Stock Indices:

| Dow Jones | 37,815 |

| S&P 500 | 5,035 |

| Nasdaq | 15,657 |

Bond Sector Yields:

| 2 Yr Treasury | 5.04% |

| 10 Yr Treasury | 4.69% |

| 10 Yr Municipal | 2.80% |

| High Yield | 7.99% |

YTD Market Returns:

| Dow Jones | 0.34% |

| S&P 500 | 5.57% |

| Nasdaq | 4.31% |

| MSCI-EAFE | 1.98% |

| MSCI-Europe | 2.05% |

| MSCI-Pacific | 1.82% |

| MSCI-Emg Mkt | 2.17% |

| US Agg Bond | 0.50% |

| US Corp Bond | 0.56% |

| US Gov’t Bond | 0.48% |

Commodity Prices:

| Gold | 2,297 |

| Silver | 26.58 |

| Oil (WTI) | 81.13 |

Currencies:

| Dollar / Euro | 1.07 |

| Dollar / Pound | 1.25 |

| Yen / Dollar | 156.66 |

| Canadian /Dollar | 0.79 |

Macro Overview

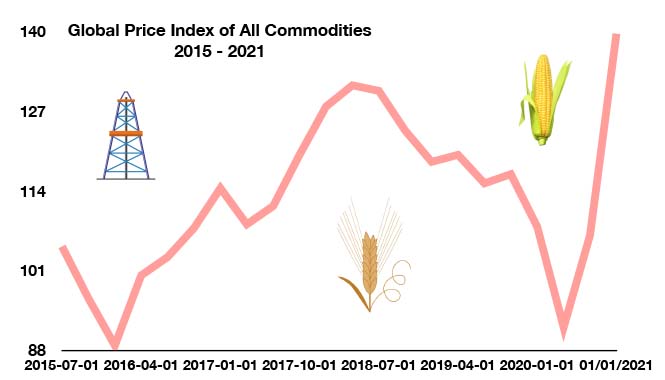

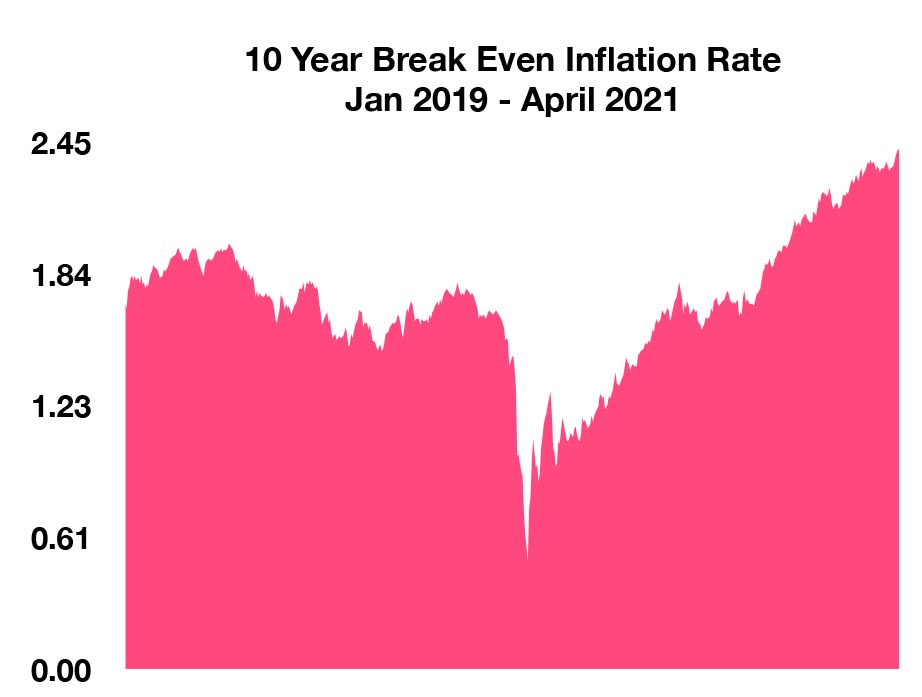

Inflationary pressures increased throughout the economy recently, as the price of raw materials required for consumer products ranging from bread to automobiles rose in cost due to short supply and growing demand. Commodities including wheat, copper, corn, lumber, and steel are essential for the production and manufacture of consumer products, whose rising costs are passed along to consumers in the form of higher prices.

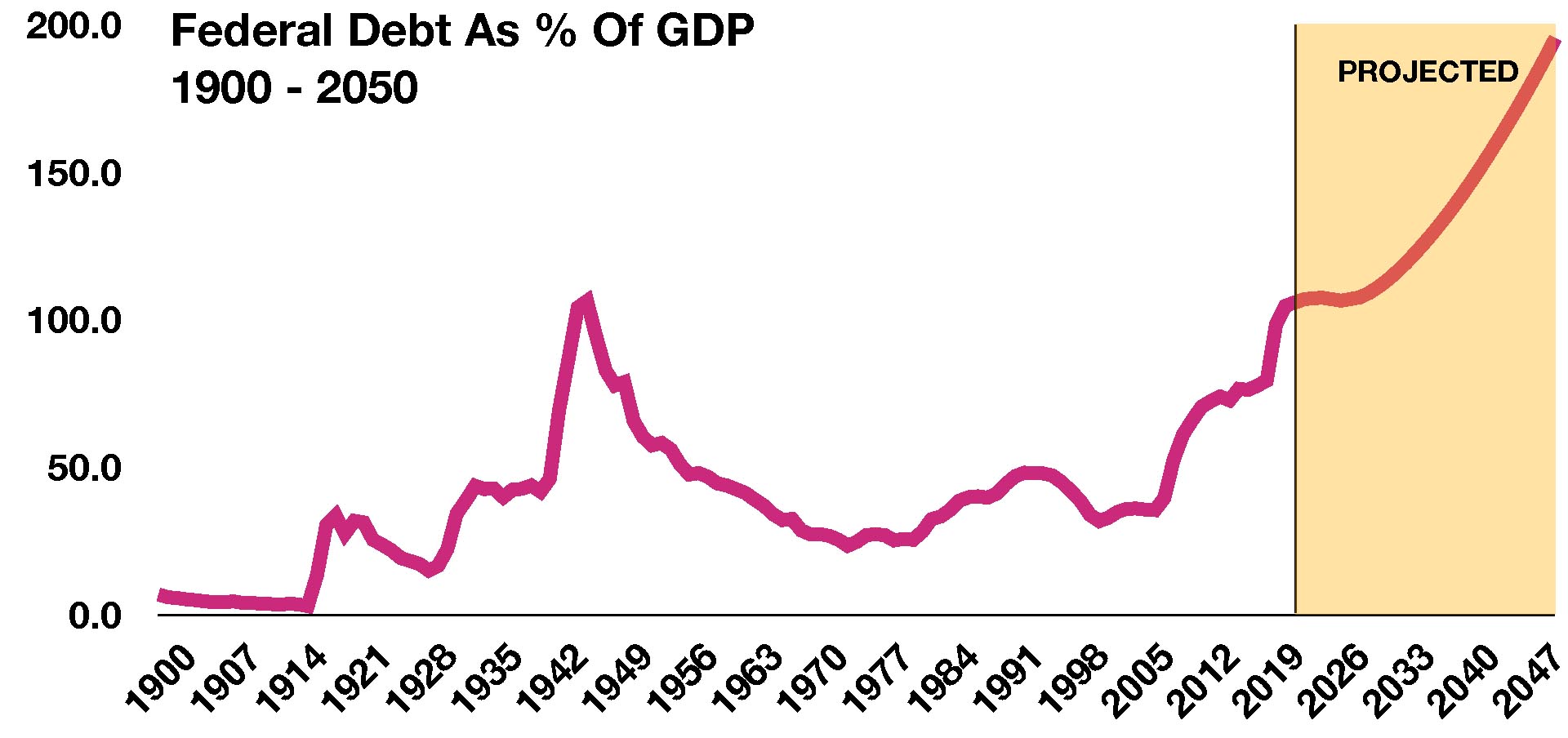

Markets reacted to proposals aimed at raising capital gains taxes and widening the reach of estate taxes. Small business owners are expected to be affected if the proposals are passed, although some analysts believe that markets will tolerate a tax increase without any significant repercussions.

The proposed tax hikes by the administration are primarily targeted at those earning over $400,000 by raising the top rate on ordinary income from 37% to 39.6%. Capital gains would be taxed as ordinary income for taxpayers earning more than $1 million. Wealth transfer is expected to become more costly as estate taxes and exclusions on home appreciation are also being considered by the administration.

The Commerce Department reported that the U.S. economy grew at an annual rate of 6.4% in the first quarter. The Federal Reserve commented that the economy is heading into a period of faster growth and job creation, yet still remains vulnerable to a spike in COVID variant cases should it occur. Companies continue to struggle in finding workers for posted positions, with nearly 7.5 million jobs unfilled. Economists note that some workers have been deterred by generous state and federal unemployment benefits.

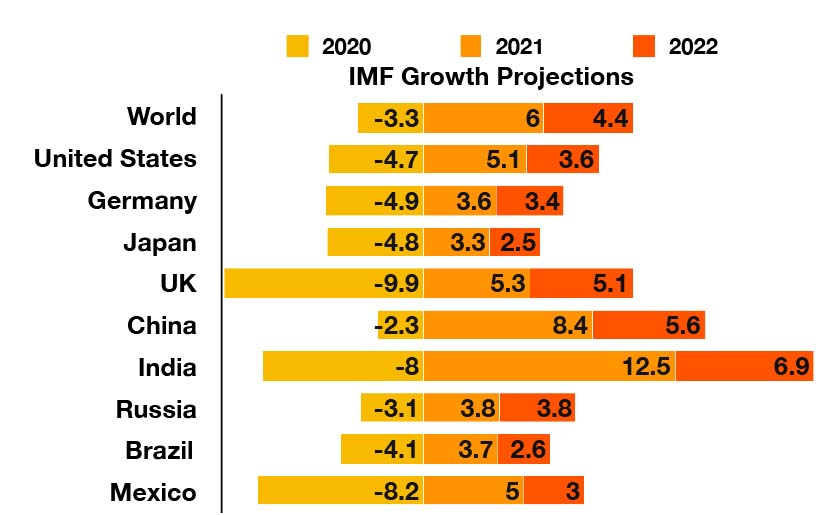

Projections by the International Monetary Fund (IMF) place global growth at an annualized rate of 6% this year, as pent-up demand drives growth. The IMF emphasized the risk of virus mutations outpacing vaccinations as a potential threat to the global economy.

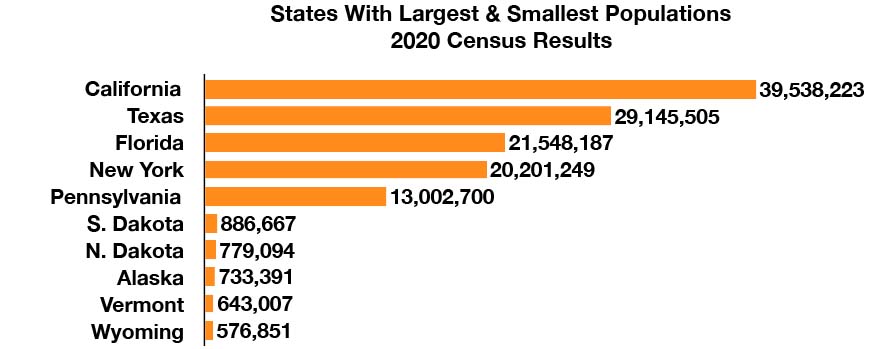

Census data released by the Census Bureau for 2020 reported a U.S. population growth of 7.4% since the last Census in 2010, with a total of 331,449,281 U.S. residents as of April 1, 2020. The Census results shifted state representation in the House of Representatives, with states including California and New York losing seats while Texas and Florida gained seats.

Sources: Federal Reserve, Commerce Dept., U.S. Census, Tax Policy Center

(Source: U.S. Census;CB21-CN.30)

(Source: U.S. Census;CB21-CN.30)