Joseph Schw

Stephen Dygos, CFP® 612.355.4364

Benjamin Wheeler, CFP® 612.355.4363

Paul Wilson 612.355.4366

www.sdwia.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

November 2020

Macro Overview

With the election over, a lingering uncertainty has been removed as expectations of how fiscal policy and stimulus programs funded by government debt may evolve. Some economists and market analysts project eventual higher taxes along with an expanding fiscal deficit.

The delay in getting a second stimulus bill through Congress hindered markets throughout October due to indecisiveness among politicians. Millions have been awaiting a second wave of stimulus benefits in order to meet expenses. With no new bill in place, a number of relief programs will expire at the end of the year which have benefited both individuals and small businesses.

Stagflation has resurfaced as a viable concern among economists, which last occurred in the late 1970s. Known as the occurrence of inflation rising faster than economic growth, the phenomenon can adversely affect consumers.

A weakening U.S. dollar contributed to emerging equity market performance in October, as emerging currencies and stocks fared better than the U.S. and developed international equities.

Market dynamics started to shift in October as anticipated election results were expected to offer a long-awaited secondary stimulus program, reigniting economic expansion throughout the economy. Fiscal policy initiatives have become forefront as the Fed meddles with monetary policies that have essentially become exhausted.

Countries throughout Europe announced national lockdowns in order to stem a rapid resurgence of the COVID-19 virus in Europe. Some fear that similar restrictions and state imposed lockdowns may resurface in the United States.

COVID-19 has brought about possibly some of the single largest shifts in consumer trends ever, as demand for online shopping, eating out, and energy consumption have dramatically changed in a matter of months. Gasoline usage cratered as electricity usage simultaneously soared, the result of millions of workers transitioning to home based offices.

As probable impasses are expected with the recently elected Congress, many believe that any immediate financial assistance may need to come from the Federal Reserve, which employs no political alliance or influence, meaning that it can help fund critical programs long before politicians get to it.

Sources: Federal Reserve, U.S. Energy Department

Election Results May Affect Rates – Fixed Income Update

Interest rates gravitated slightly higher in October, driven by the anticipation of eventual inflation and growing federal debt levels. The yield on the 10-year Treasury bond rose from 0.69% in September to 0.88% at the end of October. The rise in yields was the largest increase since June.

Election results are expected to determine the direction of interest rates over the next few years. It is expected that the continuation of new stimulus program funds may influence rates to rise as newly issued government debt is used to pay for the enormous benefit payments.

Sources: U.S. Treasury, Federal Reserve

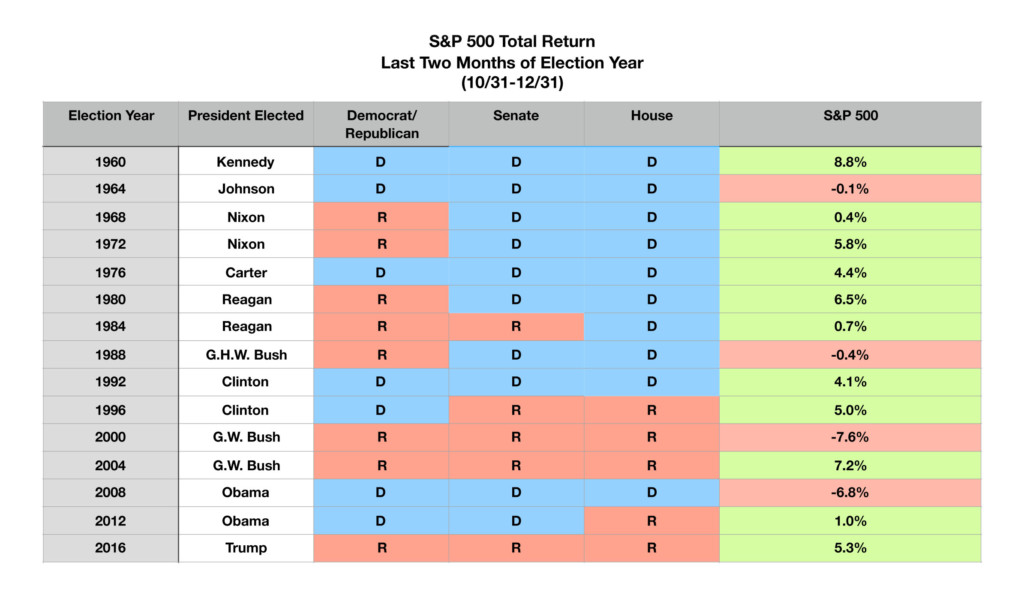

Uncertainty From Presidential Race Drove Volatility In October – Equity Overview

U.S. equities zigzagged throughout October as uncertainty surrounding the election and a second stimulus package instilled volatility.

Global developed market equities declined in October as earnings became more of a concern among companies throughout various industries. In the U.S., the S&P 500 Index dropped the most ever for the week leading up to a presidential election. Emerging market equities faired better than developed markets in October, as a weakening U.S. dollar helped buoy emerging market currencies and stocks.

Growth, momentum, and quality factors of the S&P 500 Index led markets up until October when a reverse occurred, shifting focus back to higher beta, more volatile stocks. Analysts believe that election results may eventually offer a fiscal stimulus program that may help reignite some economic expansion.

Sources: Bloomberg, Standard & Poors

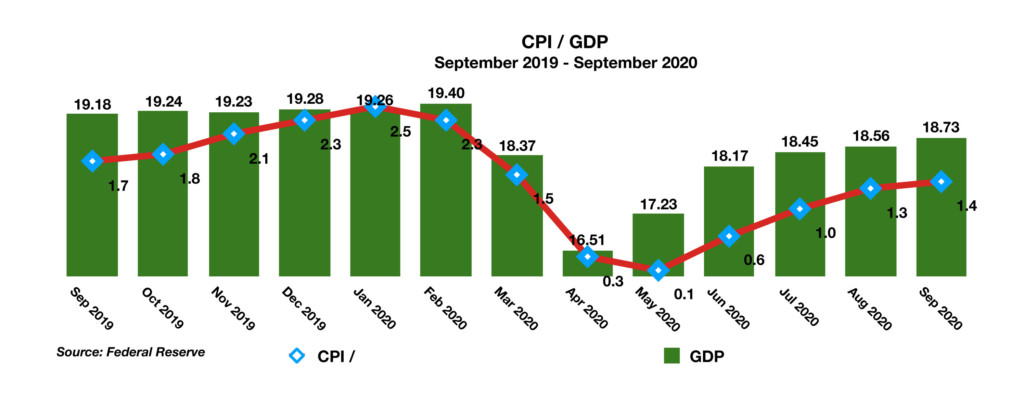

The Reemergence of Stagflation – Economic Trends

Recent government data that tracks inflation, known as the Consumer Price Index (CPI), has been rising steadily since the onset of the pandemic in March. Economists believe that the rise can be construed as either a rebounding economy or as a general rise in overall prices. The concern is that the current economic environment continues to display signs of dismal expansion and stagnant employment growth. Simultaneously higher prices for food, clothes, healthcare, and toilet paper validate broad inflationary pressures, creating a stagflation scenario.

The dynamics of stagflation can diminish a person’s income as the cost of essential services and goods rise, while no wage increases occur. The textbook inflation years of the late 70s were different from what is occurring now, as there is no wage inflation today like there was in the 70s. As a result, a growing number of workers today are experiencing higher prices but with the same or less income.

Recent data released by the Bureau of Economic Analysis (BEA) reveals that consumer prices, producer prices as well as import prices have all been rising over the past few weeks. Some believe that a weakening U.S. dollar is a culprit of the recent rise in inflation, which drives the cost of imports higher.

Sources: Bureau of Economic Analysis

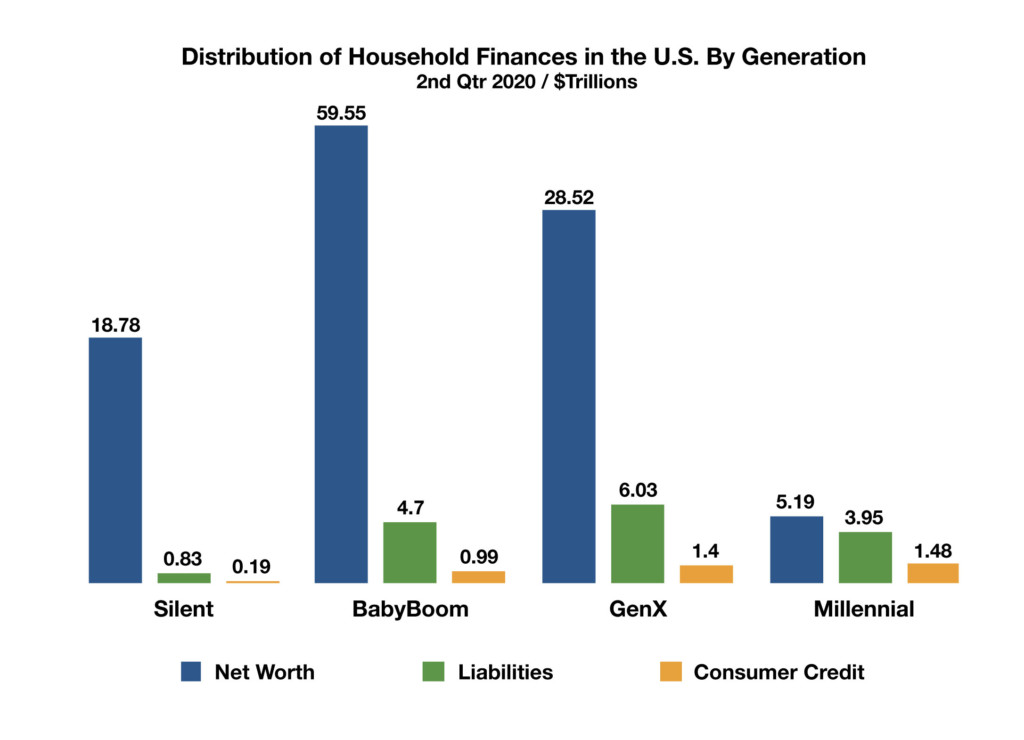

Millennials Lagging Relative To Their Parents & Grandparents – Demographics

The Federal Reserve tracks and compiles data on all of the generational members which include the Silent, Baby Boomer, Gen X, and Millennials. The data is revealing that the millennial generation, born between 1981 to 1996, are lacking in their finances.

Fed data for the four generations shows that millennials have already accumulated nearly as much debt as Boomers and have the most use of consumer credit of all the generational groups. Millennials control just 4.6% of U.S. wealth even though they represent the largest segment of the U.S. workforce. Economists view that millennials are far behind their previous generations when it comes to finance and assets, creating anticipated financial struggles for millions.

Some credit the easy money policies enacted by the Fed as well as a robust economy for the decades that drove wealth for the GenXers and the Boomers. Millennials haven’t been as fortunate to have had economic tailwinds to push them along, making it that much more difficult to build wealth and establish themselves financially.

Sources: Federal Reserve Bank of St. Louis: Survey of Consumer Finances & Financial Accounts