Wes Gautreaux

Summit Financial Wealth Advisors

326 Heymann Blvd

Lafayette, LA 70505

337.232.1141

Stock Indices:

| Dow Jones | 46,397 |

| S&P 500 | 6,688 |

| Nasdaq | 22,660 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.16% |

| 10 Yr Municipal | 2.92% |

| High Yield | 6.56% |

YTD Market Returns:

| Dow Jones | 9.06% |

| S&P 500 | 13.72% |

| Nasdaq | 17.34% |

| MSCI-EAFE | 22.34% |

| MSCI-Europe | 24.64% |

| MSCI-Pacific | 17.97% |

| MSCI-Emg Mkt | 25.16% |

| US Agg Bond | 6.13% |

| US Corp Bond | 6.88% |

| US Gov’t Bond | 5.93% |

Commodity Prices:

| Gold | 3,882 |

| Silver | 46.77 |

| Oil (WTI) | 62.52 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 148.71 |

| Canadian /Dollar | 0.71 |

Introduction

In recent years your team at Summit Financial Wealth Advisors has grown from a small office of professionals in Lafayette to sixteen professionals in four offices across Louisiana. This growth has been invaluable as it has greatly expanded our ability to serve our clients in a consistent and timely manner while supporting them across the entirety of their financial lives. It has also taught us the value of communicating clearly and frequently to ensure that everyone is informed and engaged as we continue to expand our reach. To that end we are launching this first installment of a quarterly newsletter to provide thoughts on the financial markets and general updates on our firm; we hope that you enjoy it and would encourage you to please feel free to call or stop by an office anytime if our team can be of value.

Economic Overview

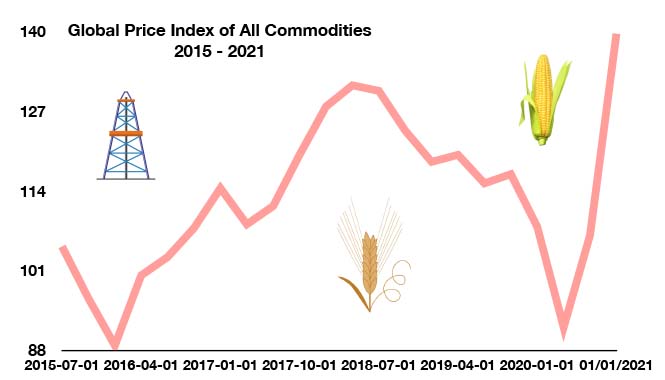

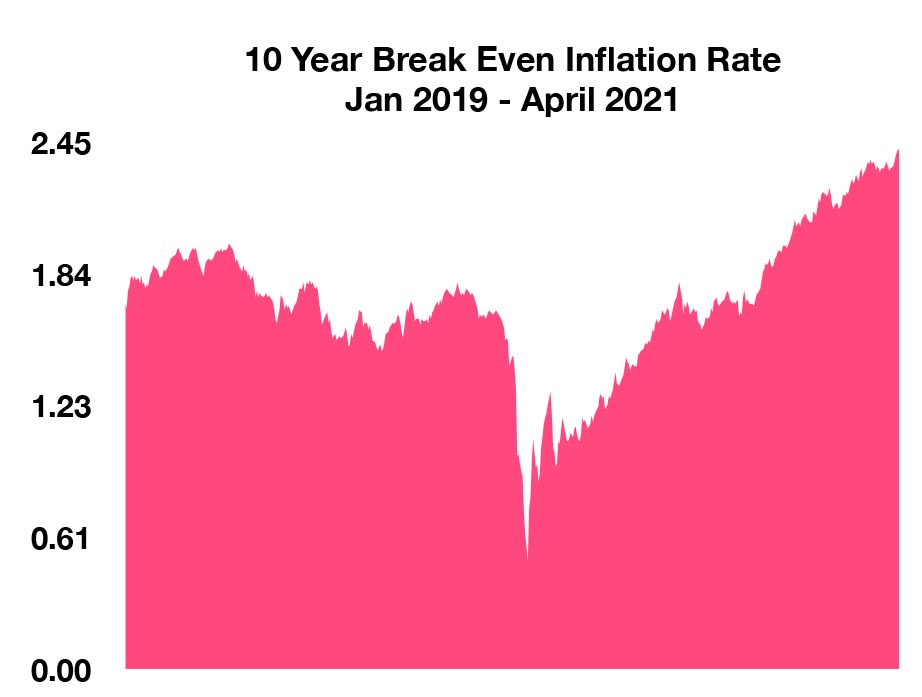

Inflationary pressures have taken hold throughout the economy, as raw materials required for most every consumer product from bread to automobiles have increased in cost due to short supply and growing demand. Commodities such as wheat, copper, corn, lumber and steel are essential for the production and manufacture of consumer products, whose rising costs are being passed along to consumers in the form of higher prices.

Markets reacted to proposals aimed at raising capital gains taxes as well as widening the reach of estate taxes. Small business owners are also expected to be affected. Some analysts believe that markets will tolerate a tax increase without any significant repercussions.

The proposed tax hikes by the administration are primarily targeted at those earning $400,000 and by raising the top rate on ordinary income from 37% to 39.6%. Capital gains would be taxed as ordinary income for taxpayers earning more than $1 million. Wealth transfer is expected to become more costly as estate taxes and exclusions on home appreciation are also a focus.

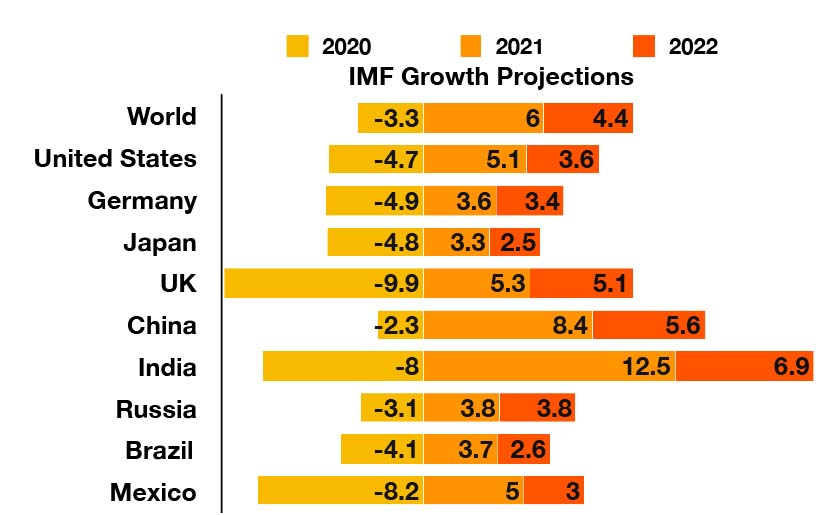

The Commerce Department reported that the U.S. economy grew at an annual rate of 6.4% in the first quarter. Concurrently, the Federal Reserve commented that the economy is heading into a period of faster growth and job creation, yet still remains vulnerable to a spike in COVID variant cases should it occur. Companies continue to struggle in finding workers for posted positions with nearly 7.5 million jobs unfilled. Economists believe that some workers have been deterred by generous state and federally funded unemployment benefits. Projections by the International Monetary Fund (IMF) place global growth at an annualized rate of 6% this year, as pent-up demand drives growth globally. (Sources: Federal Reserve, Commerce Dept., U.S. Census, Tax Policy Center)

the International Monetary Fund (IMF) to revise global growth projections higher. The IMF expects advanced economies less affected than emerging economies by the pandemic, which has taken a toll on emerging countries such as India and Brazil. Smaller emerging economies reliant on tourism have lost vast amounts of revenue and jobs as international travel essentially came to a halt. In a separately issued report released by the IMF, the Global Financial Stability Report, the IMF cautioned that the excessive use of central bank intervention and massive debt issuance as in the U.S. may produce unintended consequences such as inflationary pressures for consumers on a wide scale. (Source: IMF)

the International Monetary Fund (IMF) to revise global growth projections higher. The IMF expects advanced economies less affected than emerging economies by the pandemic, which has taken a toll on emerging countries such as India and Brazil. Smaller emerging economies reliant on tourism have lost vast amounts of revenue and jobs as international travel essentially came to a halt. In a separately issued report released by the IMF, the Global Financial Stability Report, the IMF cautioned that the excessive use of central bank intervention and massive debt issuance as in the U.S. may produce unintended consequences such as inflationary pressures for consumers on a wide scale. (Source: IMF)