Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Manager’s Comments – Nov 13, 2017

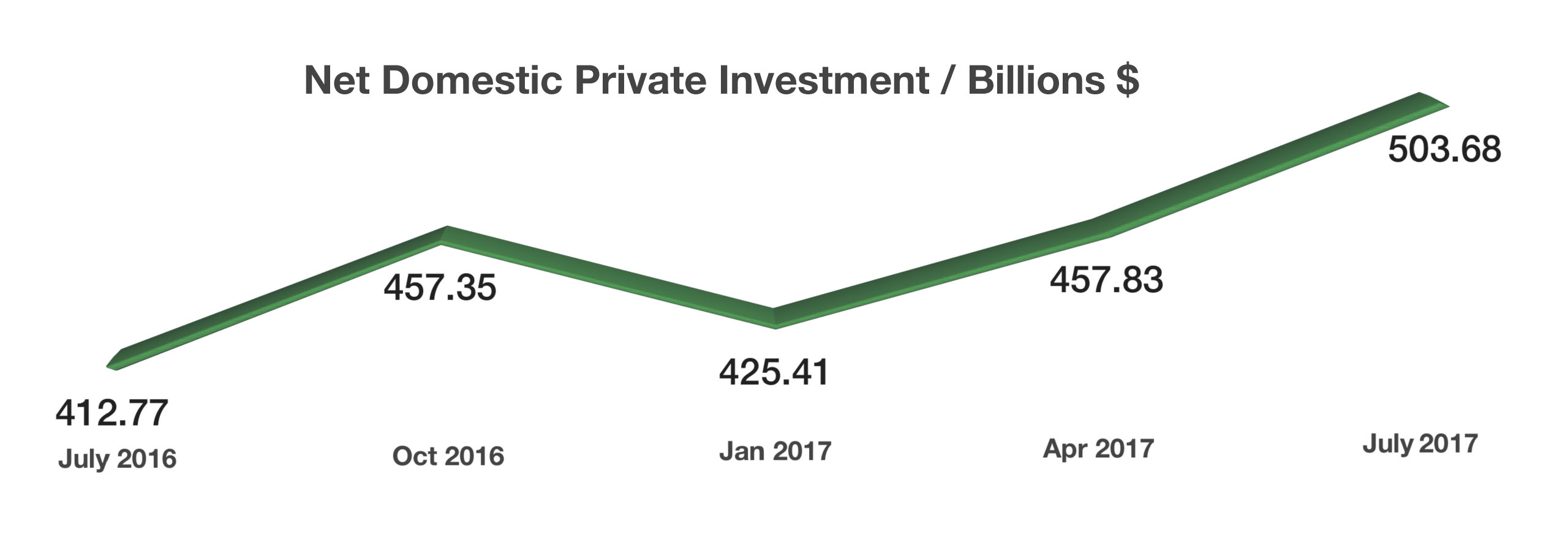

Since the 2016 Elections, the major investment markets have risen to record levels. Global economic conditions are solid and improving. Policy discussions appear pro-growth, consumer confidence is high, and employment is strong. As well, despite an outlook for higher interest rates, monetary policy remains supportive of risk assets. As an investment manager, I am delighted with current conditions. However, as a risk manager I also need to be concerned with market valuations and forward-looking return expectations. While it is tempting to get carried away with current momentum, assessing future possibilities is always top of mind. Let’s look at valuations.

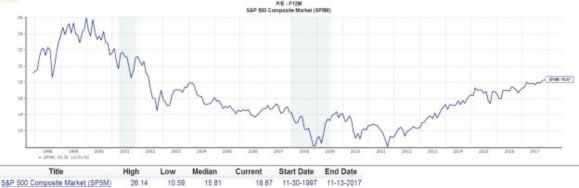

The current P/E ratio on the S&P 500 Index stands at nearly 26x which is significantly above its historic mean of 15.5x. Additionally, the Shiller P/E ratio (cyclically adjusted) stands at 31x against its historic mean of 17x. Both readings are near-extreme and taken alone should be sounding alarm bells. Finally, the dividend yield on the S&P 500 Index is near its lowest point on record. This data is available at multpl.com for verification.

A reasonable level of ‘over-valuation’ can and should be priced into the market when the macroenvironment is as favorable as it is now, especially when trend data indicates corporate earnings growth should continue into 2018. Zacks Investment Research, Inc. reports that 92% of the 500 companies in the Index have reported earnings for Q3-2017. This 92% group showed improvement of 6.9% over Q3-2016 and 11.6% improvement over the last 12 months relative to the same 12-month period at 9/30/2016.

Yet, looking forward to 2018, the market still appears stretched. Even with similar earnings growth next year, the forward P/E ratio on the S&P 500 Index is elevated. Keep in mind: Stock prices don’t usually rise at a higher pace than earnings for very long.

To restore the P/E to its historic norm, earnings must rise nearly 20% or stock prices need to fall 15% from current levels. A market correction of 5-10% seems reasonable. It is true that P/E ratios don’t tell the whole story. Despite high valuations, stocks remain attractive relative to fixed-income investments. And the odds of a recession are low. Regardless, I have been selectively taking profits, raising cash levels, looking at foreign markets and buying several real estate funds. These tactics ought to help insulate client portfolios from the full impact of a near-term correction.