NYSE FANG+ Index Hits Correction: Retirement Investing

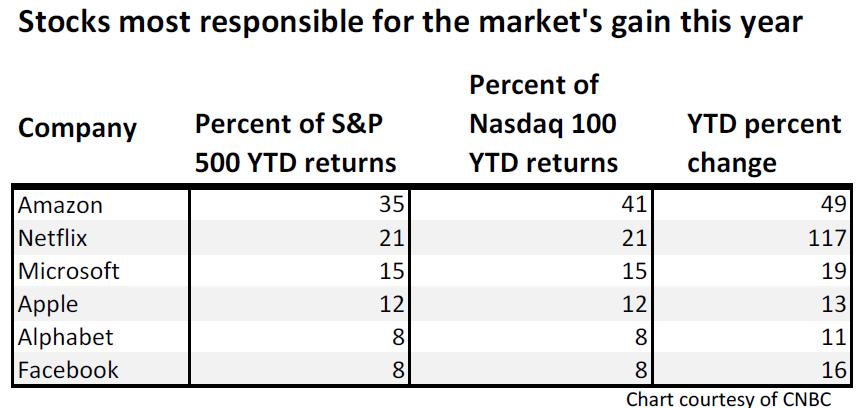

On July 10th, Michael Sheetz from @Thesheettztweetz published the following chart in a CNBC article illustrating how just three companies, Amazon, Netflix and Microsoft were responsible for 71% of the S&P 500 returns and 78% of the Nasdaq 100 returns:

As if right on cue, on July 30th, CNBC reports that the NYSE FANG+ Index is now down more than 10% from its high last month which is technically correction territory. (FANG is an acronym created by Jim Cramer for the top performing technology stocks: Facebook, Amazon.com, Netflix and Alphabet – formerly google. THE NYSE FANG+ index tracks the FANG stocks with several other high growth tech shares including Nvidia, Baidu and Telsa)

This series of events is a reminder of how fast the tide can turn and the importance of adequate diversification. If you simply “bought and held” the largest companies 18 years ago here is how you would have fared:

GE -5.4%

Intel +9%

Cisco -20%

Citigroup -80%

Ford -39%

GM -100%

And here is how you would have fared if properly diversified:

S&P 500: + 180%

Is your retirement portfolio adequately diversified?