Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

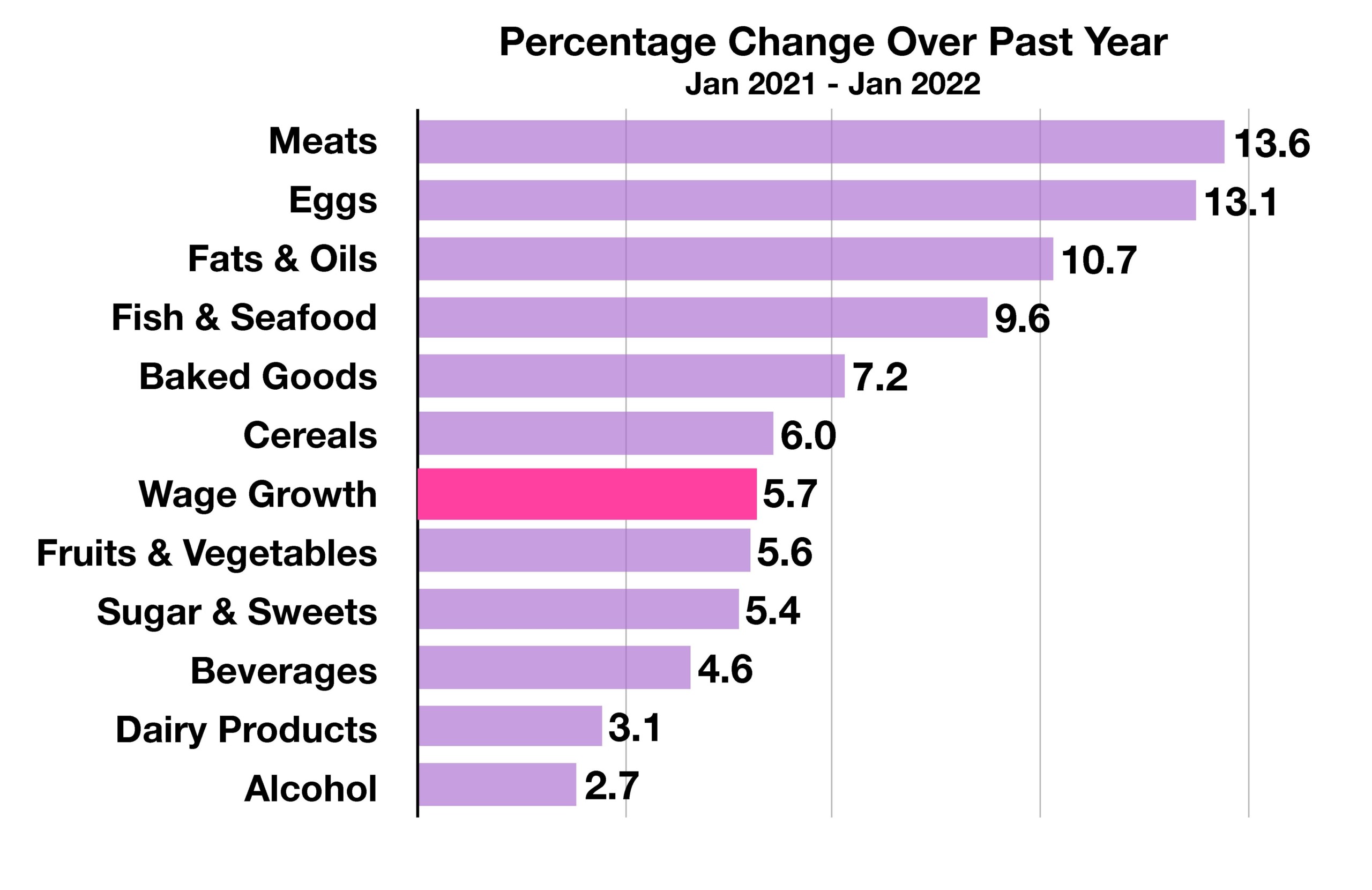

The most recent inflation data released revealed an 8.5% annual increase, lower than many analysts expected. A consensus is gradually forming among economists that inflation may be peaking; a prediction is that the Fed may ease its rapid rate rise trajectory should inflation actually decelerate.

The Russian invasion of Ukraine entered its third month with no sign of a compromise, accompanied by multitude of international sanctions that continue to expand and impose economic duress on the Russian economy. The situation, meanwhile, continues to exasperate global supply chain constraints.

An increase in COVID-19 cases across China is hampering manufacturing and distribution for various industries throughout the country, delaying the shipment of finished goods to the United States and other countries and amplifying supply side constraints.

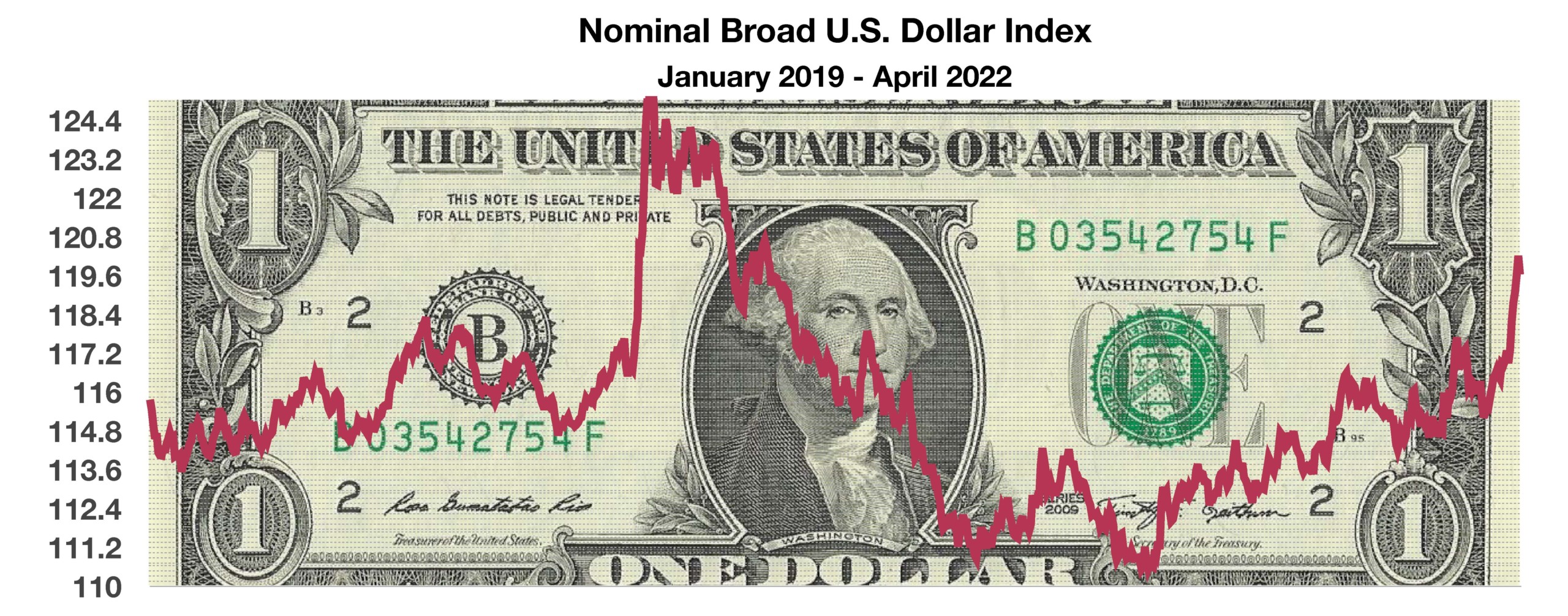

The U.S. dollar rose nearly 7% year-over-year versus other major currencies, making imports less expensive for U.S. consumers and mitigating inflationary pressures. Meanwhile, the Russian invasion of Ukraine contributed to a devalued euro, creating inflationary pressures throughout Europe, which is a substantial importer of petroleum & natural gas.

Employment costs rose in the latest release from the Bureau of Labor Statistics, indicating an increase in expenses related to wages and benefits for both government and private sector jobs. Rising employment costs pose a challenge to companies as they either pass along higher costs to consumers or bear reduced profit margins. Rising employment costs contribute to broader inflationary pressures.

The IMF and the World Bank reduced global economic growth forecasts, due largely to geopolitical tensions arising from the Russian invasion, which continues to exacerbate global supply chain issues and foster inflation. European companies potentially face additional risk if demand from China and the U.S. falters due to an economic slowdown.

Russian energy companies are reluctant cut oil and gas sales to European countries because a loss of revenue would threaten the stability of the Russian energy industry and overall economy. Roughly 70% of Russian exports are energy products including natural gas and petroleum, while approximately 8% of U.S. exports are energy-related. The sharp decrease of Russian natural gas to various European countries would likely benefit U.S. energy companies, as U.S. shipments of LNG (Liquid Natural Gas) to Europe are estimated to increase over 60% in 2022 relative to 2021.

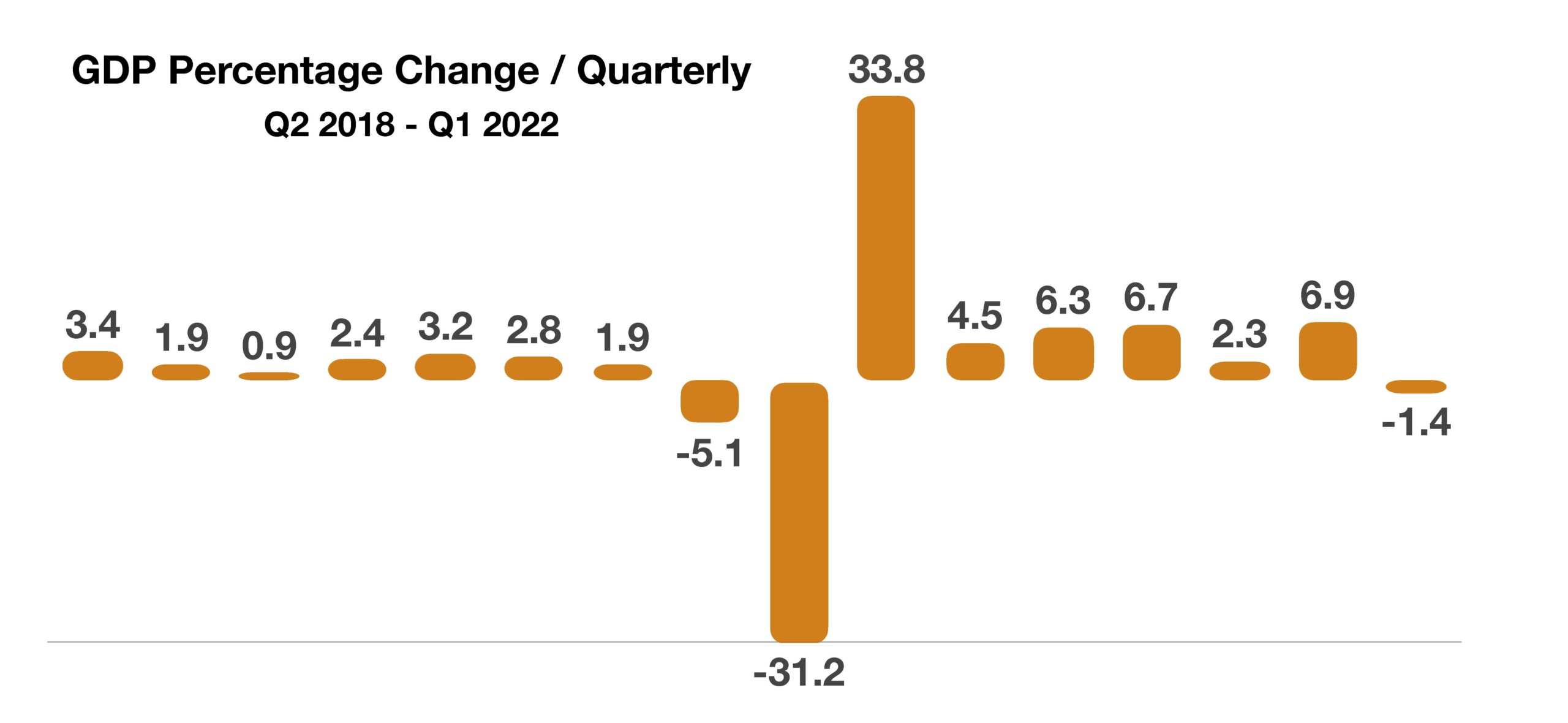

Analysts are expecting the housing market to cool off relatively soon, due to rising mortgage rates and slowing real wage growth. A potential concern is that, as housing slows, so might GDP, given that the housing industry represents roughly 20% of the nation’s economic growth.

Sources: EIA, Labor Dept., Federal Reserve, BLS, IMF, World Bank

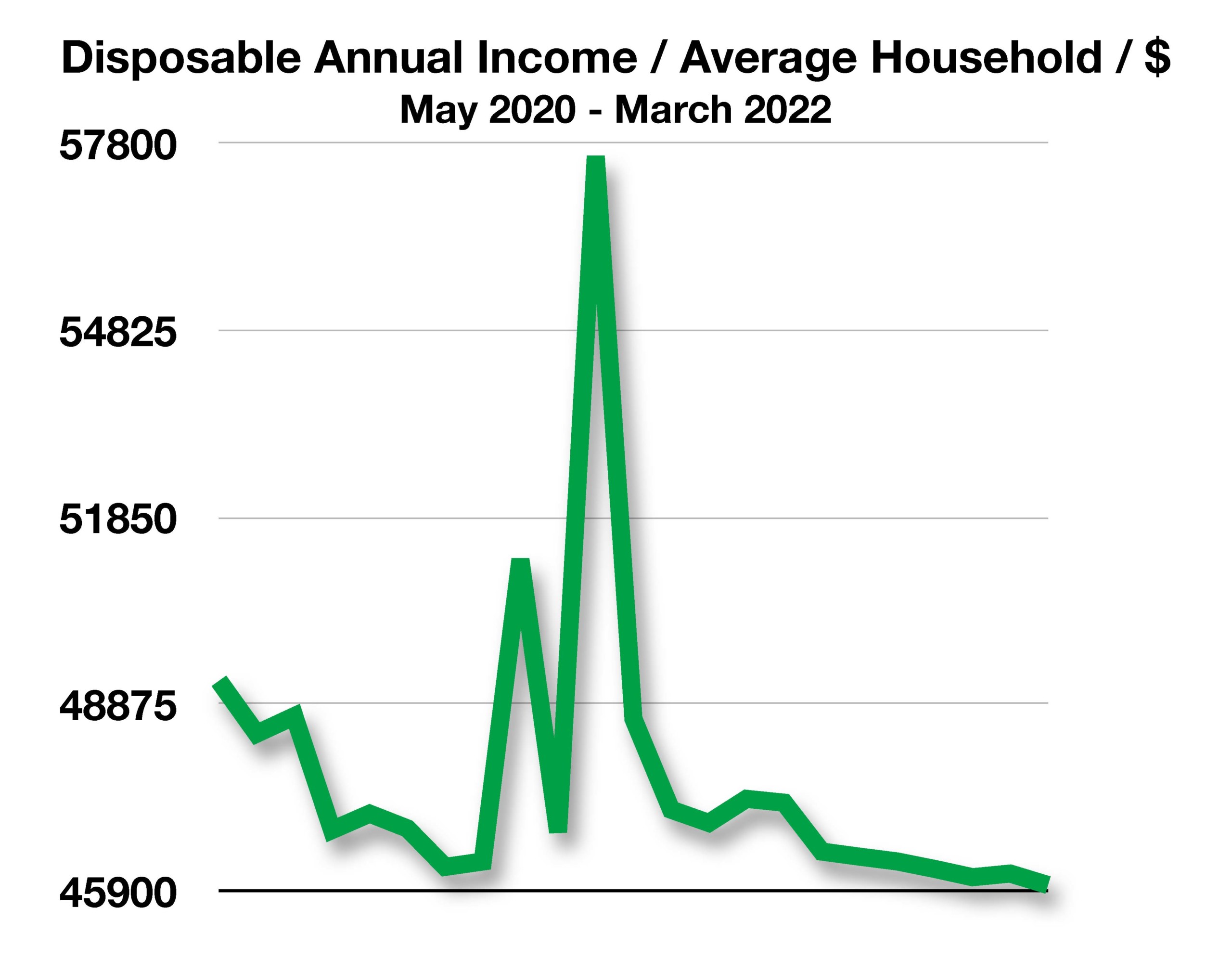

Economists outline a number of factors affecting growth in the U.S. economy, with no standalone reason for a possible slowdown. A pullback in economic expansion may come from the exhaustion of pandemic relief funds, rising interest rates, inflation, lower disposable income, and uncertainty regarding COVID-19 infections. (Source: Bureau of Labor Statistics, Bloomberg)

Economists outline a number of factors affecting growth in the U.S. economy, with no standalone reason for a possible slowdown. A pullback in economic expansion may come from the exhaustion of pandemic relief funds, rising interest rates, inflation, lower disposable income, and uncertainty regarding COVID-19 infections. (Source: Bureau of Labor Statistics, Bloomberg)