Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Macro Overview

A resurgence of sporadic economic activity emerged in May as stay at home bans were eased and some businesses slowly reopened. Virus resurgence fears are still a concern as uncertainty surrounding the availability of a vaccine lingers. Following April’s rebound for U.S. equities, May continued to post recaptured gains for all major stock indices. Slow re-openings by states and cities have allowed a gradual reactivation of economic activity benefiting nearly all sectors of the equity markets.

Unemployment hit 14.7%, the highest since the great depression era, when unemployment was 25%. Income and education levels were profoundly affected, with over 40 million applying for unemployment claims since the middle of March. The extent of the lock down for businesses nationwide is being blamed for a vast amount of small business bankruptcies that may prohibit the re-hiring of millions of workers in numerous industries.

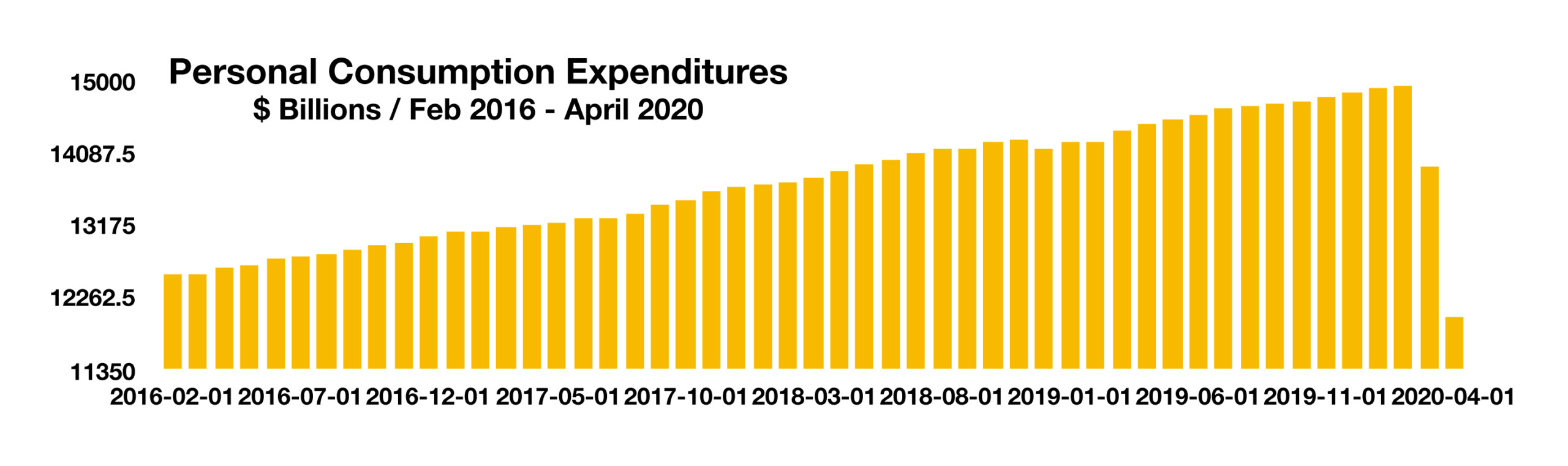

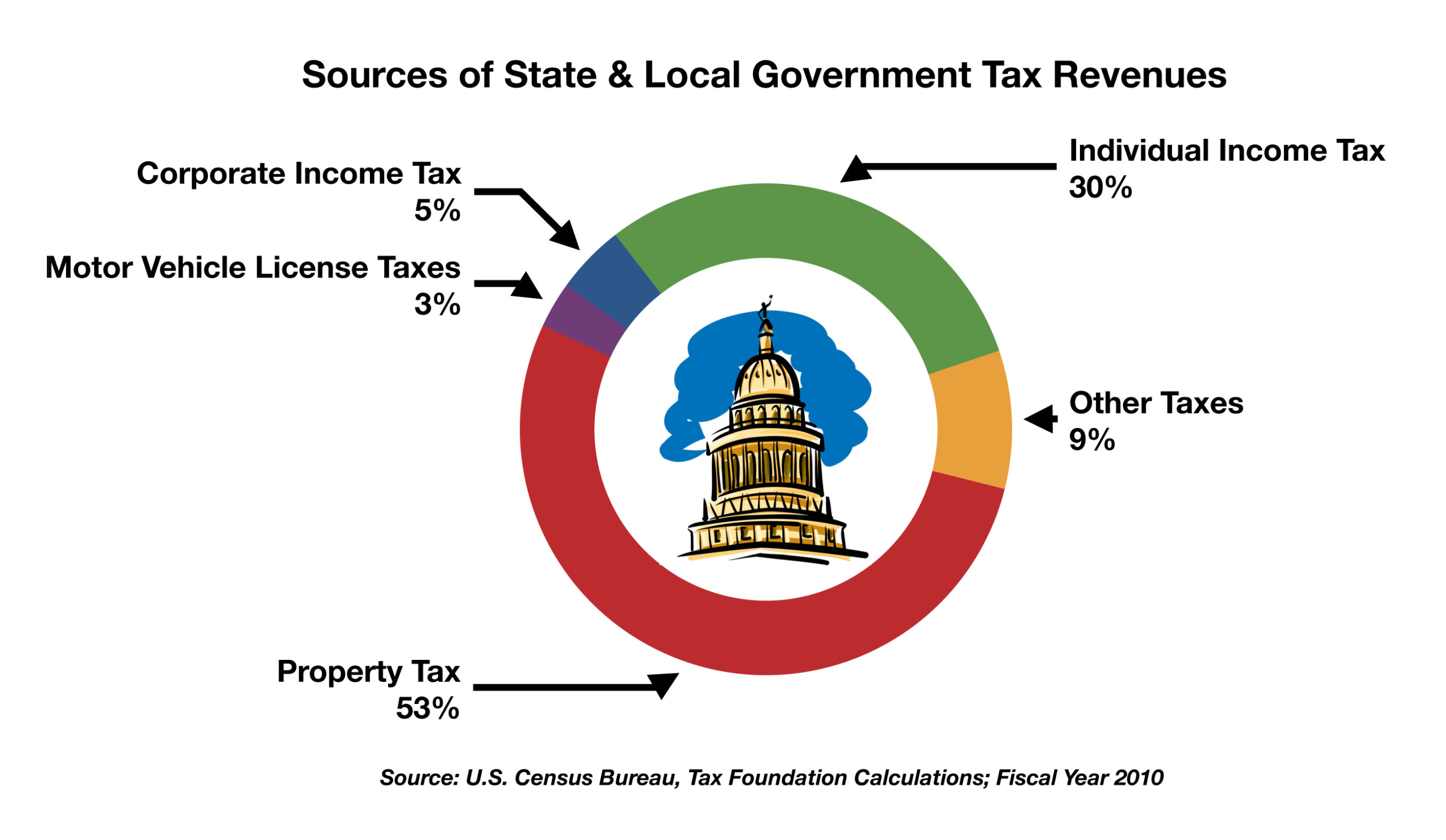

Retail sales in April saw their largest decline on record, the result of mandatory store closings and stay at home requirements. Industrial and manufacturing activity also fell in April, an indicator of a slower economic environment. Economic damage may not be fully recognized for months as lagging data tracked by various government agencies trickle into the headlines and financial markets. Consumer confidence, as measured by the University of Michigan CC Index, improved in May as consumers sought hope from the gradual easing of the virus quarantine. Inflation expectations also increased as scarce goods demanded higher prices across the country. State and local government budgets nationwide are starting to see budget deficits as tax revenues have fallen significantly due to business closures and dramatic increases in unemployment.

Economists and analysts are curious as to how the millions of unemployed workers will sustain themselves when their unemployment benefits expire. The $600 weekly unemployment benefit provided by the federal government expires on July 31st, unless extended by Congress. Individual state benefits vary on maximum weekly amounts, duration, and extension qualifications. A study compiled by the Chicago Federal Reserve revealed that consumers spent nearly half of their federal stimulus checks within two weeks, then reverting to their prior spending habits. Economists expect that the economic effects of the one-time payments will be short lived.

Congress is expected to extend the period of time allotted for small businesses to use funds provided by the Paycheck Protection Program (PPP) from 8 weeks to 24 weeks. The additional time allows businesses to apply funds to approved expenses including payroll, rent, and utilities. Higher income workers tend to have work at home opportunities more available to them than lower income workers, worsening the situation for low income earners.

Federal unemployment benefits skyrocketed to $430 billion in April, the single largest monthly increase ever. Monthly unemployment benefits had been averaging $29.5 billion per month over the last five years, prior to the initial payout in benefits starting in March 2020 following the virus outbreak. (Sources: Federal Reserve, Dept. of Labor, Commerce Dept., Bloomberg (Market Update))