Stock Indices:

| Dow Jones | 47,562 |

| S&P 500 | 6,840 |

| Nasdaq | 23,724 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.11% |

| 10 Yr Municipal | 2.73% |

| High Yield | 6.53% |

YTD Market Returns:

| Dow Jones | 11.80% |

| S&P 500 | 16.30% |

| Nasdaq | 22.86% |

| MSCI-EAFE | 23.69% |

| MSCI-Europe | 25.44% |

| MSCI-Pacific | 25.83% |

| MSCI-Emg Mkt | 30.32% |

| US Agg Bond | 6.80% |

| US Corp Bond | 7.29% |

| US Gov’t Bond | 6.51% |

Commodity Prices:

| Gold | 4,013 |

| Silver | 48.25 |

| Oil (WTI) | 60.88 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.31 |

| Yen / Dollar | 153.64 |

| Canadian /Dollar | 0.71 |

Macro Overview

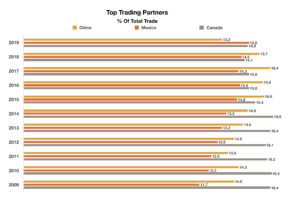

A proposed tariff increase on goods imported from China was delayed from October 1st to October 15th. Tariffs on a number of Chinese goods are scheduled to increase to 30 percent from 25 percent effective on the 15th.

U.S. equity markets marked their best third quarter since 1997, recapturing gains that were lost in the final quarter of 2018. The market’s resilience has allowed stock and bond prices to elevate higher even with the headwinds of trade tensions and recessionary concerns. Meager bond yields worldwide also fueled a gravitation towards stocks as investors sought more attractive yields in the form of dividends.

Domestic bond yields rose in September, climbing back from ultra low levels reached in August. The Fed’s easing rate trend is part of a larger global movement by other central banks to lower rates internationally.

Currency markets reacted to slightly higher U.S. rates in September, sending the U.S. dollar to its strongest levels in over two years. Various factors such as consistent consumer demand and a stable economic environment, relative to other global economies, helped drive the demand for the dollar.

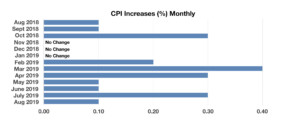

A key inflation indicator, the Consumer Price Index (CPI), moved higher with its fastest annualized growth since 2008. The CPI index, which measures the price of various goods and services such as food, housing, and medical expenses, rose 2.4% over the past year. Medical insurance and healthcare related expenses saw some of the largest increases.

Sources: Commerce Depart., U.S. Treasury, BLS

Stretch IRA Rules May Change – Retirement Planning

Rules surrounding the distribution of funds from an Inherited IRA may change due to new rules being imposed. Those most affected by the new rules are retirees with generous IRA balances intending to leave funds to their children and grandchildren. Known also as Stretch IRAs, which have allowed IRA beneficiaries to stretch distributions and taxes over an extended period of time.

Both the House of Representatives and the Senate have drafted their own versions of the new rules. The House has named the legislation the Secure Act, which stands for the Setting Every Community Up For Retirement Enhancement Act. Both versions essentially accelerate the distribution and taxation of Inherited IRA funds going to non spouses.

A current rule that will remain the same is allowing a spouse to rollover their deceased spouse’s IRA to a spousal IRA and take Required Minimum Distributions (RMDs) based on their life expectancy. Inherited IRA rules will be modified by the newly imposed rules, affecting non spousal beneficiaries such as children and grandchildren, the most common types of inherited IRA beneficiaries.

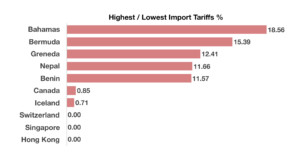

Some countries impose import duties, also known as tariffs, on certain imports for various reasons. Import duties on products that may hinder or compete with an industry or product produced in that country may have tariffs imposed in order to limit imports that may have negative consequences.

Some countries impose import duties, also known as tariffs, on certain imports for various reasons. Import duties on products that may hinder or compete with an industry or product produced in that country may have tariffs imposed in order to limit imports that may have negative consequences.

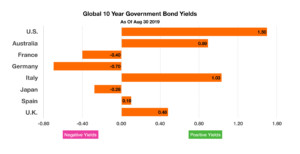

Even as the 10-year Treasury yield fell below 1.5% in August, it is still offering a more attractive yield than most other developed country government bonds. Yields for 10-year government bonds in Germany and Japan yielded -0.69% and -0.27% respectively. Such negative yields mean that investors are basically paying the governments of Germany and Japan to hold on to their funds.

Even as the 10-year Treasury yield fell below 1.5% in August, it is still offering a more attractive yield than most other developed country government bonds. Yields for 10-year government bonds in Germany and Japan yielded -0.69% and -0.27% respectively. Such negative yields mean that investors are basically paying the governments of Germany and Japan to hold on to their funds.