Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview – May 2020

Markets were encouraged with the announcement of reopening plans by various states and the probability of reigniting economic activity. Individual states started to ease restrictions and allow certain businesses to reopen for the first time since a state of emergency was declared on March 14th. Analysts and economists agree that it may be a drawn-out process of reopening the economy as normalcy is gradually restored.

Congress voted to inject an additional $484 billion into the original Paycheck Protection Program passed in March. The program ran out of its initially allocated $350 billion in stimulus funds in mid-April with over 1.6 million loans having been approved. Smaller businesses with less than 500 employees are the target for the stimulus payments, not larger corporations. Funds critical to keeping small businesses open have been failing to reach smaller neighborhood establishments in time, prompting the increasing possibility of a multitude of bankruptcies and business closures.

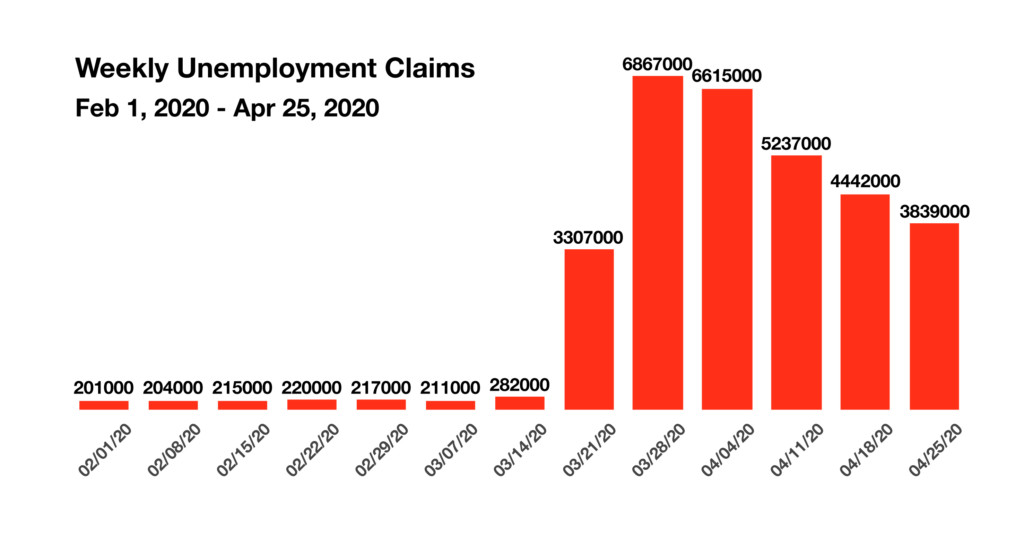

Labor Department data revealed that nearly all of the jobs gained since the recession of 2008-2009 were essentially lost in three weeks. Revised unemployment claims through the end of April showed an increase to over 30 million people filing for unemployment since the pandemic shuttered the economy in mid-March.

Three of the largest employing industries in the country have become extremely vulnerable to the crisis. The auto, energy, and housing industries employed over 17 million workers throughout the country as of the end of 2019. The Federal government as well as the Federal Reserve are studying methods as to how best to subsidize and support employment in these industries. Another crucial component to the economy, the airline industry, has already been appropriated $25 billion in assistance funds in order to support operations and employment.

Supply chain disruptions throughout the food industry are leaving grocery store shelves barren as shoppers horde perishable and cleaning products. Dramatic shifts in consumer behavior have also stirred shortages and inventory challenges for stores across the country. Rationing of various products including pork, meat, toilet paper and hand sanitizers is expected to continue as reported by the U.S. Food & Drug Administration.

Economists suggest that a lack of consumer confidence, along with the lingering fear of another virus outbreak in the fall, will hinder consumers from continuing to spend freely. Consumer confidence and spending is at the forefront of critical data of which economists and analysts will be closely following to determine how severe of an economic downturn the U.S. may suffer. Consumer confidence and retail sales bore the wrath of the virus outbreak as stores were shuttered across the country with the Fed reporting that retail sales fell a record 8.7% in March.

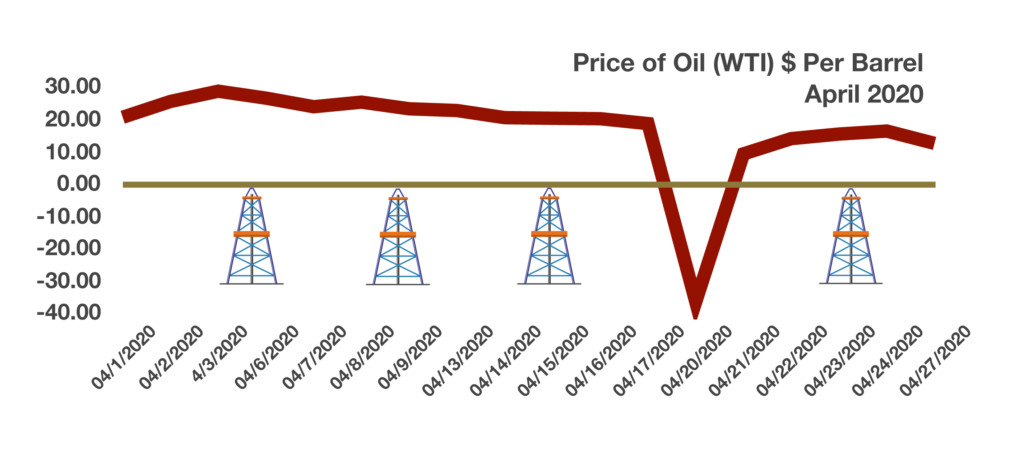

Crude oil production in the United States, which is measured by West Texas Intermediate (WTI), traded as low negative $36 per barrel in mid-April. The sudden collapse in oil prices was the result of excessive global supply in a recessionary global economy, creating a shortage of storage for oil worldwide. Optimistically, lower gasoline prices may help propel the U.S. economy as economic activity slowly resumes.

Sources: Labor Department, SBA, Fed, BEA

Rates Stabilize Due To Stimulus – Fixed Income Update

The Fed pledged its continued support for the economy in the form of fixed income purchases including government bonds, mortgages, and various ETFs. The Fed also resorted to buying junk bonds in the open market, as well as continuing to buy unlimited amounts of U.S. government bonds and mortgage backed securities. Lending facilities were also extended to corporations and municipalities helping to support the corporate and municipal bond markets.

The U.S. Treasury is expected to issue over $2 trillion in short-term Treasury bills this year, with the intention of selling additional billions of dollars of longer term notes and bonds to subsidize the massive stimulus efforts underway.

An increase in the money supply, as measured by M2, rose to over $17.2 trillion as of April 20th, up from $15.5 trillion on February 24, 2020. The rapid increase is a result of the massive fiscal and monetary stimulus infused in order to stem the effects of the pandemic.

Both short-term and long-term yields have fallen as massive stimulus efforts have buoyed the bond markets. The yield on the 10-year Treasury bond ended April at 0.64%, with the yield on the 2-year Treasury ending the month at 0.20%. All bond sectors are positive for the year, outperforming all equites indices since the beginning of the year.

Sources: Federal Reserve, U.S. Treasury

Earnings Are Focus For Equities – Stock Market Review

Equities rebounded in April, recapturing some of the losses suffered in March. Stocks were enhanced by reopening prospects and stimulus efforts targeting businesses. All eleven sectors composing the S&P 500 Index were positive in April, a strong reversal relative to March. Health Care, Technology, and Consumer Staples were among the top performing sectors for the month. The collapse in U.S. oil prices, as measured by West Texas Intermediate (WTI), drove energy related stocks lower producing dismal revenue and profit expectations.

Earnings dominated equity markets as corporate earnings have become a barometer of the impact that the pandemic is having on the economy. Some analysts can’t explain the discrepancy between the economy and the stock market, with equites propelling higher in April as dismal economic data points to subdued growth.

Sources: S&P, Bloomberg

Why Small Businesses Are So Important To The Economy – Domestic Economy

The country is composed of millions of small businesses from home-based one person consultants to hair salons and manufacturing companies. As defined by the SBA’s Office of Advocacy, a small business has less than 500 employees and operates independently, not under the control of another entity.

As of 2018, the SBA acknowledged that there were 30.2 million small businesses in the U.S., 22 million of which were individually operated with no employees other than the owner. At 49.2%, nearly half of the nation’s workforce is employed by a small business, representing roughly 120 million employees.

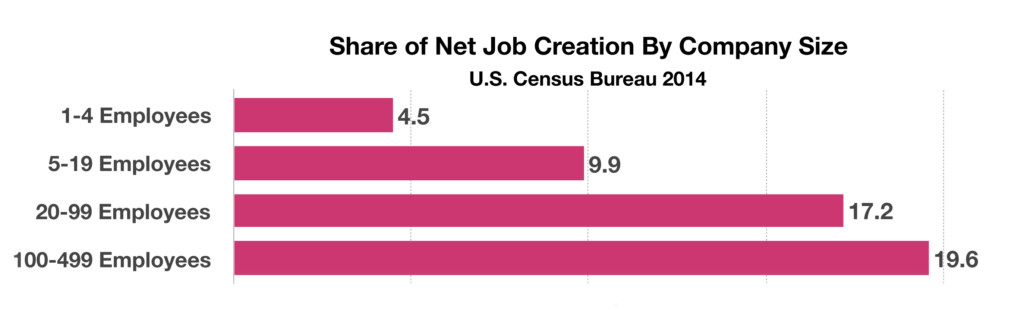

The SBA reports that small businesses have historically accounted for 60-65% of net new jobs nationwide every year, amounting to approximately 2 million jobs per year. Data compiled by the Census Bureau for 2014 identify that roughly 50% of all net jobs created nationwide were by small business employers. With over 30 million newly unemployed Americans since the outbreak, small businesses are expected to eventually hire many of the recently unemployed.

The Paycheck Protection Program is extremely critical for small businesses because of the financial burden derived by the mandatory closures. Of the various industries affected, restaurants have been one of the hardest hit nationwide, as business owners have had to lay off employees and succumb to selling take out only menus in order to survive to pay rent and utilities. The SBA’s data shows that about 60% of all small businesses either are operating at a loss or merely breaking even.

Sources: Labor Department, BLS, SBA

Oil Prices Drop Below $0 In April – Oil Industry Update

Oil’s plunge in April was of historic proportion, falling below $0 per barrel for the first time ever in history. The collapse in U.S. oil prices, as tracked by WTI, fell as storage for crude oil became nearly completely unavailable worldwide.

The economy may have an indirect boost with the price of gasoline expected to drop to new lows as the price of crude oil (WTI) collapsed to below $10 per barrel in April.

Lower crude oil prices have historically led to lower gasoline prices nationwide as product costs have dropped exponentially. Some states such as California and Hawaii may not see the full benefits of lower oil prices due to additional excise state taxes, refining costs, and distribution expenses.

Storage for crude oil has become increasingly scarce as the virus outbreak has led to a growing supply amid falling global demand, thus creating a glut of oil with minimal potential buyers.

Source: Department of Energy

How The Housing Market Is Being Affected – Housing

A drop in mortgage rates to near historic lows has not been enough to offset a decline in demand for home buyers. The ongoing travel and socialization restrictions are inhibiting would be home shoppers from viewing and buying properties.

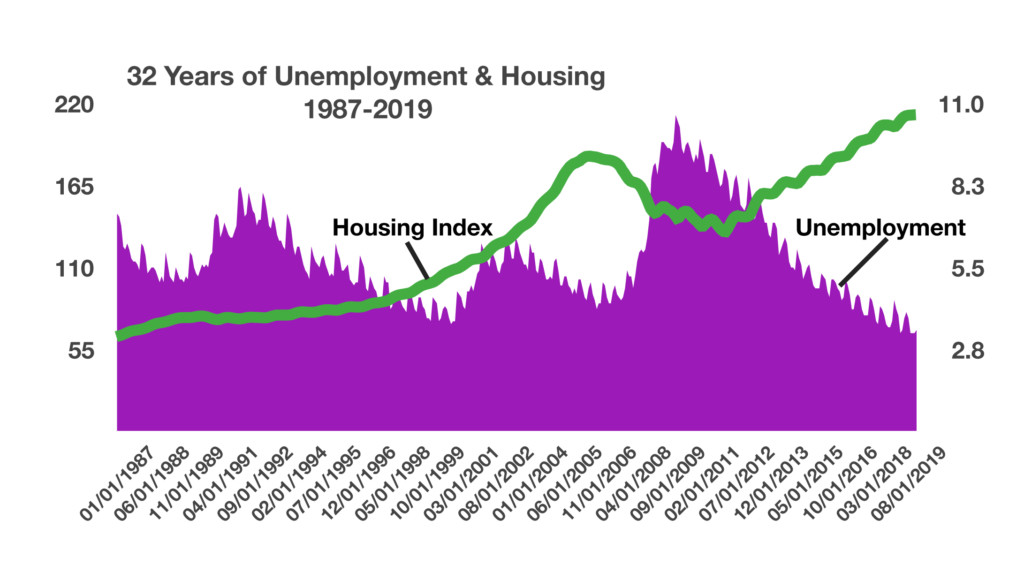

Of the various factors influencing the housing market, employment is the most significant. No matter how low mortgage rates are, if someone is unemployed, they won’t be able to make a mortgage payment at all. Historically, rising unemployment rates have been detrimental to the housing market. The last housing contraction, as measured by the Federal Reserve’s House Price Index, occurred in 2008 and 2009, when unemployment peaked at 10% in October 2009. Some economists believe that an extended period of elevated unemployment will negatively impact the housing market.

In addition, the onset of forbearance allowance for homeowners as enacted by the CARES Act has put lenders in precarious positions. The Federal Housing Finance Agency estimates that there were roughly one million mortgages in forbearance at the end of April, representing 7% of government held mortgages by the agency.

With mortgage rates falling, refinances have increased for existing homeowners, with numerous applications backlogged due to the flood of new refiance activity. Borrowers are experiencing varied approvals as lenders are sensitive to a deteriorating economic environment that may lead to additional foreclosures and bankruptcies.

Sources: Federal Housing Agency, Fannie Mae, Federal Reserve