Alex Gregory Garcia

AGG Asset Management, LLC

875 S. Westlake Blvd, Suite 218

Westlake Village, CA 91361

805.496.3344

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

An improving economic environment and earnings optimism propelled markets higher, along with prospects that there might be some agreement on tax reform in Washington.

The House of Representatives released a draft of tax policy proposals known as The Tax Cuts & Jobs Act. The prospect of lower taxes for corporations and individuals are part of the proposals, while also targeting tax avoidance by multinational U.S. firms, reassuring markets that fiscal reform could prove possible.

Effects of hurricane influenced rebuilding efforts underway in Texas and Florida are expected to become more visible via labor and materials data over the next few weeks. Economists expect an increase in job placements and material costs as insurance claims start to pay out. Hurricane Harvey destroyed over 15,500 homes in Texas, while Hurricane Irma damaged 90% of the homes in the Florida Keys.

Apart from hopeful tax reform passage, equity markets have soared due to stronger global demand, improving earnings, and fewer regulatory hurdles. Internationally, global growth surpassed 4.5% in the second quarter, following a 3.9% increase in the first quarter. The data suggests that global production and consumption is increasing, eventually translating into higher earnings for global equities. The International Monetary Fund (IMF) issued increased growth estimates for 2017 & 2018 following better than expected growth data.

The U.S. economy posted two consecutive quarters of GDP growth above 3% in the second and third quarters, marking the best six-month consistent period of growth in three years. Gross Domestic Product (GDP) grew at a 3.1% rate in the second quarter and 3% in the third quarter, per Commerce Department data. The subdued third quarter results are believed to be attributable to Hurricanes Harvey and Irma as economic activity came to a halt for portions of Texas and Florida. Economists believe that rebuilding efforts following the storms will give GDP growth a boost in the fourth quarter. Historically, U.S. GDP has averaged around 3% annual growth.

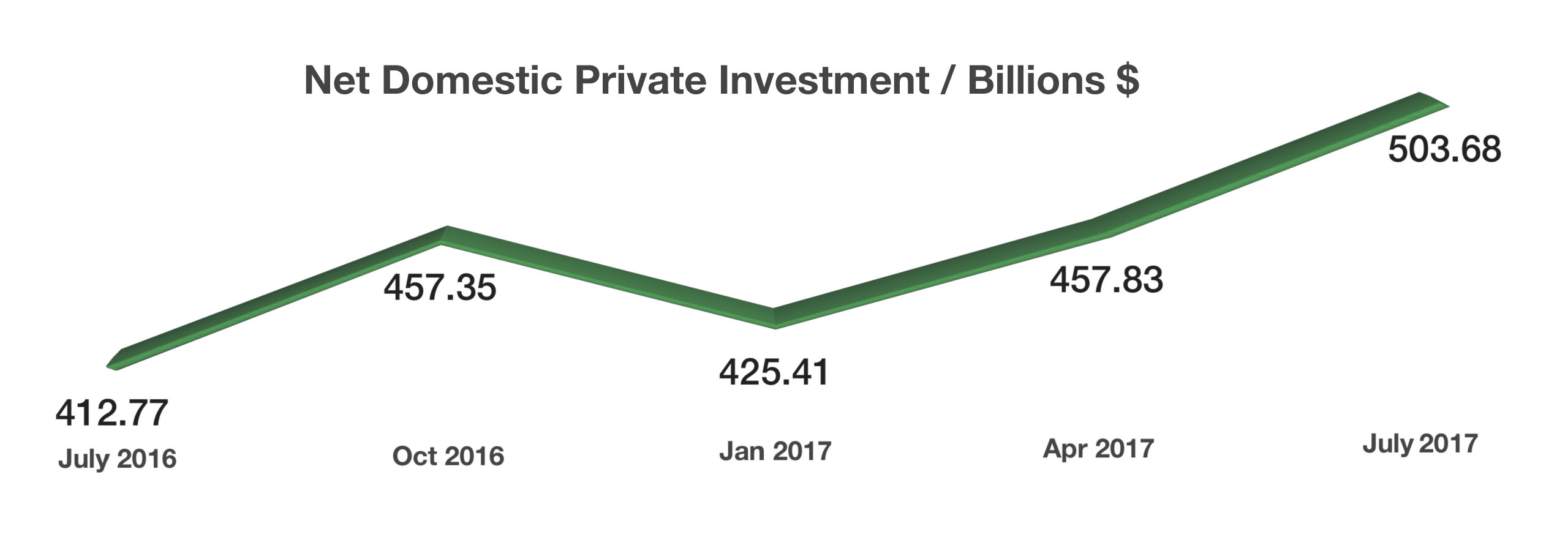

Proposed business tax reforms are expected to increase business investment, which has lagged in recent years. The Federal Reserve Bank of St. Louis released data showing that business investment rose in the second and third quarters. Overall, a rising trend in business investment is a confirmation of improved confidence held by companies on economic and tax reform prospects. (Sources: House.gov, Commerce Department, Federal Reserve)

When the Social Security Administration started issuing numbers in 1936, the intent was to track U.S. workers’ earnings in order to determine their Social Security benefits. Over the decades various government agencies and private companies started using the numbers as a general identifier, which was never the original intent. In order to do away with Social Security numbers, it would need to be voted on and approved by Congress. (Sources: Social Security Administration, Medicare.gov)

When the Social Security Administration started issuing numbers in 1936, the intent was to track U.S. workers’ earnings in order to determine their Social Security benefits. Over the decades various government agencies and private companies started using the numbers as a general identifier, which was never the original intent. In order to do away with Social Security numbers, it would need to be voted on and approved by Congress. (Sources: Social Security Administration, Medicare.gov)