Jason Napoli, ChFC, AAMS, MBA

President and Chief Investment Officer

High Country Capital Management

970.249.3499

www.hccm.com

Stock Indices:

| Dow Jones | 42,270 |

| S&P 500 | 5,911 |

| Nasdaq | 19,113 |

Bond Sector Yields:

| 2 Yr Treasury | 3.89% |

| 10 Yr Treasury | 4.41% |

| 10 Yr Municipal | 3.31% |

| High Yield | 7.26% |

YTD Market Returns:

| Dow Jones | -0.64% |

| S&P 500 | 0.51% |

| Nasdaq | -1.02% |

| MSCI-EAFE | 17.30% |

| MSCI-Europe | 21.20% |

| MSCI-Pacific | 10.50% |

| MSCI-Emg Mkt | 8.90% |

| US Agg Bond | 2.45% |

| US Corp Bond | 2.26% |

| US Gov’t Bond | 2.44% |

Commodity Prices:

| Gold | 3,313 |

| Silver | 33.07 |

| Oil (WTI) | 60.79 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 144.85 |

| Canadian /Dollar | 0.72 |

Macro Overview

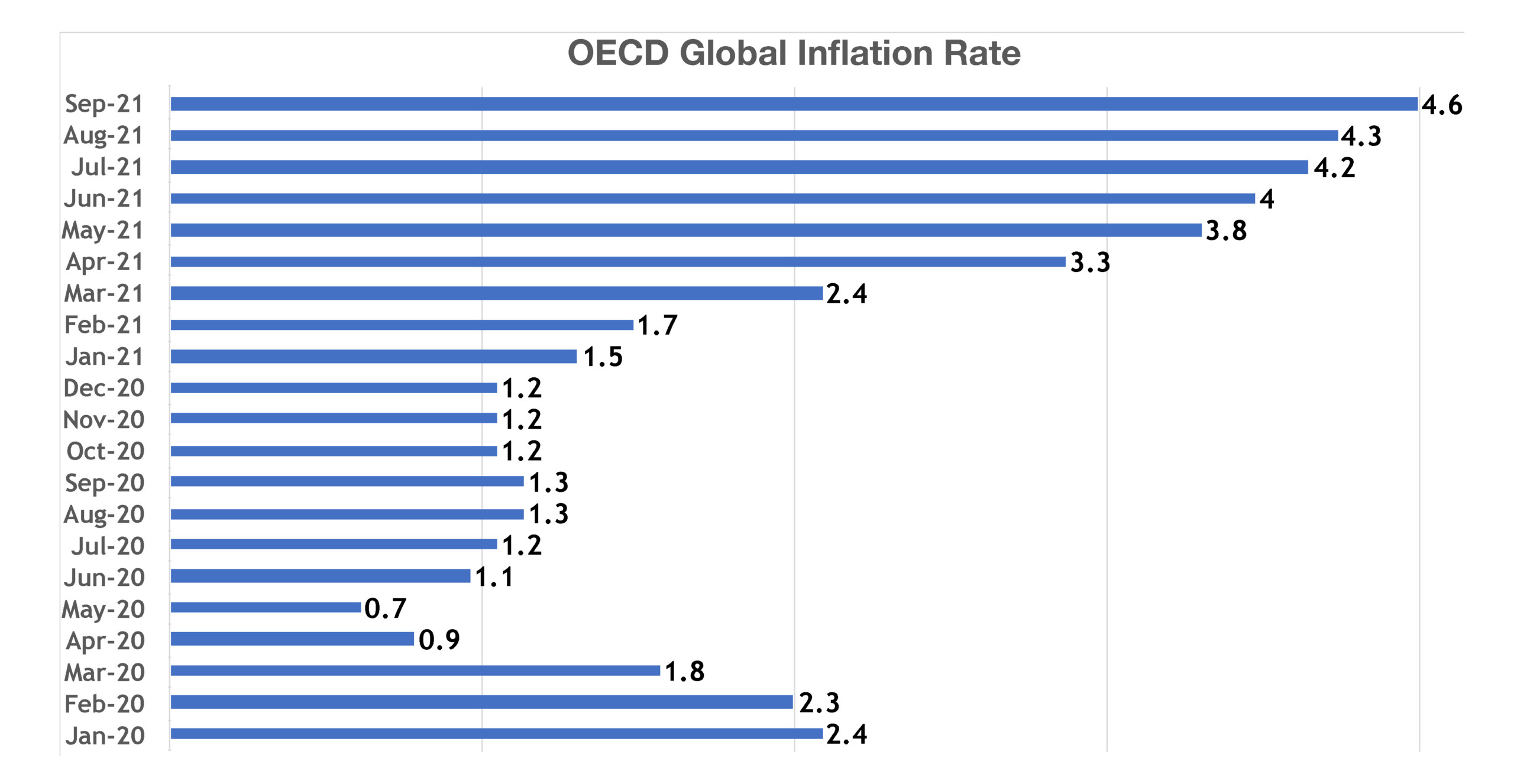

Severe labor shortages and supply chain disruptions continue to hamper industries throughout the country, elevating inflationary pressures for millions of Americans.

Higher prices for gasoline and natural gas are expected to raise heating costs for consumers heading into the winter months. A spike in demand for natural gas is common every winter, driving prices higher as well as intensified this season due to supply issues. Crude oil prices reached levels not seen in seven years as a gradual increase in demand and supply constraints contributed to price pressures.

Rising mortgage rates in October increased concerns about housing affordability for millions of Americans. Limited housing supply and elevated home prices have been an issue for home buyers for over a year. The onset of rising rates is expected to exacerbate the issue, putting home purchases out of reach for many Americans.

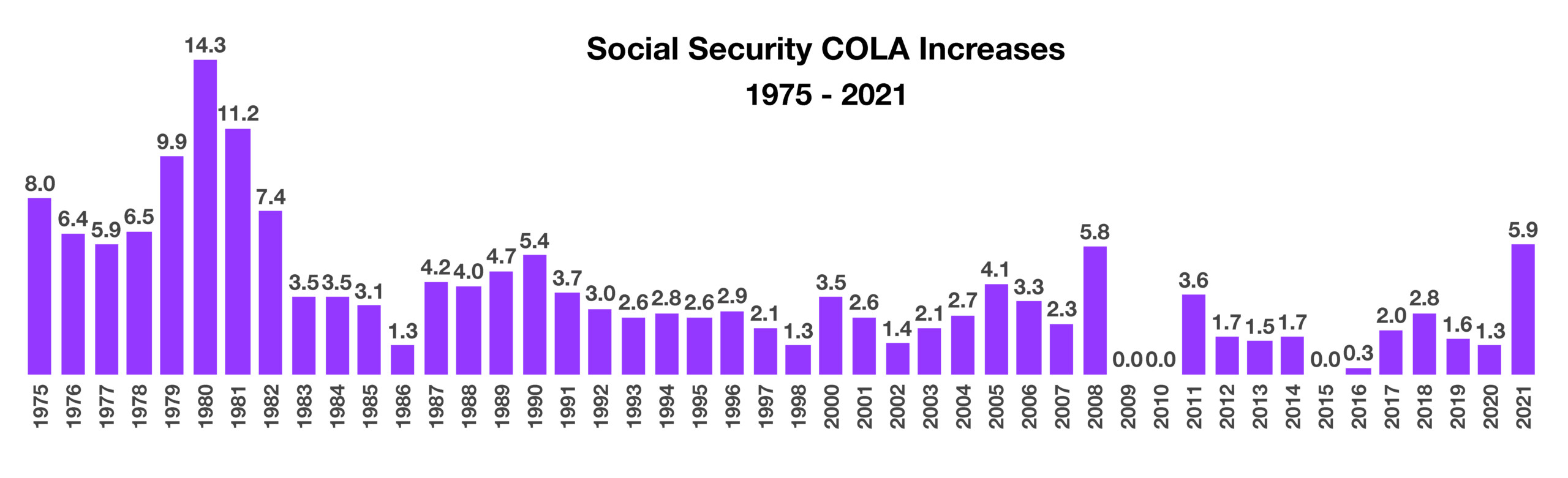

Social Security recipients will see a 5.9% increase in benefit payments starting in January 2022. The increase is the largest since 1982, adding an average of another $92 per month to an average monthly benefit of $1,657 per recipient. The Social Security Administration bases benefit adjustments on the current inflation rate, measured by the Consumer Price Index. The COLA (cost-of-living adjustment) is based on the most recent inflation rate and revised each year. As of September 2021, there were 69.9 million Americans receiving benefit payments from the Social Security Administration.

Equity markets were resilient in October as the Dow Jones Industrial Average, S&P 500, and the Nasdaq indices all reached new highs despite supply chain constraints, inflationary pressures, and rising rates.

Employment costs for wages and salaries in the private sector rose 4.6% over the past year compared to 2.4% for state and government positions. Employers are having to raise compensation and pay incentives in order to attract skilled workers for the 10 million open positions nationwide. Economists view the escalation of pay as wage inflation, affecting company margins and igniting further inflationary pressures.

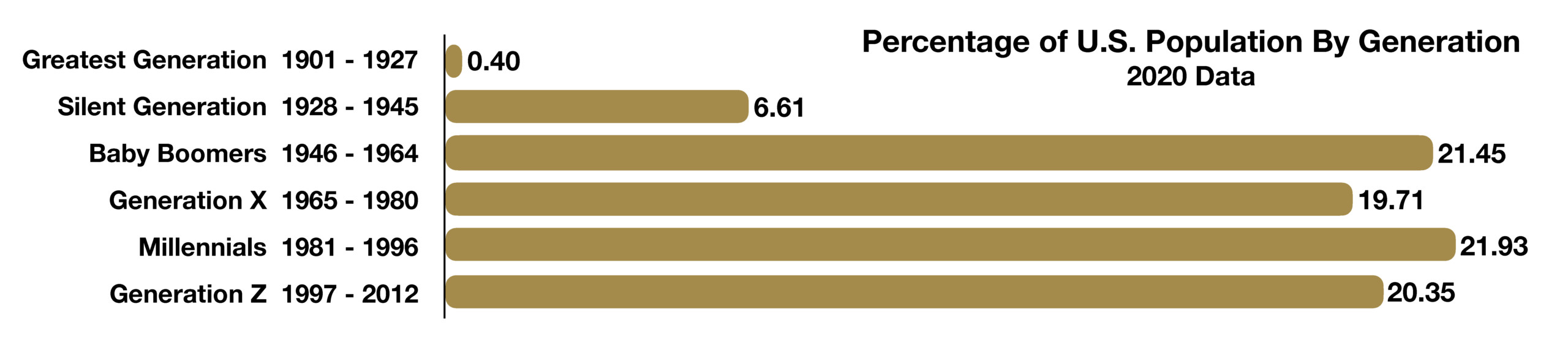

Millennials are becoming a fierce force in the U.S. economy, representing nearly 22% of the U.S. population, surpassing Baby Boomers which now account for roughly 21.5% of the population. Federal Reserve data show that millennials now represent over 5.5% of wealth held by the various generations, compared to 4.4% before the pandemic. Baby Boomers now represent 54.1 of wealth, down from 51.4% prior to the pandemic. (Sources: Federal Reserve, Labor Dept., Social Security Adm.)

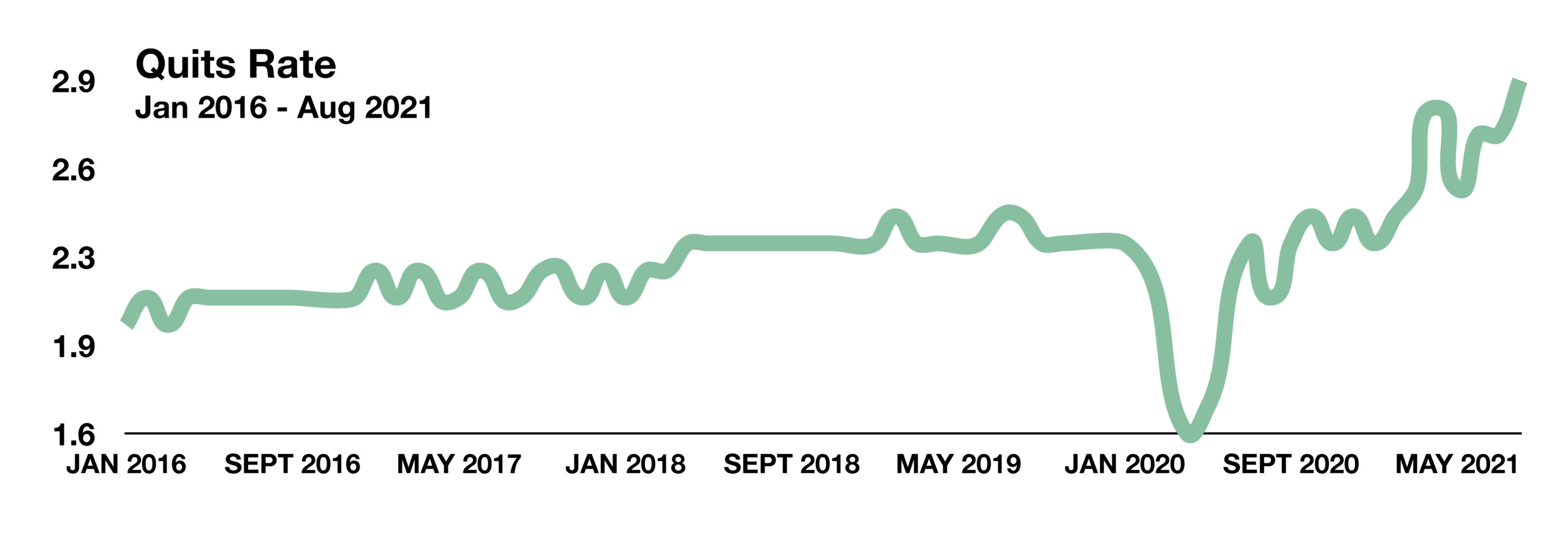

Following the financial crisis in 2008, the quits rate dropped as workers were less confident in leaving a job they had, rather than look for another job opportunity. Meanwhile, threats of layoffs and firings lingered following the 2008 crisis.

Following the financial crisis in 2008, the quits rate dropped as workers were less confident in leaving a job they had, rather than look for another job opportunity. Meanwhile, threats of layoffs and firings lingered following the 2008 crisis.