Corporate Profits Hit New Record: Economy

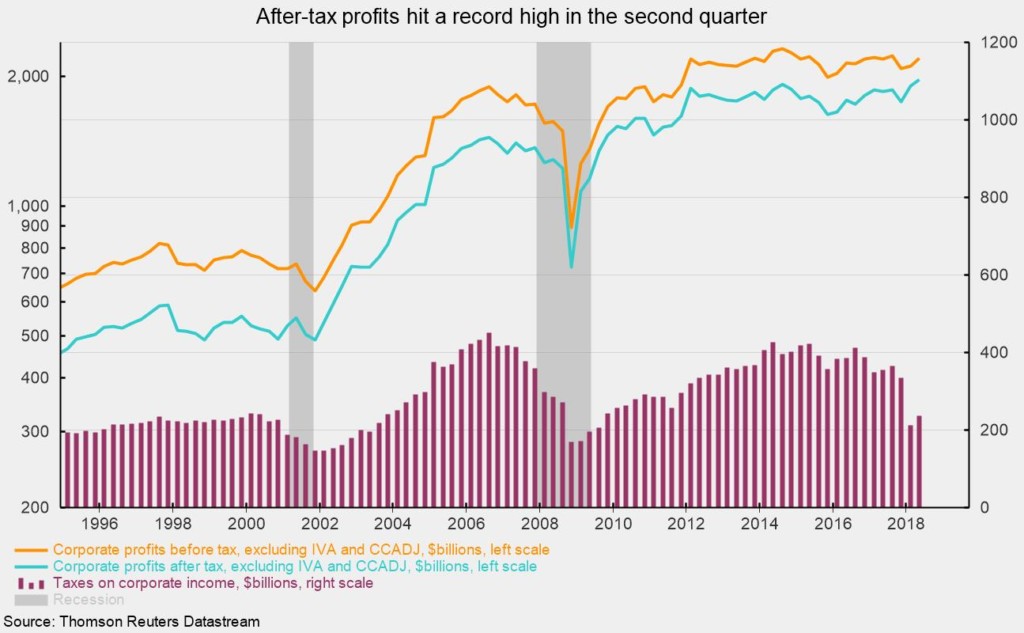

Revised estimates released on 8/29 revealed that the U.S. economy grew at 4.2% (Annual rate) in Q2 of this year, slightly better than the initial estimate of 4.1%. Included in this release were estimates of corporate profits; On an after-tax basis NIPA basis (National Income and Products Accounts) corporate profits rose 2.4% in Q2. When we use an accounting standard more aligned with private sector standards, after-tax profits rose 3.7%. On this basis, profits in the U.S. hit a new record (See Figure 1).

While the economy and markets are booming, some feel it’s not really that strong because of the income equality gap and the markets will crash if Trump’s legal problems increase. But if Trump left tomorrow, what would change? There may be a selloff or correction due to the shock of the event, but would economic policies be altered? Tariffs may go away, which is an economic boost, not a hindrance. And tax reform and reduced regulations wouldn’t change much at all.

Figure 1

Cell phone bills are rising across the country as providers eliminate promotions and consolidate operations. The announcement of recent mega mergers in the industry has reduced the number of providers and lessened competition, leading to increased rates for customers.

Cell phone bills are rising across the country as providers eliminate promotions and consolidate operations. The announcement of recent mega mergers in the industry has reduced the number of providers and lessened competition, leading to increased rates for customers.