Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Concern over additional bank failures has created ongoing uncertainty for equity and bond markets, as the collapse of First Republic Bank this past month has become the second-largest bank failure ever, with $229 billion in assets and over $100 billion in deposits.

Federal regulators struck a deal with JPMorgan, the nation’s largest bank, to take over the failed bank and assume its loans and assets. The FDIC and JPMorgan agreed to a loss–share transaction which is projected to maximize recoveries on the assets by keeping them in the private sector. The FDIC estimates that the cost to the Deposit Insurance Fund will be about $13 billion.

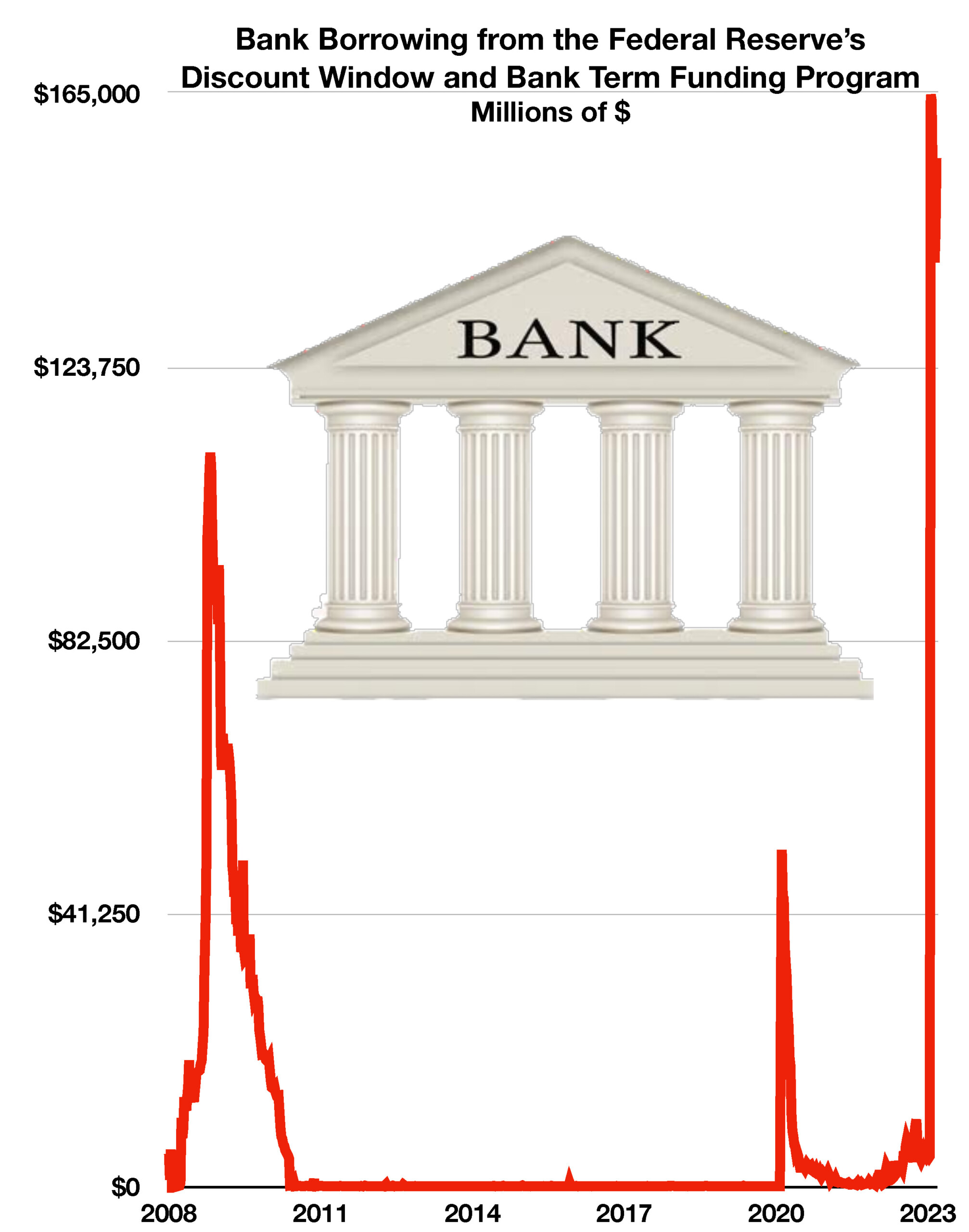

Following the failures of Silicon Valley Bank, Signature Bank, and First Republic Bank, banks across the nation have been scrambling to maintain their depositors’ trust and cover losses of depositors’ withdrawals. To acquire short-term funding, many banks have turned to the Federal Reserve’s discount window, a backstop for banks that require liquidity assistance. Banks have been borrowing funds from the Fed’s discount window at levels not seen since the 2008 banking crisis.

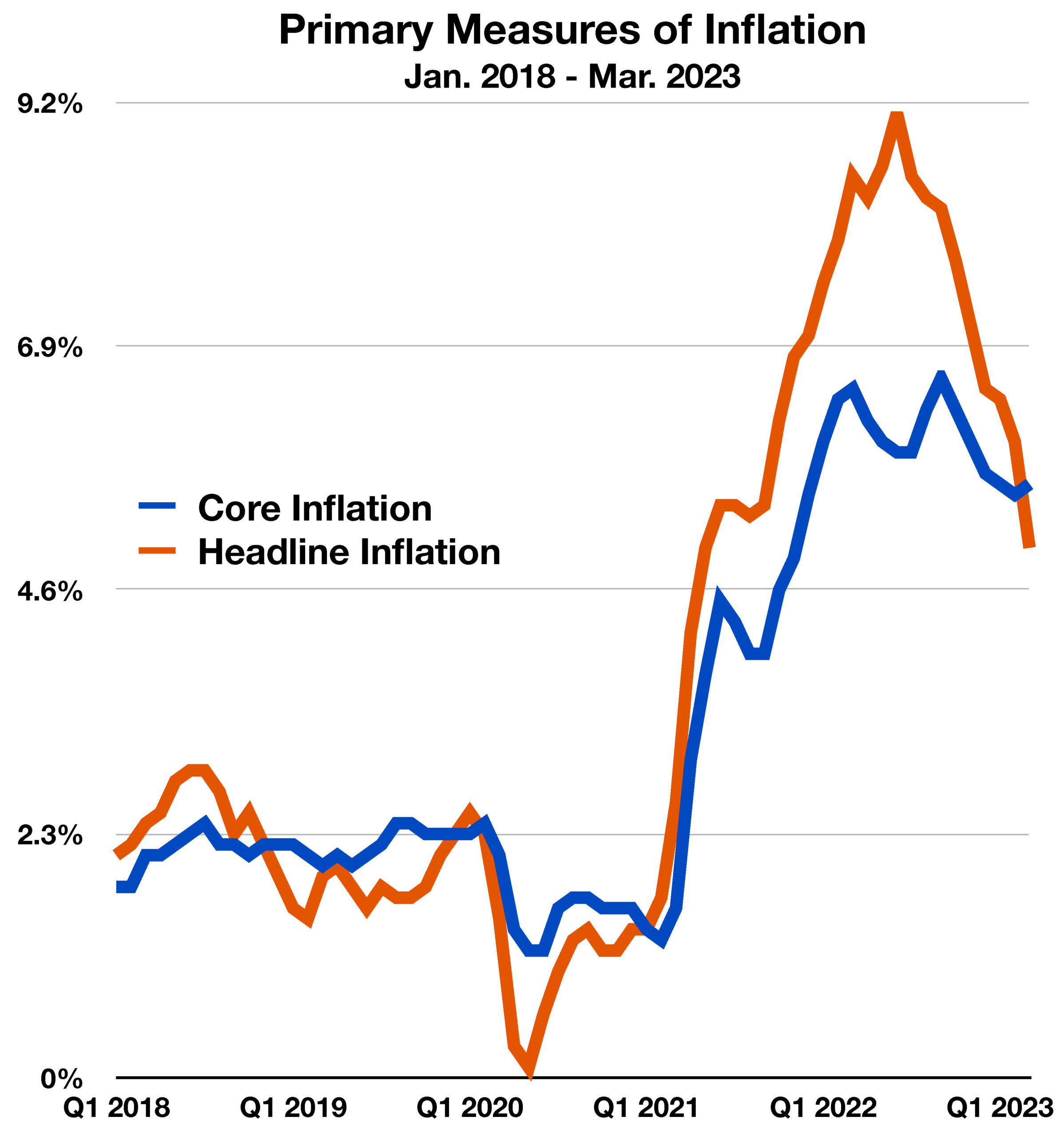

Interest rates held steady in April with shorter-term rates rising somewhat, a result of the Fed expected to make a final rate increase before altering its course. Analysts are carefully tracking economic growth and inflation data to determine what direction the Fed might take. Many believe that the recent interest rate increase has already brought about a retraction in economic activity nationwide.

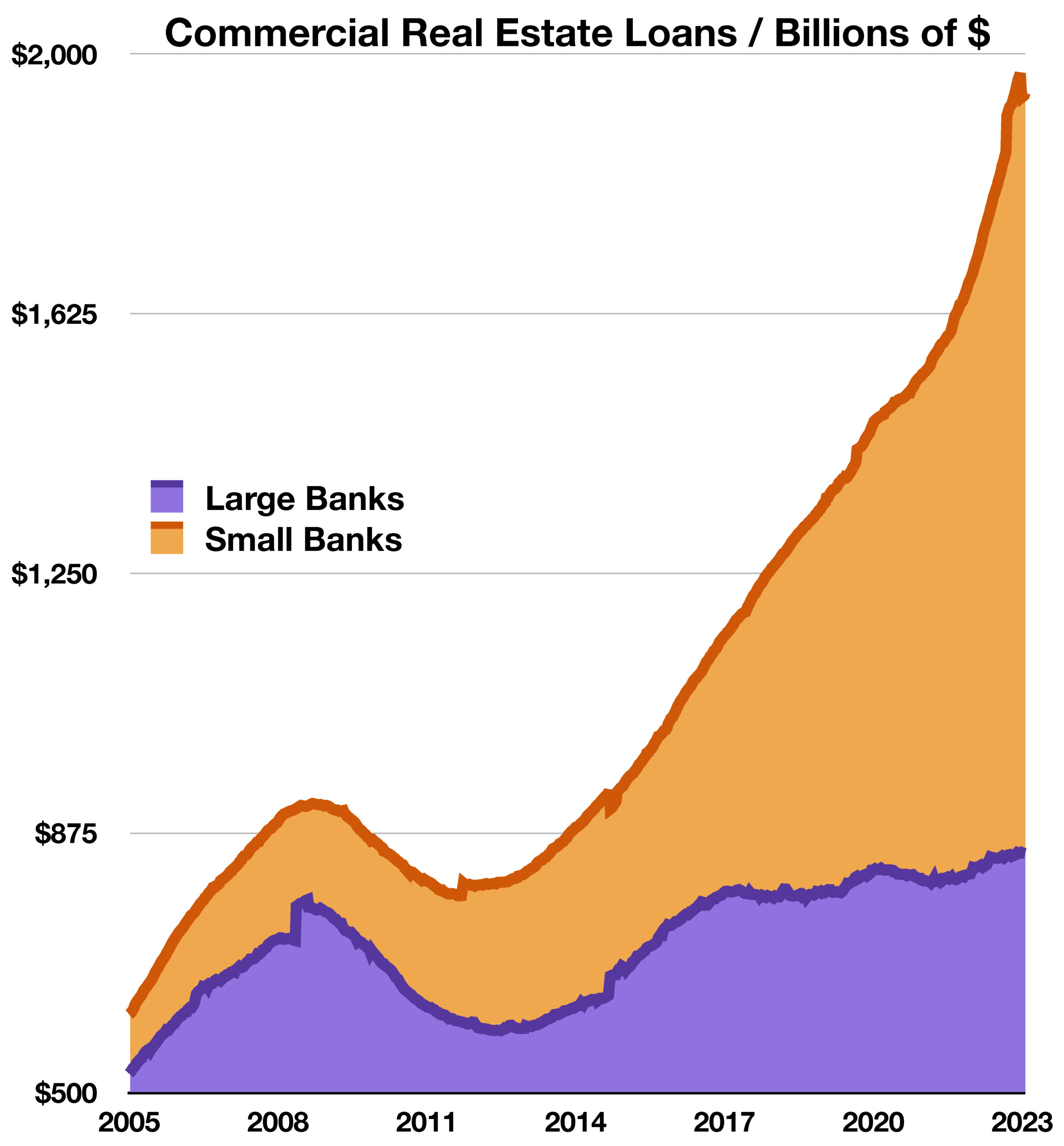

The commercial real estate market has begun to show trends of shadow banking on the rise. Shadow banks are characterized as firms that issue short-term loans and invest the proceeds into mortgage-backed securities, which were at the forefront of the 2007-2009 financial crisis. Banking regulations have become more stringent since the financial crisis, yet banks still emerged as a weak link within the financial markets due to high-interest rates and speculative investments. Internationally, the International Monetary Fund (IMF) recently communicated concerns surrounding shadow banking practices in both the U.K. and South Korea. (Sources; Bloomberg, IMF, Fed,U.S. Treasury.)

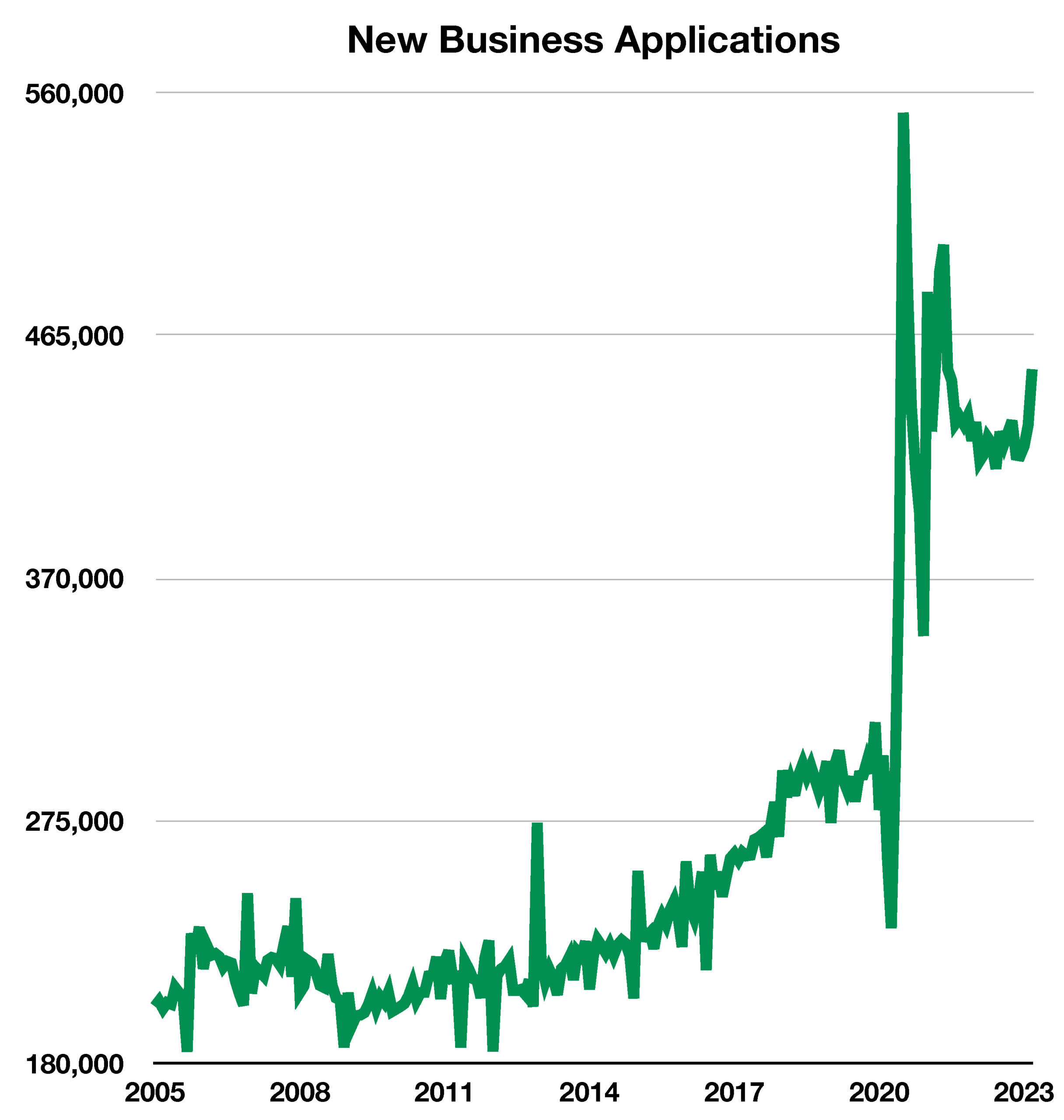

While business applications had been trending upward in the past decade before the pandemic, 2020 saw a historic surge in business applications. Workers, faced with losing their jobs due to the pandemic’s vast disruption, looked to open their own businesses in a mass wave. In the summer of 2020, monthly business applications reached a historic level of 550,000. This was nearly double the level of business applications in late 2019 and early 2020, just months before the pandemic struck.

While business applications had been trending upward in the past decade before the pandemic, 2020 saw a historic surge in business applications. Workers, faced with losing their jobs due to the pandemic’s vast disruption, looked to open their own businesses in a mass wave. In the summer of 2020, monthly business applications reached a historic level of 550,000. This was nearly double the level of business applications in late 2019 and early 2020, just months before the pandemic struck.