Michael J. Berger & Co., CPA’s LLP

3425 Veterans Memorial Hwy

Ronkonkoma, NY 11779

631.471.3400

www.bergercpa.com

cpa@bergercpa.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

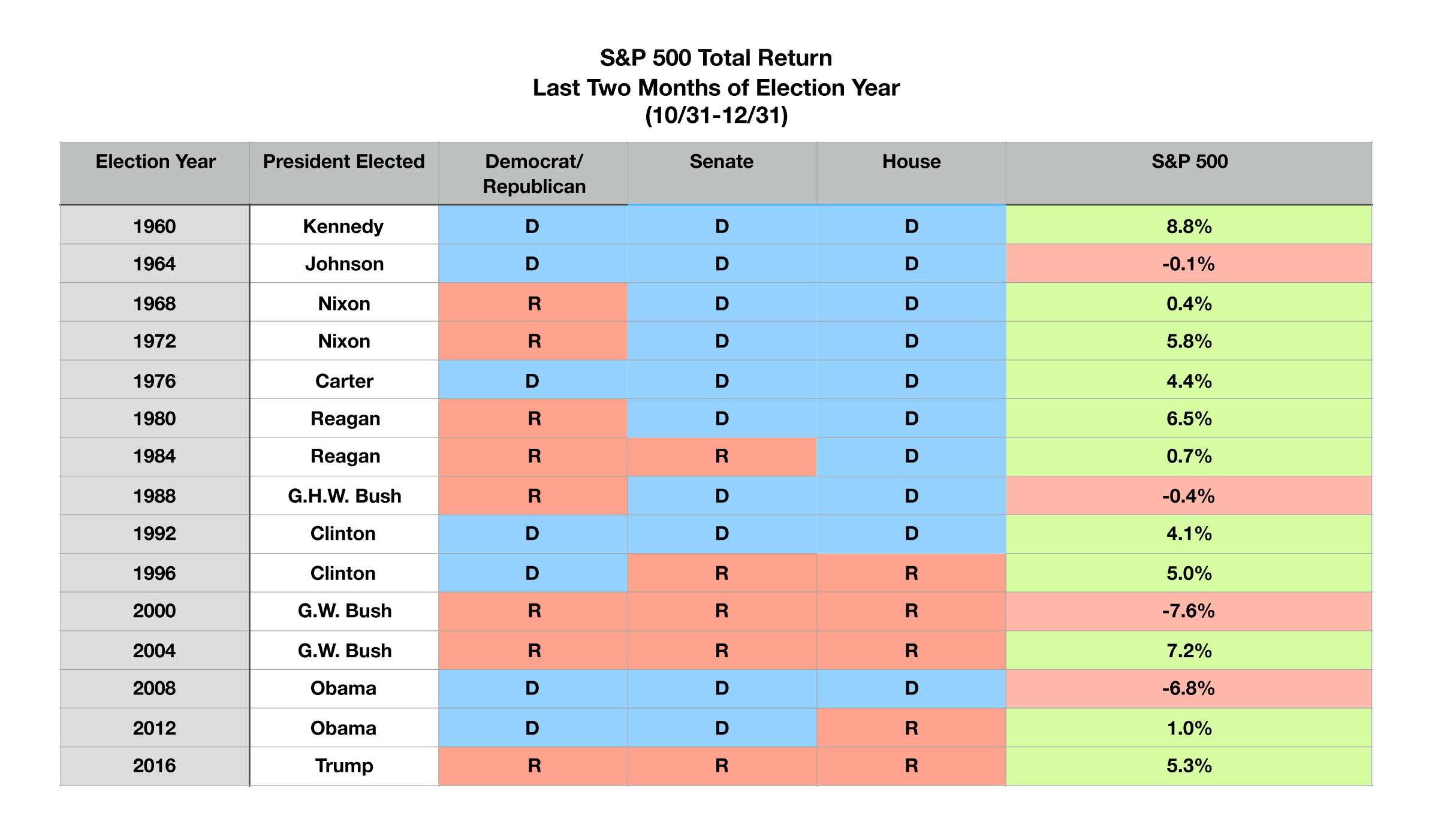

With the election over, a lingering uncertainty has been removed as expectations of how fiscal policy and stimulus programs funded by government debt may evolve. Some economists and market analysts project eventual higher taxes along with an expanding fiscal deficit.

The delay in getting a second stimulus bill through Congress hindered markets throughout October due to indecisiveness among politicians. Millions have been awaiting a second wave of stimulus benefits in order to meet expenses. With no new bill in place, a number of relief programs will expire at the end of the year which have benefited both individuals and small businesses.

A weakening U.S. dollar contributed to emerging equity market performance in October, as emerging currencies and stocks fared better than U.S. equities and developed international equities. Countries throughout Europe announced national lockdowns in order to stem a rapid resurgence of the COVID-19 virus in Europe. Some fear that similar restrictions and state imposed lockdowns may resurface in the United States.

Market dynamics started to shift in October as anticipated election results were expected to offer a long-awaited secondary stimulus program, reigniting economic expansion throughout the economy. Fiscal policy initiatives have become forefront as the Fed meddles with monetary policies that have essentially become exhausted.

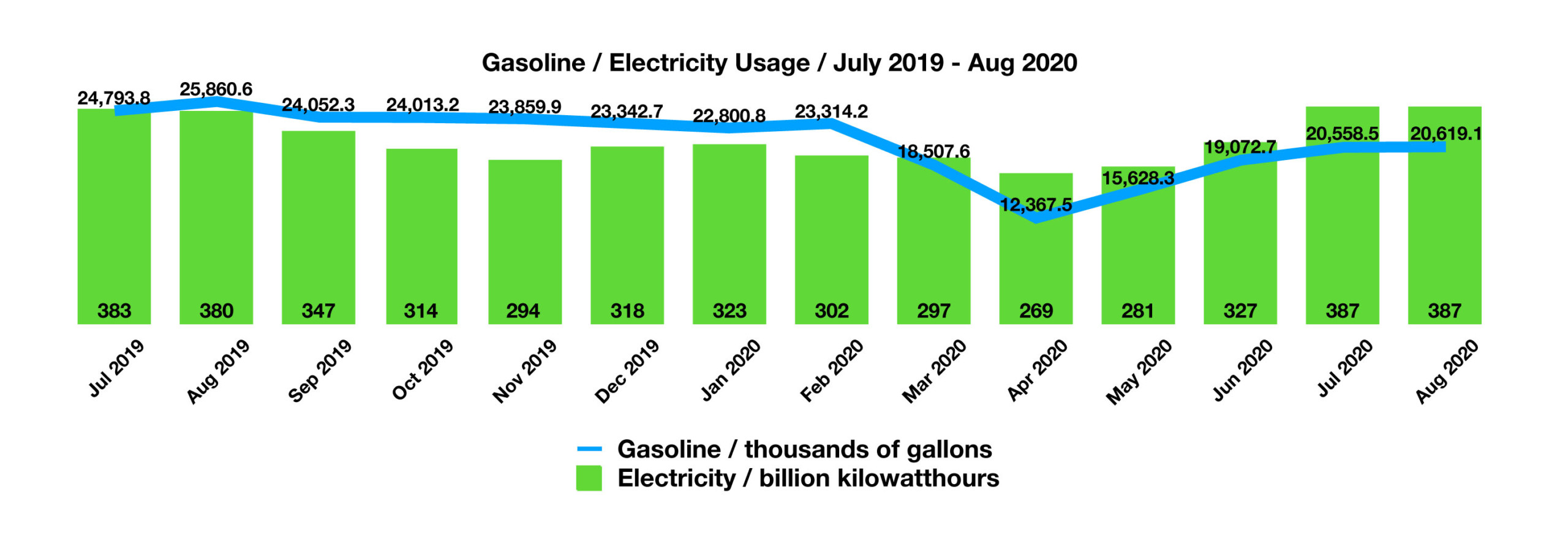

COVID-19 has brought about possibly some of the largest shifts in consumer trends ever, as demand for online shopping, eating out, and energy consumption have dramatically changed in a matter of months. Gasoline usage cratered as electricity usage simultaneously soared, the result of millions of workers transitioning to home based offices.

Sources: Federal Reserve, U.S. Energy Department, S&P