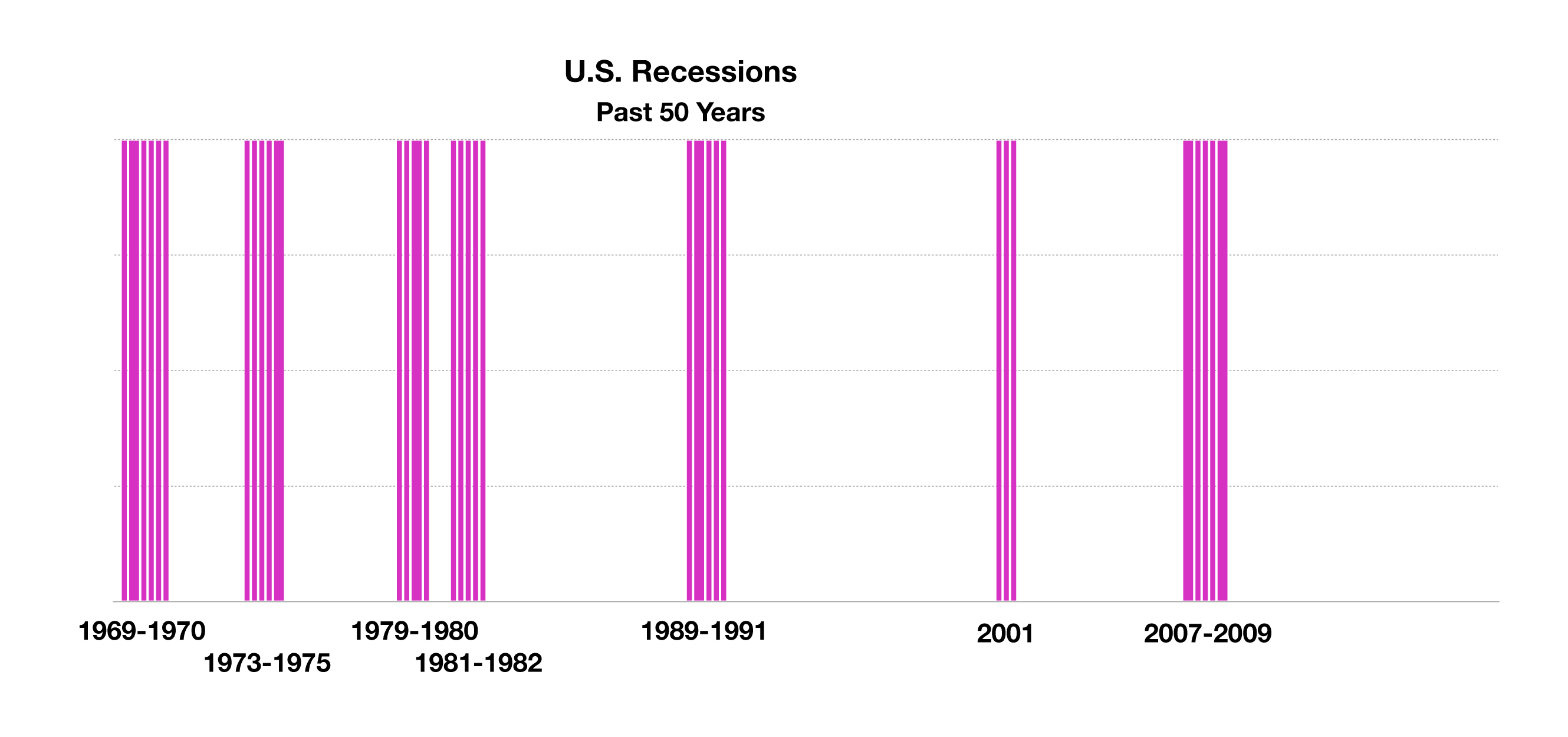

U.S. Recessions

Historians and economists claim that there have been 47 recessions in the United States dating back to the Articles of Confederation, which was ratified in 1781. The duration and intensity of each recession has been unique, with various factors affecting economic conditions contingent on current circumstances.

Modern recessions occurring in the 19th century have resulted from financial crises and market driven events, while recessions that occurred in the 1800s were primarily driven by war and the weather due to the dependence on agriculture.

Talk of an upcoming recession in the news has been a focal discussion as low rates and weakening economic indicators create an argument for a recessionary environment. Economists and analysts see recessions as an economic cycle driven by expansions and contractions.

However, no expert can consistently predict the timing or depth of a recession. Nor can we ever know specifically how a recession will impact your portfolio. Therefore, at Complete Advisors we focus on creating a long term investment according to that plan rather than trying to work around a recession.

Sources: Federal Reserve; fred.stlouisfed.org/series/JHDUSRGDPBR