Robert Krueger

Alexander Randolph Advisory Inc.

8200 Greensboro Drive, Suite 1125

McLean, VA 22102

703.734.1507

The New Tax Bill – Fiscal Policy Review

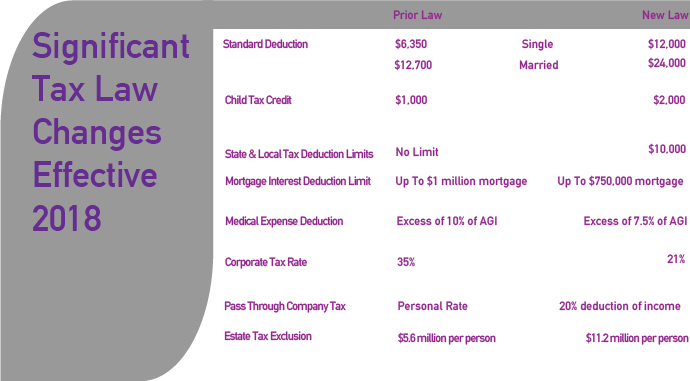

Both individual taxpayers and companies will see broad changes for deductions and tax rates. The emphasis of the tax bill, known formally as the Tax Cuts & Jobs Act, is to stimulate economic activity via new and higher paying jobs. This is why many of the changes directly benefit large and small businesses in order to encourage hiring.

Some of the tax provisions enacted by the new tax act will be temporary, while others permanent. The cost of reduced tax revenue brought about by tax cuts may only be viable for a certain period, thus producing more immediate benefits from tax cuts rather than later.

Affecting essentially every taxpayer is the increase in the standard deduction, which is meant to simplify the tax preparation process by replacing itemized deductions with a larger standard deduction.

The IRS estimates that about 95% of the businesses in the United States are pass-through entities, such as sole proprietors, S-Corps, LLCs, and partnerships. These entities are called pass-throughs because the profits generated are passed directly through the business to the owners, which are taxed at the owners’ individual income tax rates. The new tax law allows for a 20% deduction of that income, thus reducing overall taxable income. According to the Tax Foundation, pass-through businesses account for over 55% of all private sector employment, representing over 65.5 million workers nationwide.

Sources: IRS, www.congress.gov/bill/115th-congress/house-bill/1,

Deductions By Income Groups – Financial Planning

One of the most coveted tax tools proposed for elimination are various deductions. As controversial as the elimination of certain deductions have become, IRS data reveals that higher income taxpayers are the ones that take advantage of these deductions.

IRS data shows that approximately 70% of taxpayers take the standard deduction rather than taking itemized deductions. Taxpayers, regardless of their income, have the option of using either one. According to the IRS, over 30% of households choose to itemize their deductions in tax year 2013. Data also shows that households with incomes greater than $75,000 made most use of these deductions, validating that higher income households tend to itemize deductions. The same IRS data revealed that only 6% of tax returns with under $25,000 in income chose to itemize, while over 93% of tax returns with over $200,000 in income itemized.

Households with higher incomes are more likely to pay more in state and local taxes, take larger mortgages, and donate to charities. All of these can lead to sizeable deductions on a tax return. The Tax Foundation concludes that itemized deductions mostly benefit wealthy taxpayers and is the reason why many recent tax reform proposals have sought to limit or eliminate them.br>

Sources: IRS, Tax Foundation