Markets On Fire, But Many Are Still Worried

A blistering open to 2019 has powered nearly every publicly traded business in the U.S.A. As of this writing* 26 of the 30 holdings in the DOW and 465 of the 500 holdings in the S&P have risen this year with industrials and Real Estate leading the charge. Tech shares have also been a force in the amazing start to 2019 with Facebook and Amazon leading the way. However, many are still worried because more than 30 companies in the S&P 500 including Netflix and Delta airlines have provided us with Q1 earnings forecasts that fell short of analysist projections citing deteriorating outlooks for the world economy and uncertainty around trade.

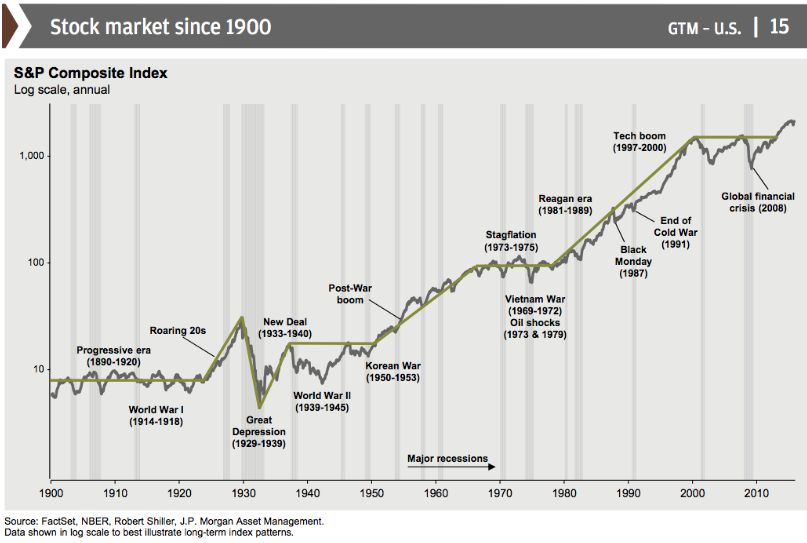

The forecasts have put companies in the broad equity index on track to report a 1.9% decline in profits in the first Quarter from year earlier. These developments appear to be nothing less than a potential “earnings slump” which has investors and advisors alike worried. But the markets have been climbing a wall of worry since the great depression and it’s almost impossible to predict when and how these events will effect share prices, so it’s more effective to establish a long-term plan rather than trying to “time the effects of an earning slump” or any other worrisome event.

*2/8/2019