Caveat Emptor, Growth Stocks: Investing

“When there is a gap between perception and reality it is only a matter of time until it is reconciled…in favor of reality” – Jack Bogle

Equities are generally divided into two categories: Growth and Value. Growth Companies are focused on reinvesting to expand, tend to perform best in bull markets, and often show up in the technology and healthcare sectors. Value companies are considered “Bargains” and are often most attractive in the later stages of an economic cycle. As expected, Growth has been outperforming value – but my current concern is that many companies without steady earnings are leading the growth charge.

To illustrate: unprofitable growth stocks that have surged this year include Sarepta Therapeutics (Nasdaq: SRPT) and Okta Inc. (Nasdaq: QKTA) While both have seen their stocks prices double, they do not have many profits which means it may all come back to roost. Sarepta has had only one quarterly profit since 2016 yet 20 of 22 analysts polled by FactSet have a buy rating. Do they see something we don’t? Okta went public in 4/2017 and has yet to post a quarterly profit, while 11 of 13 analysts have a buy rating!

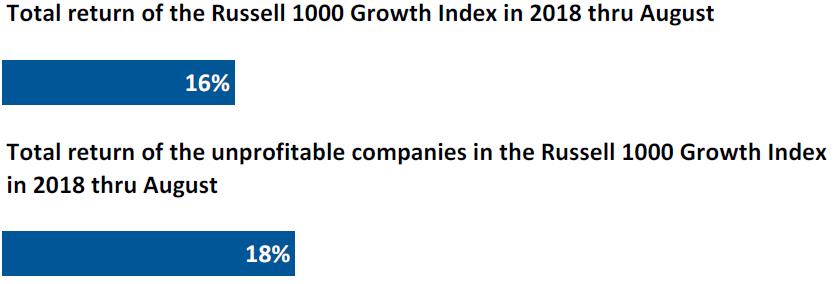

Below is the return of the Russell 1000 Growth Index compared to the return of the unprofitable companies that reside within the index.

Source: Wall Street Journal

The solution: We can’t predict when the markets will turn up or down, so broad diversification remains the best approach. If you own individual stocks, make sure they do not represent more than 10% of your total portfolio. And for your diversified stock holdings, make sure they are equally weighted between Growth and Value equities or tilted to Value, this will help avoid an unpleasant surprise!