Amazon Plunges into a Bear Market: Retirement Investing

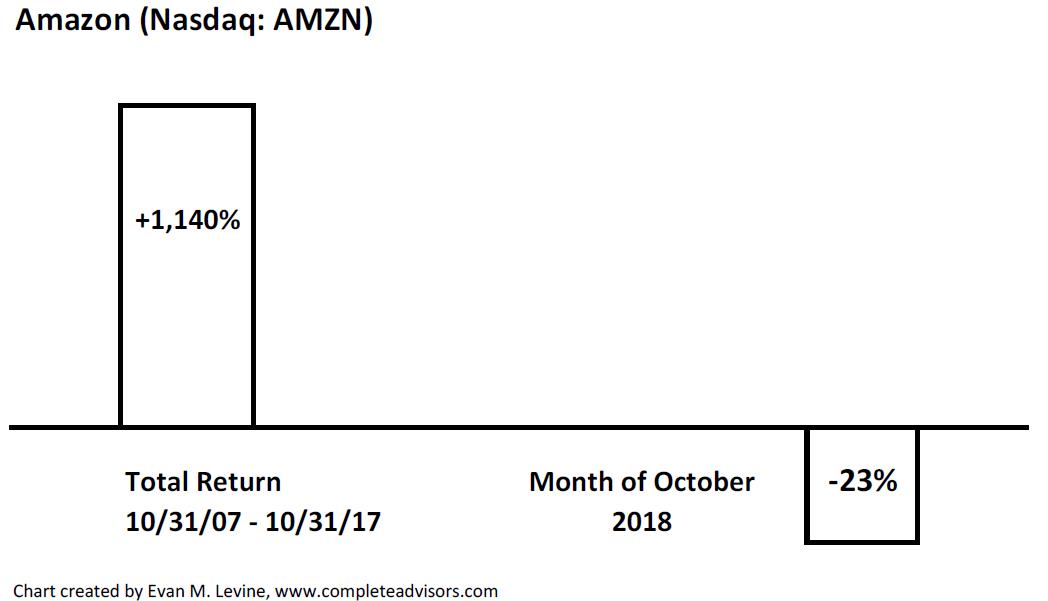

A few weeks ago, on a Monday, Amazon shares fell 6.3% as investors were running away from Amazon following a disappointing earnings report. The two-day drop was 14%, and the share prices were down 23% in the past month! The technical definition of a correction is a 10% drop, and a bear market is a 20% drop. So the 20% drop puts Amazon in bear market territory even though the broader diversified market is not.

Will it “bounce back”? Is it a dip that you should buy or the start of a longer-term downturn for the company?

I do not know the answer, but this sell-off demonstrates, once again, the importance of maintaining adequate diversification, especially if you are getting close to retirement or semi-retirement.

Source: CNBC

If more than 10% of your portfolio is in any one investment and you are nearing (or in) retirement, you should reduce the position and diversify, to avoid unnecessary concentration risk.