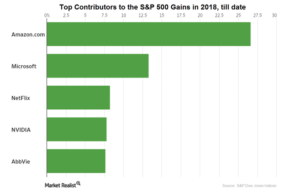

Amazon, Microsoft and Netflix Carry S&P 500

According to a recent wall street journal report, (dated 2/22/18), Amazon has accounted for 27% of the S&P 500 gains this year, followed by Microsoft and Netflix. Based on Dow Jones data Amazon, Microsoft and Netflix accounted for 27%, 13% and 8.3% of the S&P 500’s 1.6% gain as of 2/22. (Figure 1)

Figure 1

This phenomenon of just a few businesses dominating the S&P 500 frequently occurs because the S&P is capitalization weighted, which means bigger companies carry a heavier weight in the index. And Amazon recently became the third largest company in the index behind second place Google and first place Apple.

As an investor planning for retirement or semi-retirement, it’s important to keep this in mind and diversify beyond Large company indexes such as the S&P 500. You can accomplish adequate diversification by including indexes weighted by a metric other than a market cap, such as equal weighted or dividend weighted. You should also diversify with exposure to mid-cap and small-cap US equities as well as international equities and perhaps Income annuities.

As a retiree moves from accumulation phase to distribution, it is important to control volatility. We don’t want our future in the hands of Amazon, no matter how fast they deliver our packages!