An Unintended Consequence of the 2017 Tax Act: Estate Planning

The big change to the recently passed tax and jobs act of 2017 is the doubling of the integrated federal estate and gift tax exemption to ~ 11.2 Million for descendants dying and gifts made in 2018. And this can have an unintended consequence for you, particularly if you are semi- affluent.

It is common for folks like you to have a will that creates a trust at death for the amount of property “that would be exempt from estate tax at the creator’s death”. Most of this amount is expressed in a formula based on tax law that is currently in effect, not an exact amount. Check your will. If your document contains a clause with a formula related to the US estate and gift tax exemption, the doubling of this exemption may have created an unintended consequence for you.

To illustrate: a person who leaves the “federal exemption amount” to children either outright or in trust – with the balance payable to her spouse or partner – will have a dramatically different result based on the tax law that would have been the case last year (2017). And even more different if your will was drafted many years ago when the exemption was much lower.

If you have not reviewed your estate planning lately, the tax and jobs act of 2017 provides a reason to meet with your estate attorney or financial advisor for an update.

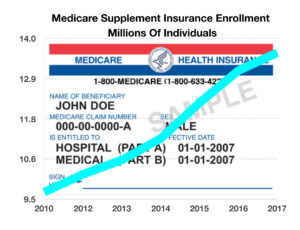

Medicare Supplemental Insurance Purchase On The Rise – Healthcare Overview

Retirees can optionally enroll in private individual insurance policies that supplement original Medicare. These plans are standardized and identified by plan letter (Plans A-N). Also called Medicare Supplemental Insurance, retirees have the ability to choose their doctors, specialists, and care facilities.

Sources: Congressional Research Service, American Association for Medicare Supplement Insurance