Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

Historically volatile October was validated once again by dramatic price swings for both stocks and bonds. Among the catalysts behind the volatility were rising rates, a strong dollar, tariffs, and waning benefits stemming from the tax cuts.

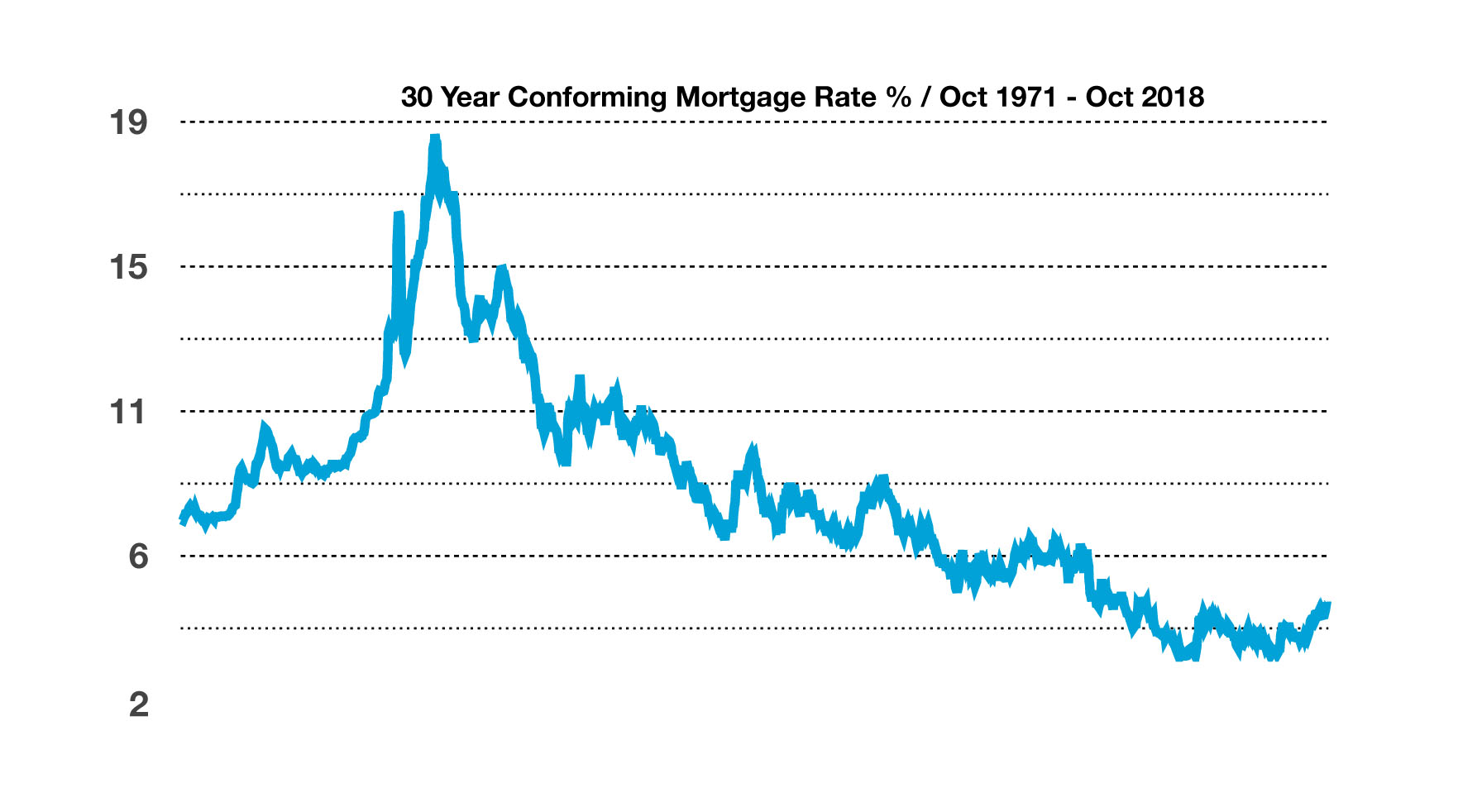

Markets are transitioning from a deflationary environment to an inflationary environment, returning to levels that the Fed classifies as normalized. Rising rates are encroaching upon various consumer driven areas, including mortgages, auto loans, and lines of credit. Rising mortgage rates are weighing on the housing market, hindering certain buyers from affording higher payments.

The long awaited rise in interest rates is spurring a shift in equity valuations as company assets and profits are being reassessed as rates start to gradually rise for both consumers and businesses. Most analysts and economists agree that rising rates tend to signal that a broader economic expansion is underway. Optimistically, valuations for equities have fallen, making prices more attractive for active investors and buyers.

Earnings released for the nation’s largest banks this past month revealed that economic expansion is taking hold. Consumer and business loans are fundamental to the banking business and act as a gauge of the strength of the economic environment. Banks noted that their consumer and business loans were in exceptionally good standing with no issues of borrowers staying current on their loan payments.

The federal deficit, which ended its fiscal year for 2018 in September, grew 17% to $779 billion. A drop in government revenue from personal and corporate tax cuts is the primary reason.

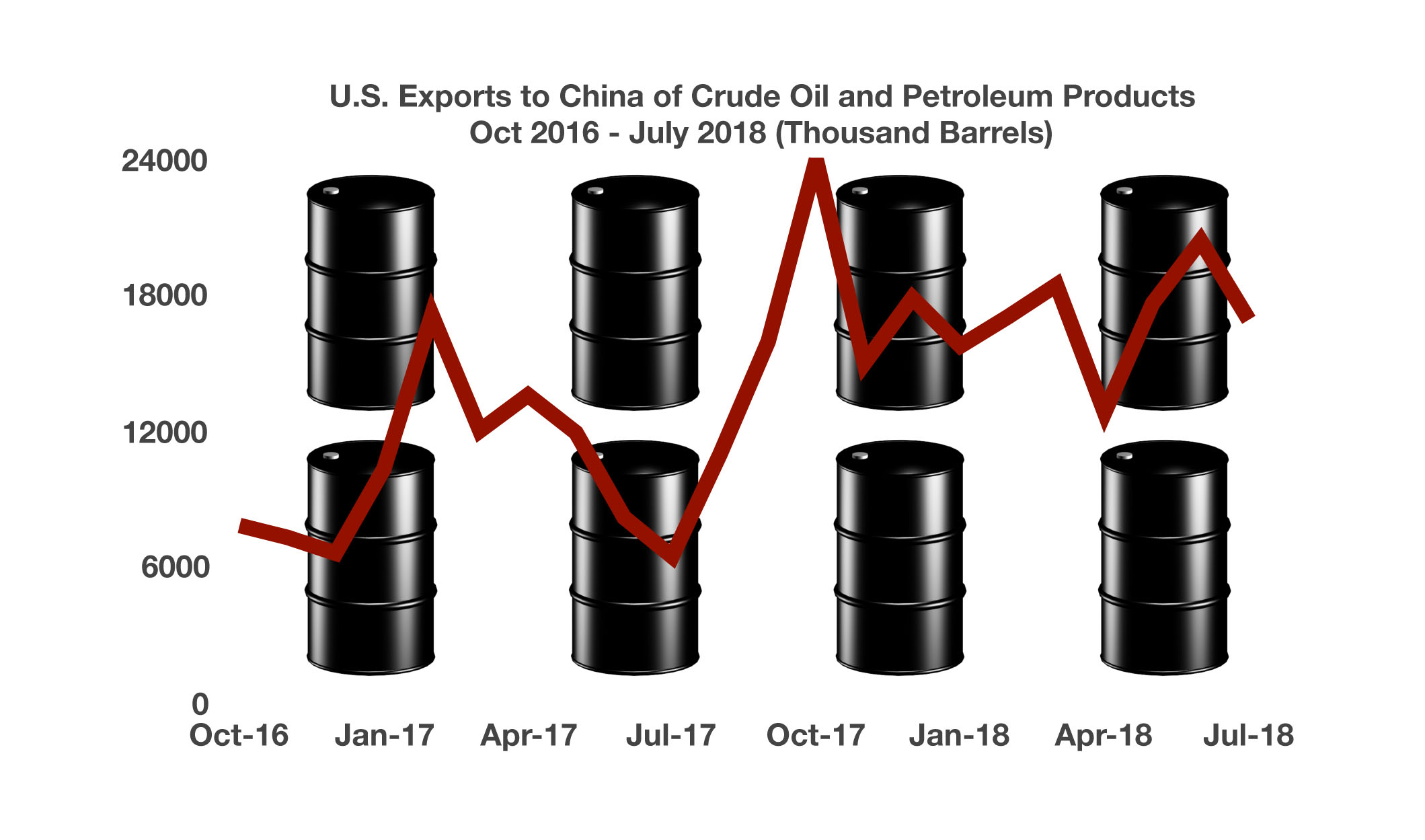

Energy forecasts by the U.S. Energy Department and International Energy Agency are expecting a higher than average price for gasoline this fall, diverting from the normalized drop in prices following the summer months. Factors affecting prices include less available supply from domestic and international producers as well as reimposed sanctions on Iranian oil exports.

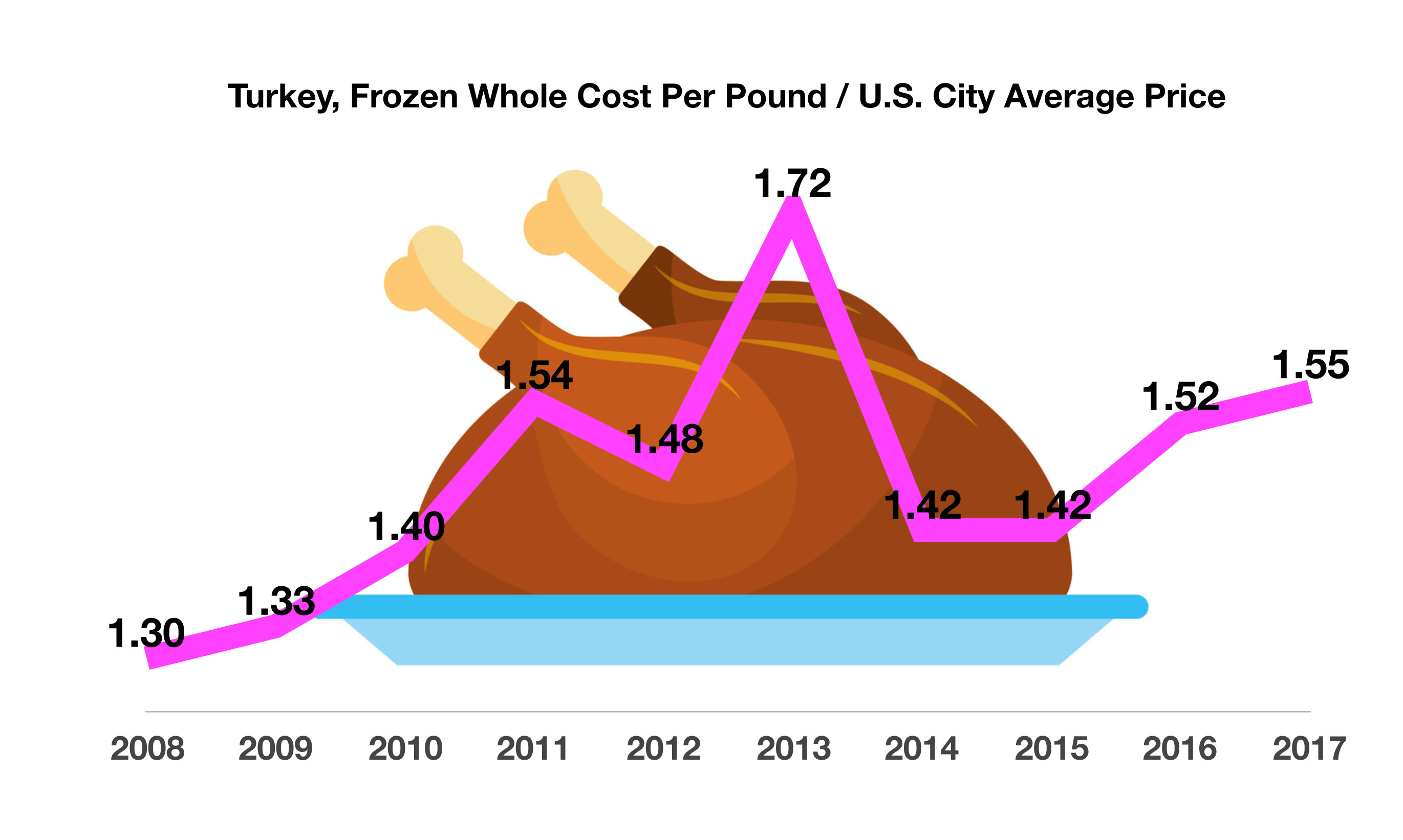

As the holidays approach, turkey will once again be the favored bird for millions of Americans. The National Turkey Federation estimates that about 46 million turkeys are consumed each Thanksgiving.

(Sources: U.S. Department Of Energy, International Energy Agency, Federal Reserve, BLS; CPI-Average Price Data, National Turkey Federation)

A tight job market and rising wages may help alleviate the rise in mortgage rates, as a strong labor market and higher payrolls help maintain demand for homes.

A tight job market and rising wages may help alleviate the rise in mortgage rates, as a strong labor market and higher payrolls help maintain demand for homes.

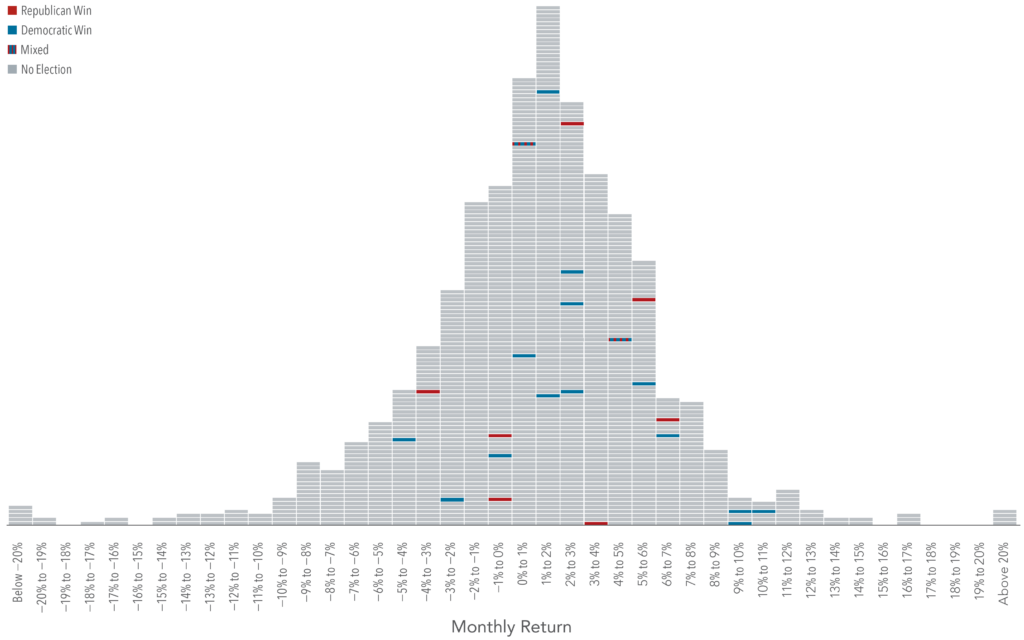

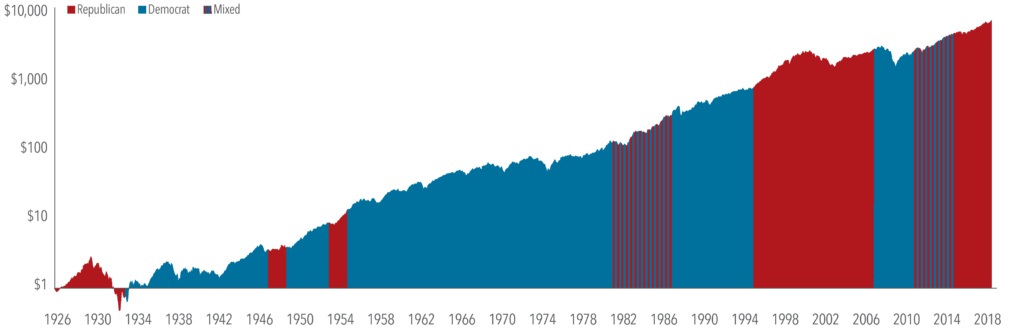

ection polling), there is no guarantee that they would have predicted the correct directional move, especially given the narrative at the time.

ection polling), there is no guarantee that they would have predicted the correct directional move, especially given the narrative at the time.

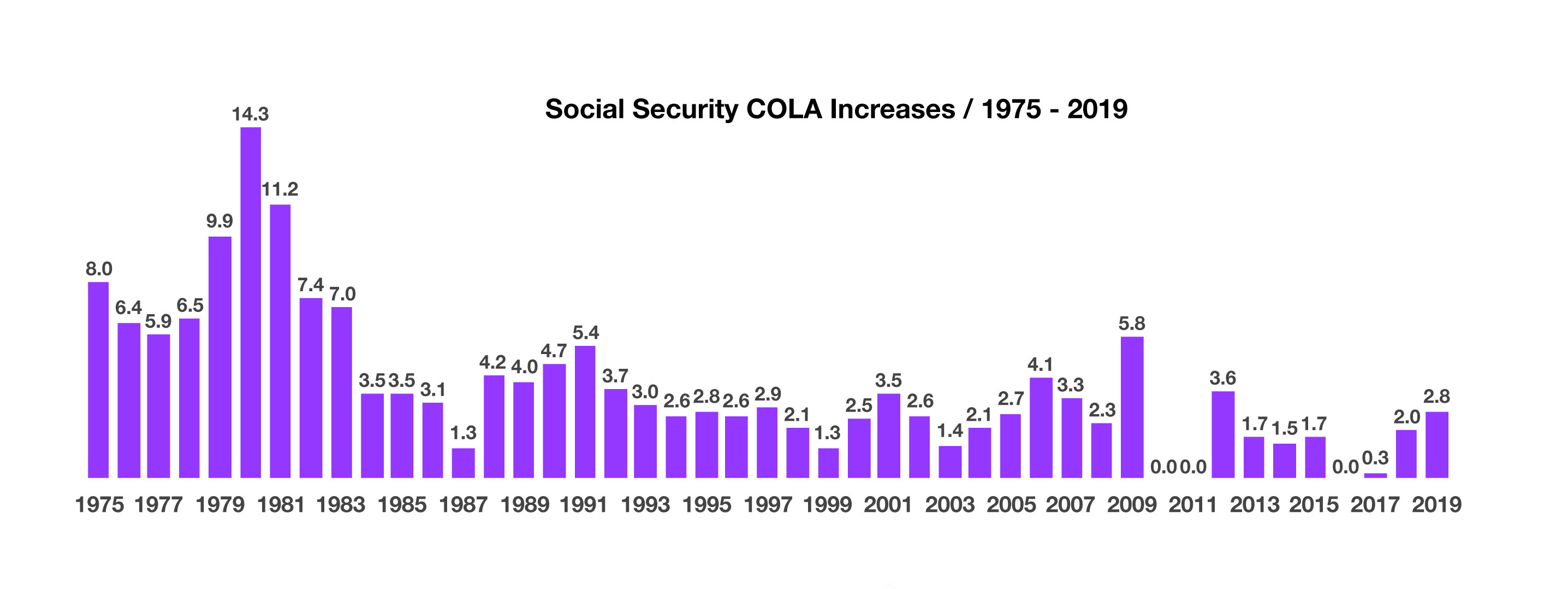

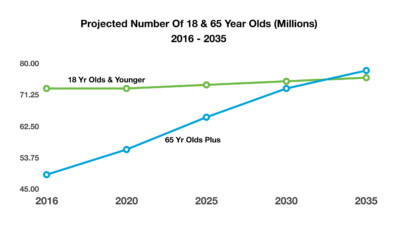

between 1946 – 1964 have shaped the economic status of our country while providing economic growth and vitally skilled workers. The first wave of baby boomers reached 65 years of age in 2011, starting a massive shift of individuals from working status to retirement status.

between 1946 – 1964 have shaped the economic status of our country while providing economic growth and vitally skilled workers. The first wave of baby boomers reached 65 years of age in 2011, starting a massive shift of individuals from working status to retirement status.