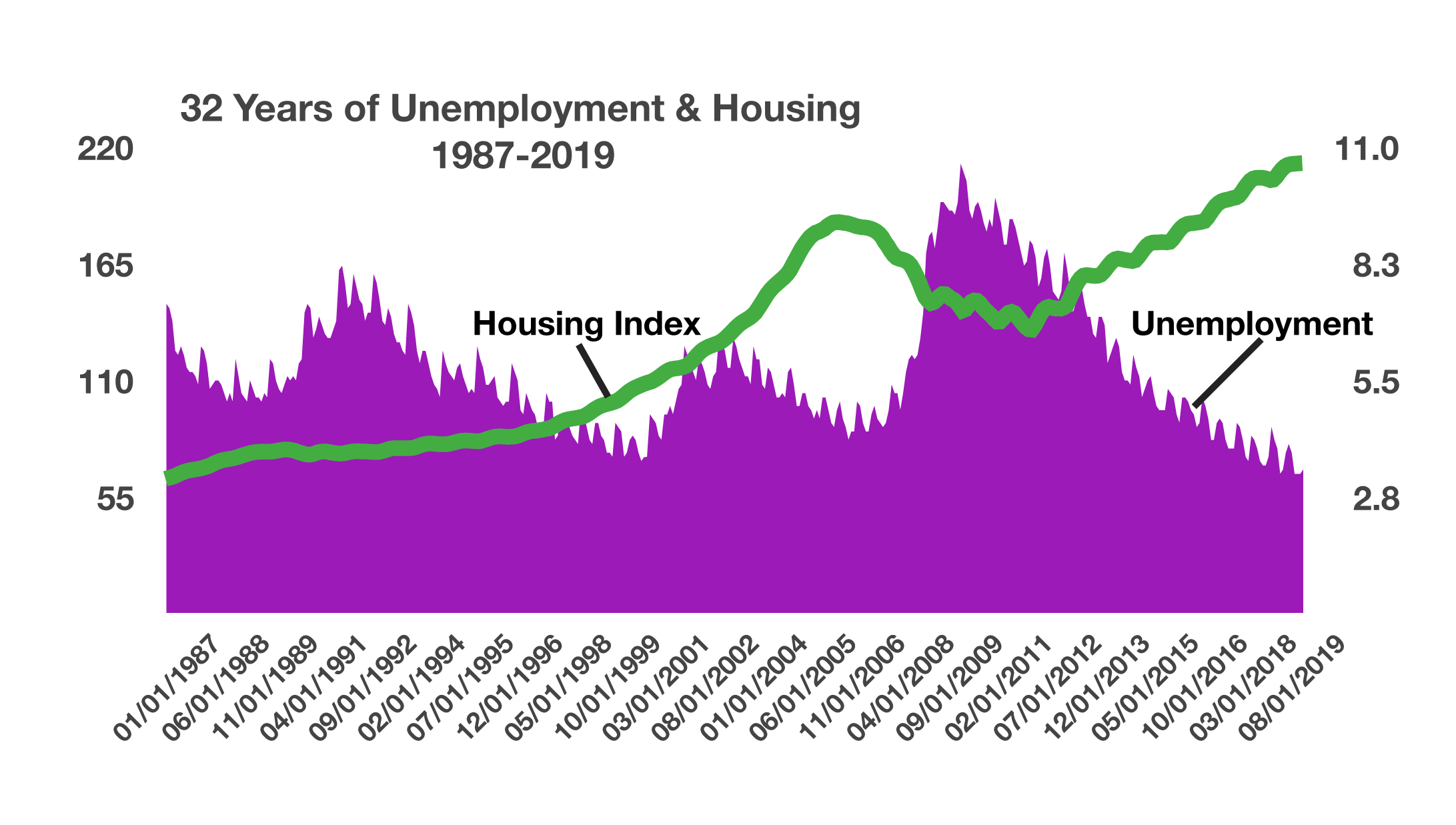

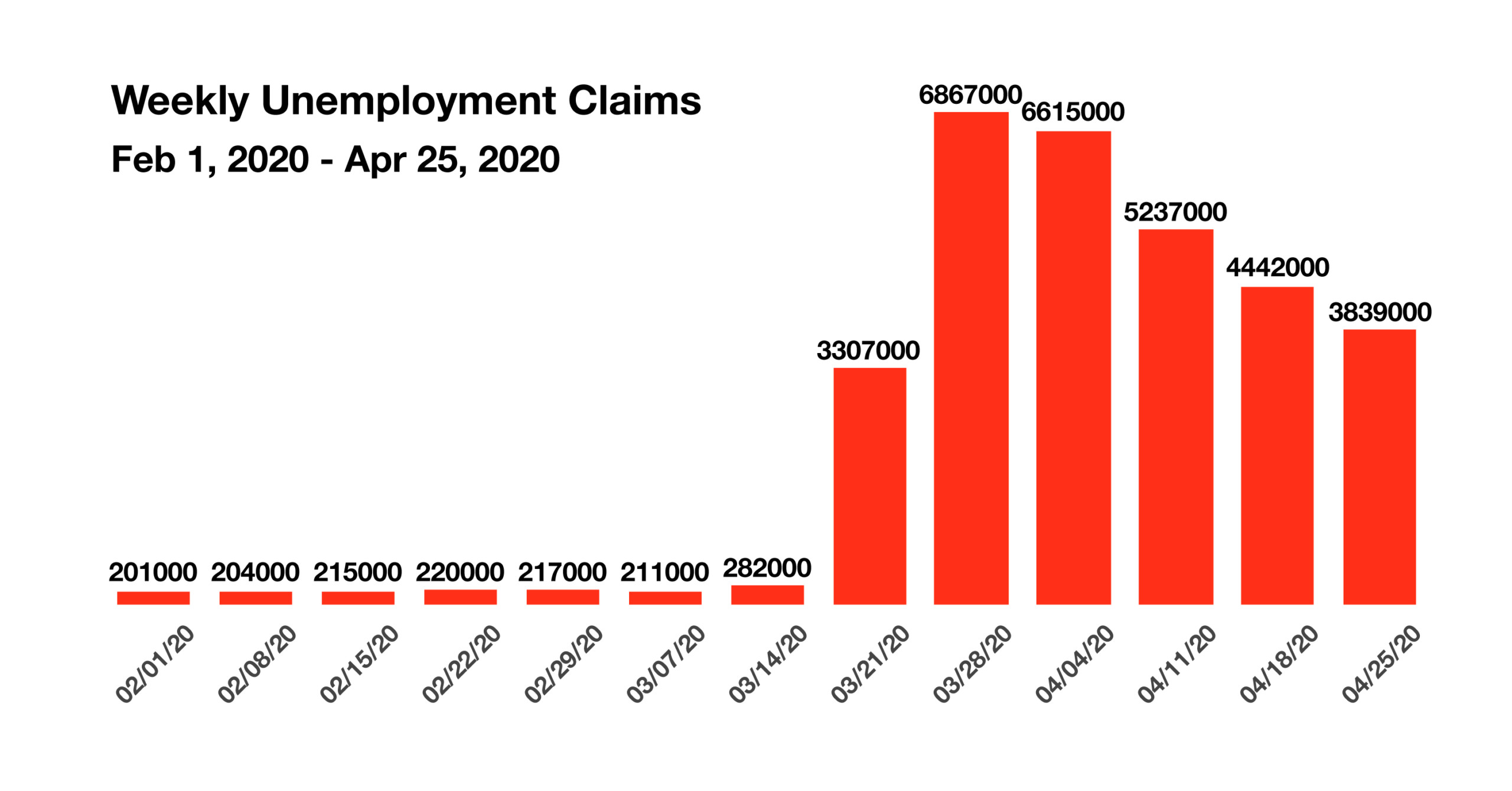

Labor Department data revealed that nearly all of the jobs gained since the recession of 2008-2009 were essentially lost in three weeks. Revised unemployment claims through the end of April showed an increase to over 30 million people filing for unemployment since the pandemic shuttered the economy in mid-March.

Supply chain disruptions throughout the food industry are leaving grocery store shelves barren as shoppers horde perishables, toilet paper, flour and cleaning products. Dramatic shifts in consumer behavior have also stirred shortages and inventory challenges for stores across the country. Rationing of various products including pork, meat, toilet paper and hand sanitizers is expected to continue as reported by the U.S. Food & Drug Administration.

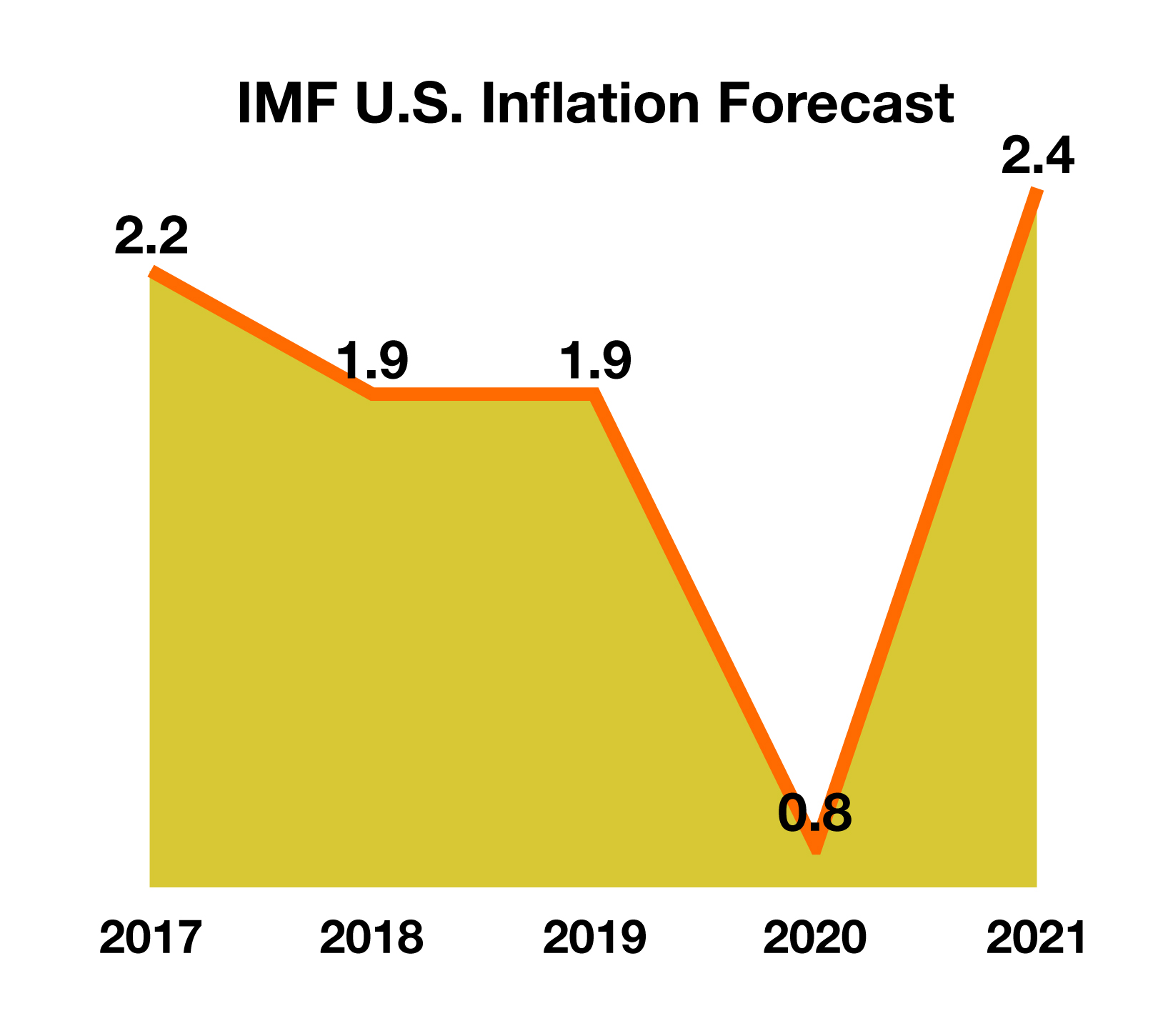

Economists suggest that a lack of consumer confidence, along with the lingering fear of another virus outbreak in the fall, will hinder consumers from continuing to spend freely. Consumer confidence and retail sales bore the wrath of the virus outbreak as stores were shuttered across the country with the Fed reporting that retail sales fell a record 8.7% in March.

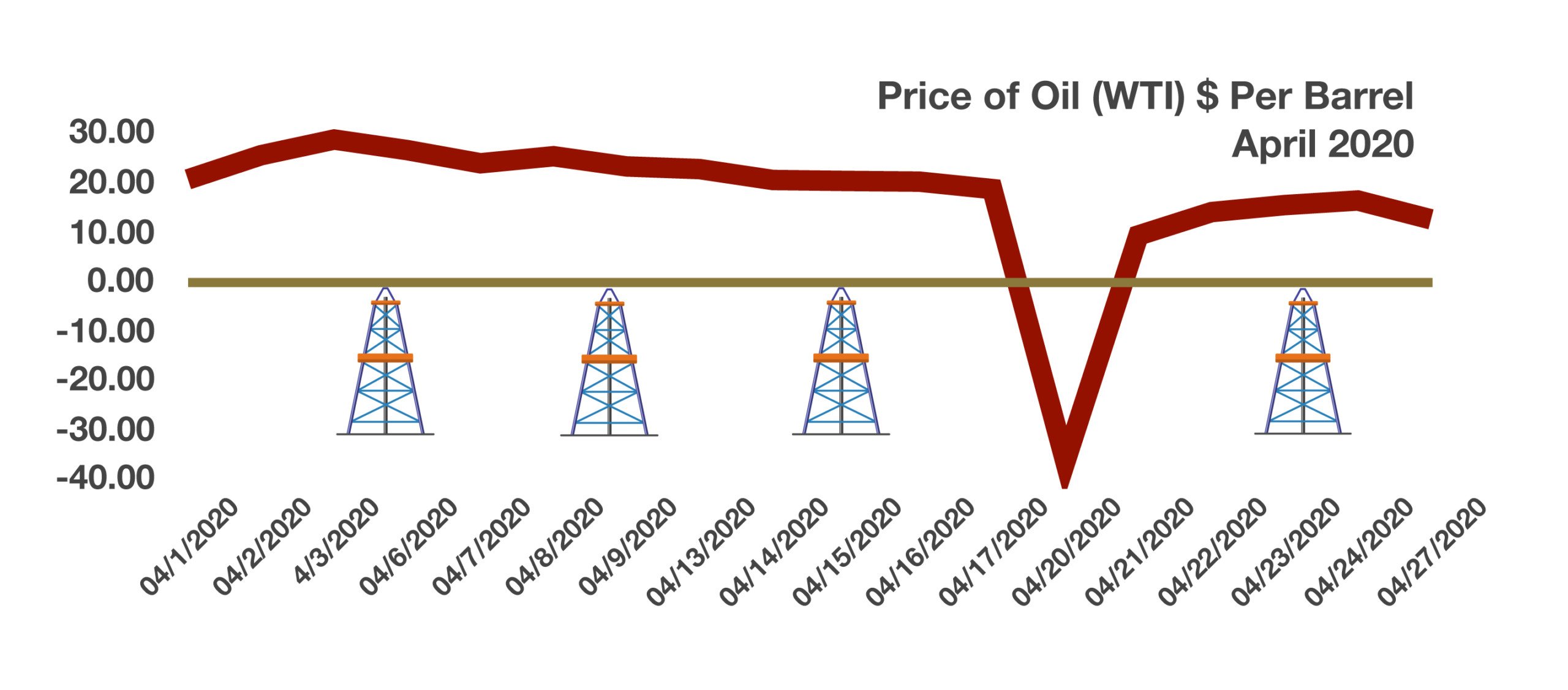

Crude oil production in the U.S., which is measured by West Texas Intermediate (WTI), traded as low negative $36 per barrel in mid-April. The sudden collapse in prices was the result of excessive global supply in a recessionary global economy, creating a shortage of storage for oil worldwide. Optimistically, lower gasoline prices may help propel the U.S. economy as economic activity slowly resumes.

(Sources: Labor Department, SBA, Fed, BEA)

Lower crude oil prices have historically led to lower gasoline prices nationwide as product costs have dropped exponentially. Some states such as California and Hawaii may not see the full benefits of lower oil prices due to additional excise state taxes, refining costs, and distribution expenses.

Lower crude oil prices have historically led to lower gasoline prices nationwide as product costs have dropped exponentially. Some states such as California and Hawaii may not see the full benefits of lower oil prices due to additional excise state taxes, refining costs, and distribution expenses.