Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

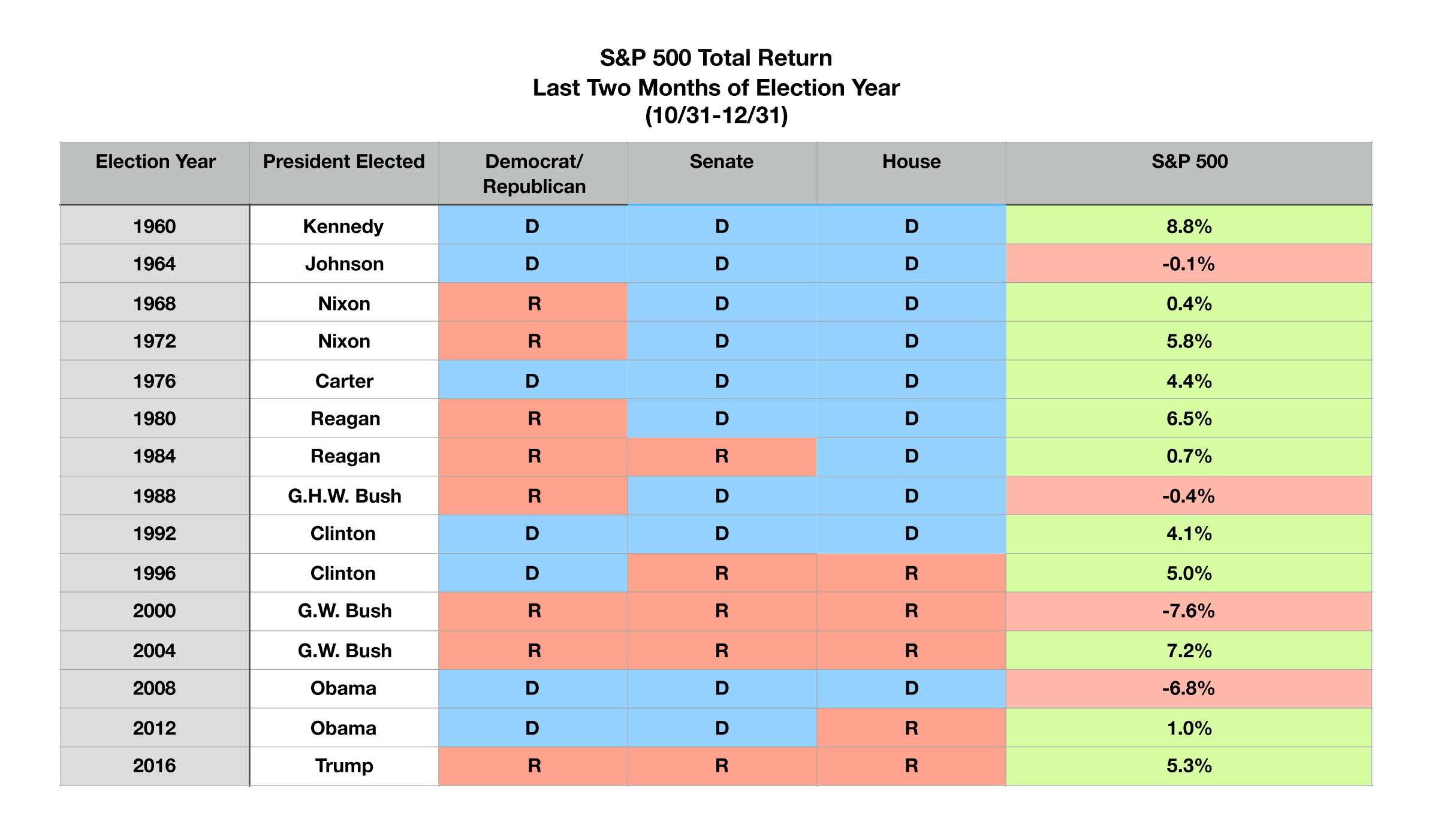

In the wake of the recent U.S. national election, financial markets responded to updated expectations regarding fiscal policy, stimulus programs, and government debt. Some economists and market analysts project an eventual increase in tax rates, along with an expanding fiscal deficit.

A delay in passing a second stimulus bill through Congress put pressure on markets in October as legislators and the administration negotiated the proposed details of a potential bill. Many individuals and businesses anticipate a second wave of government stimulus spending in the form of cash payments, debt subsidization, and other fiscal benefits in order to meet expenses. In the absence of a new stimulus bill, a number of relief programs will expire at the end of the year.

A weakening U.S. dollar contributed to positive emerging market performance in October, as many emerging market currencies and equities fared better than U.S. equities and developed international equities. Countries throughout Europe announced new national lockdowns in order to stem a rapid resurgence of COVID-19 virus infection rates in Europe. Some policy analysts caution that similar restrictions and state imposed lockdowns may resurface in the United States.

Market dynamics shifted in October as anticipated election results were expected to offer a long-awaited secondary stimulus program, contributing to economic expansion across industries as a result of increased consumer and business spending. Fiscal policy initiatives are in focus as the Federal Reserve faces diminishing returns on additional expansionary monetary policy actions.

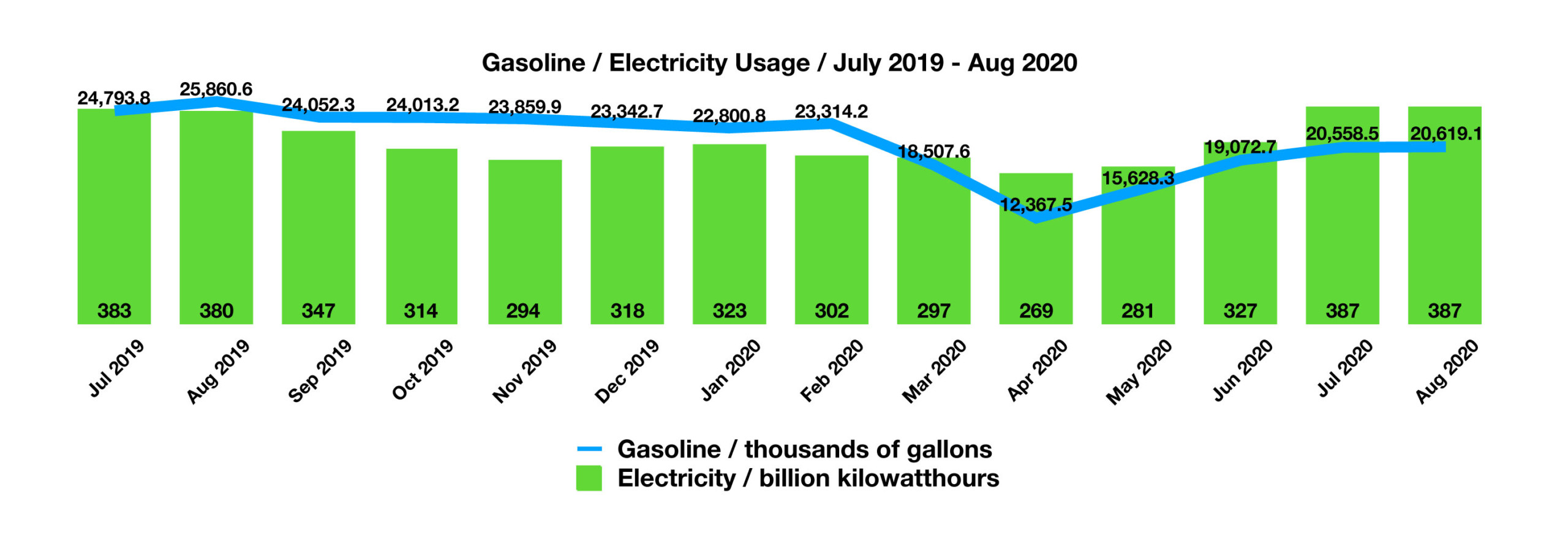

The national response to COVID-19 has effected massive shifts in consumer trends, as demand for retail shopping, dining out, and energy consumption have changed dramatically since the beginning of the year. Gasoline usage cratered as electricity usage simultaneously soared, the result of millions of workers transitioning to home based offices.

Sources: Federal Reserve, U.S. Energy Department, S&P