Michael McCormick

5 West Mendenhall, Ste 202 | Bozeman, MT 59715

406.920.1682 mike@mccormickfinancialadvisors.com

Sustainable Income Planning | Investments | Retirement

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Dear Friends,

Both of our girls ran cross country for the high school this Fall and being a Sportsparent has been a big part of life for Jamey and me. I also coached for the Bozeman Track Club middle school team, which is more my speed. Watching the kids of this community working hard in their activities and competing so passionately is so inspiring! Along with the thrills of success, there are the inevitable hard-lessons that create character and test our confidence in ourselves. Together, I feel they yield some of the most memorable moments in their lives, and it is a joy to be a part of it. When it works, it’s like my favorite scene in the classic movie Hoosiers, where a parent/coach leads the team to a key victory (despite all of his own faults)! This Christmas season I hope you dream with our loved ones of all the great moments coming in 2020!

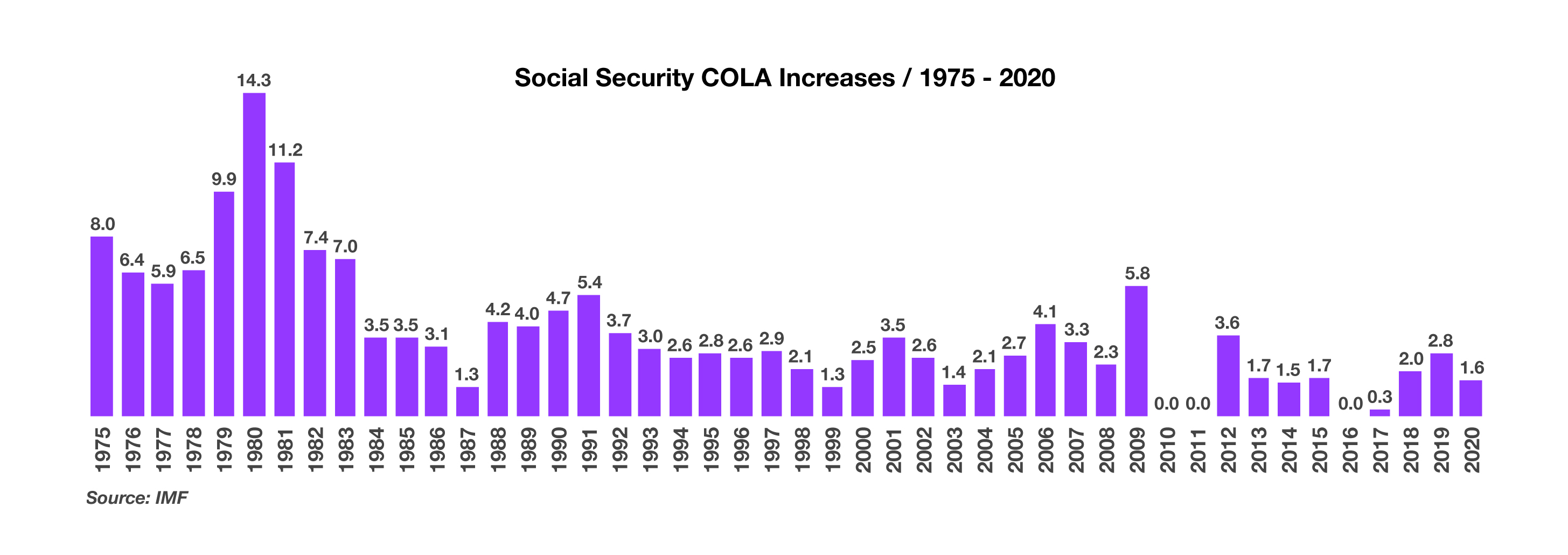

Markets are in great shape, but we continue to prepare for a change to that story. Our belief is that in 2020 we will continue to see risk rewarded thanks to a strong consumer and economy.

A few tips to improve your digital security as we go into Winter

- It is time to change your passwords (annually). The best passwords are longer phrases you can remember with a (oup1eofl3tters changed. Go ahead and write it down, but keep it safe, and tell your loved one where it is.

- Using double authentication is a great strategy where a code is texted to you, or generated directly from your phone. Until something better comes along, a dynamic code sent to you independently is the highest security available.

- The phone is becoming the center of our legal identity. Please, be careful with your mobile number, it is being used as your unique ID more and more.

- Don’t lose your phone, but have a plan if you do. Imagine the horror! Fortunately, several apps exist and they usually require you to keep the location setting on. You will be thankful for a plan B that works.

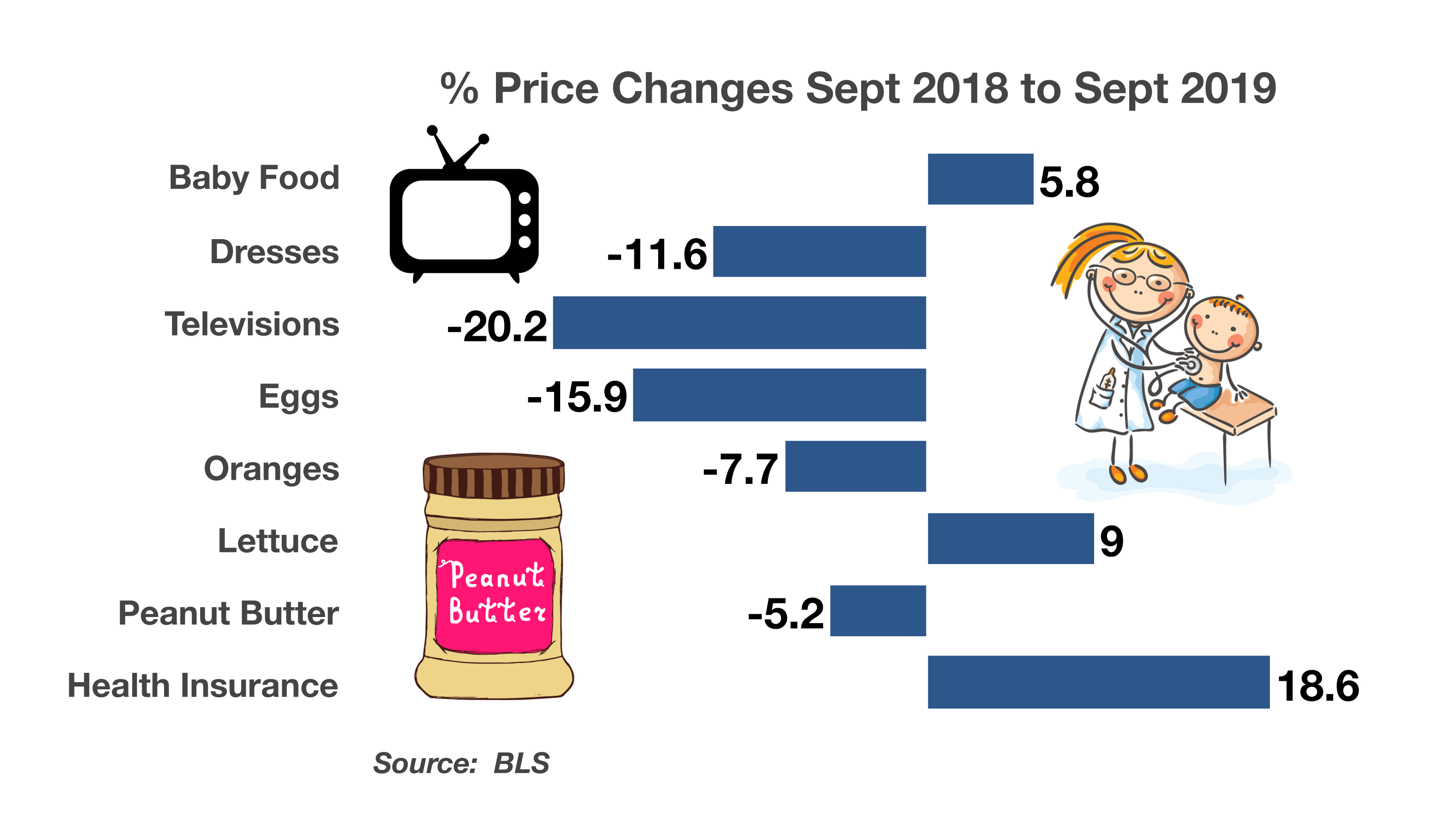

Here is something that can be predicted – healthcare costs will cause many of us to delay retirement. Any plans for retirement before Medicare kicks in (65) must account for a rising cost of health insurance. And since the math on delaying Social Security to age 70 is so strong (8% annual), the cost usually eats directly into your savings until those entitlements are started. I just went through the Healthcare.gov exchange, and it looks like most plans that cover my family will run about $25,000 per year! Even if you can afford it, do you want to pay it? One strategy is to find a ‘hobby job’ that provides benefits. Another idea is to ‘pre-tire’, or cut your hours and responsibilities down so that you can enjoy a different lifestyle, but still retain some key benefits.