New Rules Benefit 529 College Savings Plans As An Estate Planning Tool

The Tax Cuts and Jobs Act includes a provision to now allow 529 Plans to be used for private elementary and high school expenses, rather than just college related expenses. The new rules are a treat for both parents and grandparents looking for a better way to pay for private educational costs.

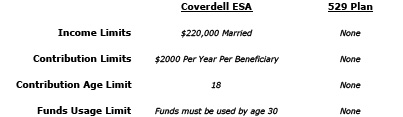

Until now, the only plan that allowed for tax-free earnings growth was a Coverdell Education Savings Account (ESA). Limitations on contributions and income has made these plans unfavorable for many families.

A key notable benefit to a 529 versus a Coverdell ESA includes transferability. Funds in a 529 account may be transferred from the original beneficiary to another. Another benefit is the fact that funds in a 529 may grow perpetually, and never have to be used. Some families are using this feature as an estate planning tool, allowing unused funds in a 529 to pass along to future recipients.

The new tax plan does limit the amount used for K-12 expenses to $10,000 per year. Any current funds held in an existing Coverdell ESA account may be rolled over to a 529 plan with no tax consequences.

These plans offer two primary benefits: assets grow tax deferred and come out tax free for qualified expenses; and, contributions made by parents and grandparents are considered a gift, thus proving a tax benefit for some contributors.

Source: IRS, www.congress.gov/bill/115th-congress/house-bill/1