Ocean Park Capital Management

2503 Main Street

Santa Monica, CA 90405

Main: 310.392.7300

Daily Performance Line: 310.281.8577

Stock Indices:

| Dow Jones | 47,562 |

| S&P 500 | 6,840 |

| Nasdaq | 23,724 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.11% |

| 10 Yr Municipal | 2.73% |

| High Yield | 6.53% |

YTD Market Returns:

| Dow Jones | 11.80% |

| S&P 500 | 16.30% |

| Nasdaq | 22.86% |

| MSCI-EAFE | 23.69% |

| MSCI-Europe | 25.44% |

| MSCI-Pacific | 25.83% |

| MSCI-Emg Mkt | 30.32% |

| US Agg Bond | 6.80% |

| US Corp Bond | 7.29% |

| US Gov’t Bond | 6.51% |

Commodity Prices:

| Gold | 4,013 |

| Silver | 48.25 |

| Oil (WTI) | 60.88 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.31 |

| Yen / Dollar | 153.64 |

| Canadian /Dollar | 0.71 |

Portfolio Overview

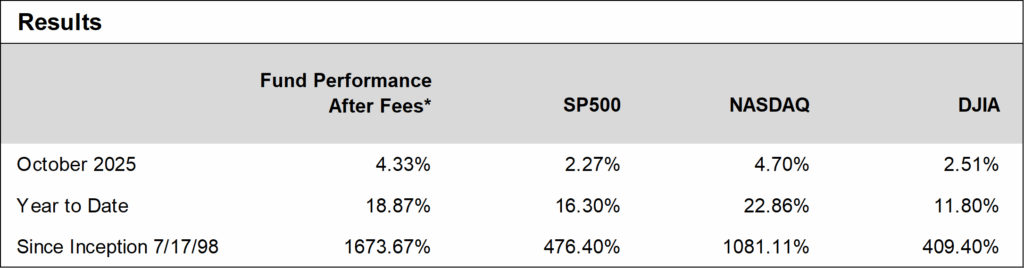

Ocean Park Investors Fund rose 4.33%* in October, while the S&P 500 gained 2.27% and the NASDAQ Composite gained 4.70%. Once again the fund’s technology holdings led the way, with Lumentum, Micron, Snowflake, and Western Digital all posting gains in excess of 20% for the month.

The Fund’s strong October showing also reflected notable one-day post-earnings gains among several holdings which rallied following quarterly beats. These included Amazon (+9.6%), Reddit (+7.5%), Western Digital (+8.7%), and Seagate Technology (+19.1%). These results highlight continued positive momentum across select AI, software, and data-infrastructure exposures.

We actively managed our market exposure for both risk and opportunity, finishing the month at about 97% net long.

Daily updates on our activity are available on our Results Line, at 310-281-8577. Current information is also maintained on our website at www.oceanparkcapital.com. Use password opcap.

*These results are pro forma. Actual results for most investors will vary. See additional disclosures on page 4. Past performance does not guarantee future results.