Prepare for the Bear: Retirement Investing

After the worst ever performance on Christmas Eve last year, the markets staged a “post-Christmas rally” as the DOW added over 1,080 points (4.9%) its biggest one day point gain ever. The S&P 500 also rose 4.9% on that day. That unlikely rebound offered a much-needed reprieve from an otherwise abysmal month. Shares had fallen four consecutive days prior, pushing the S&P 500 just a few points from a bear market which is defined as a 20% retreat from its high water mark. Will the markets melt back down in 2019 and enter into (20%) bear market territory? Or will they rebound this year and avoid the bear? While nobody knows for sure, if they do rebound it’s a temporary avoidance, because a bear market is coming at some point, we just can’t know precisely when.

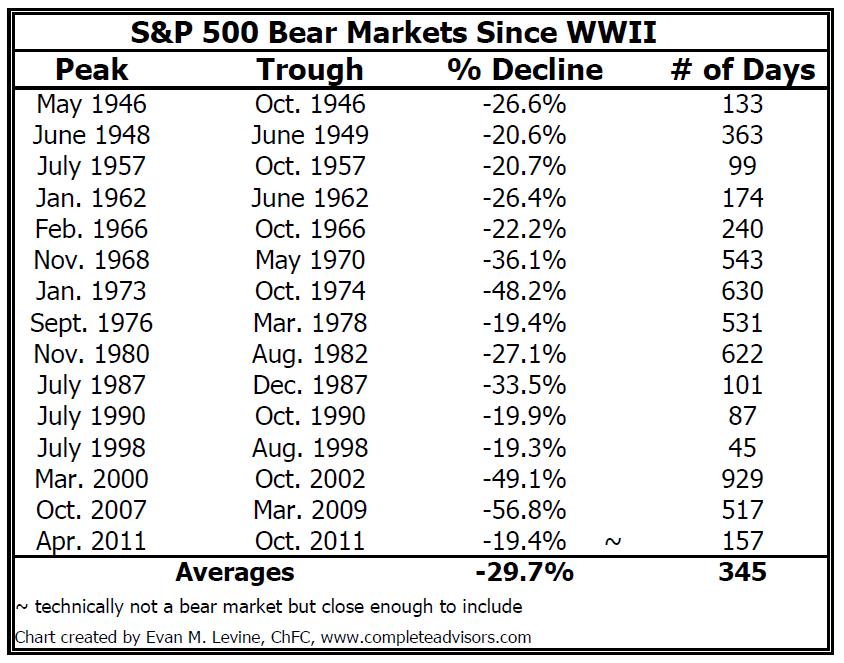

Since WWII, there have been 15 bear markets:

Please note that the average bear market takes the S&P down almost 30% and the duration ranges from about 6 weeks to about two and a half years.