What A Flattening Yield Curve Means – Bond Market Update

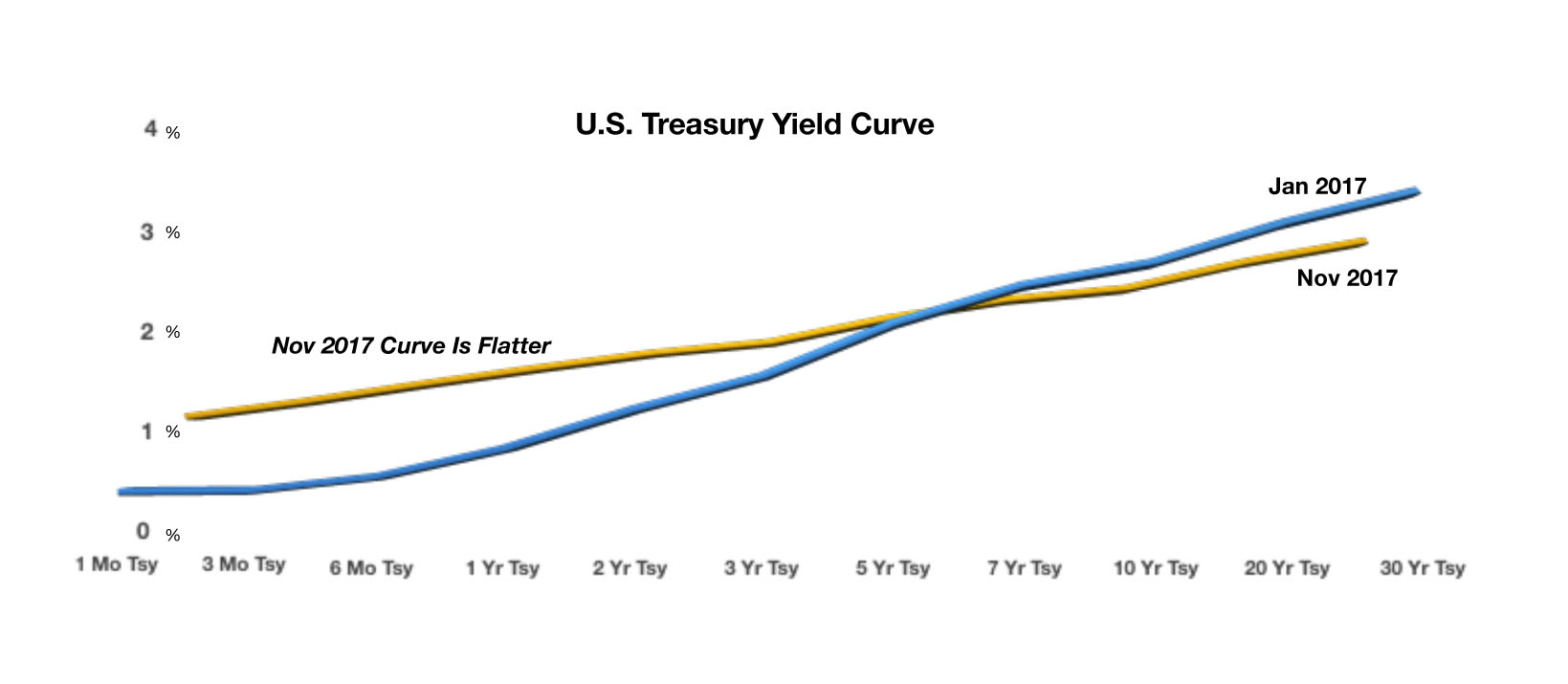

The anticipation of Fed rate hikes has gradually raised short-term rates this year, with the demand for longer-term bond maturities increasing. The result has been a flatter yield curve, where short-term rates have risen and long-term yields have dropped. A flattening yield curve implies that longer-term economic growth may be subdued or not expected to be very extensive.

At the end of November, short-term rates such as the 2-year Treasury yield had risen to 1.75% from 1.22% at the beginning of the year. The longer-term 30-year Treasury bond yield fell to 2.77% on November 30th from 3.04% in January.

As promised, the Fed has started to curtail its buying of Mortgage Backed Securities (MBS). Through September, the Fed was buying an estimated 20-25% of the roughly $110 billion of MBS sold each month. In October, the Fed scaled back its purchases by $4 billion and is scheduled to reduce purchases by another $4 billion every quarter. As the Fed buys less and less MBS, the market will need to slowly absorb the additional paper made available by the Fed’s lack of buying. As this occurs, it is expected that MBS prices will gradually fall and yields will gradually rise.

Sources: Federal Reserve, Bloomberg, Treasury Department