Alex Gregory Garcia

AGG Asset Management, LLC

875 S. Westlake Blvd, Suite 218

Westlake Village, CA 91361

805.496.3344

Stock Indices:

| Dow Jones | 47,562 |

| S&P 500 | 6,840 |

| Nasdaq | 23,724 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.11% |

| 10 Yr Municipal | 2.73% |

| High Yield | 6.53% |

YTD Market Returns:

| Dow Jones | 11.80% |

| S&P 500 | 16.30% |

| Nasdaq | 22.86% |

| MSCI-EAFE | 23.69% |

| MSCI-Europe | 25.44% |

| MSCI-Pacific | 25.83% |

| MSCI-Emg Mkt | 30.32% |

| US Agg Bond | 6.80% |

| US Corp Bond | 7.29% |

| US Gov’t Bond | 6.51% |

Commodity Prices:

| Gold | 4,013 |

| Silver | 48.25 |

| Oil (WTI) | 60.88 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.31 |

| Yen / Dollar | 153.64 |

| Canadian /Dollar | 0.71 |

Macro Overview

The Federal Reserve announced a rate reduction of a quarter point on the Fed Funds Rate in late October, yet is casting doubt on further rate cuts this year. Concerns surrounding underlying inflation are focal to the Fed as well a weakening jobs market with increasing layoffs across various industries.

The U.S. government shutdown, a result of a congressional impasse, surpassed the prior longest shutdown of 34 days which occurred in 2019, making the current shutdown the longest on record. Air traffic control, national parks, and programs that provide benefits, such as food stamps and small business loans have been affected by the shutdown.

There are a growing number of companies reporting rising profitability with the implementation of AI and the reduction of employee count. Companies have been investing heavily in AI infrastructure from data centers to semi conductor chips and utilities. Concurrently, layoffs have been rising in certain sectors where AI is thought to be most effective.

A growing number of analysts and economists believe that the Fed’s current easing of rates may be too little too late, as consumer loan payment delinquencies continue to rise. Commercial real estate loans are also under duress due to elevated variable rates brought about by the rapid Fed tightening in 2022 and 2023, and which haven’t fallen since then.

Japan’s new Prime Minister, Sanae Takaichi, is the nation’s first female Prime Minister, with ample support for her ambitious fiscal and economic objectives. Japan currently ranks as the world’s fourth largest economy, behind Germany, China and the United States. Japan’s trade pacts with neighboring countries as well as the U.S. is critical to global trade due to its expansive manufacturing capabilities.

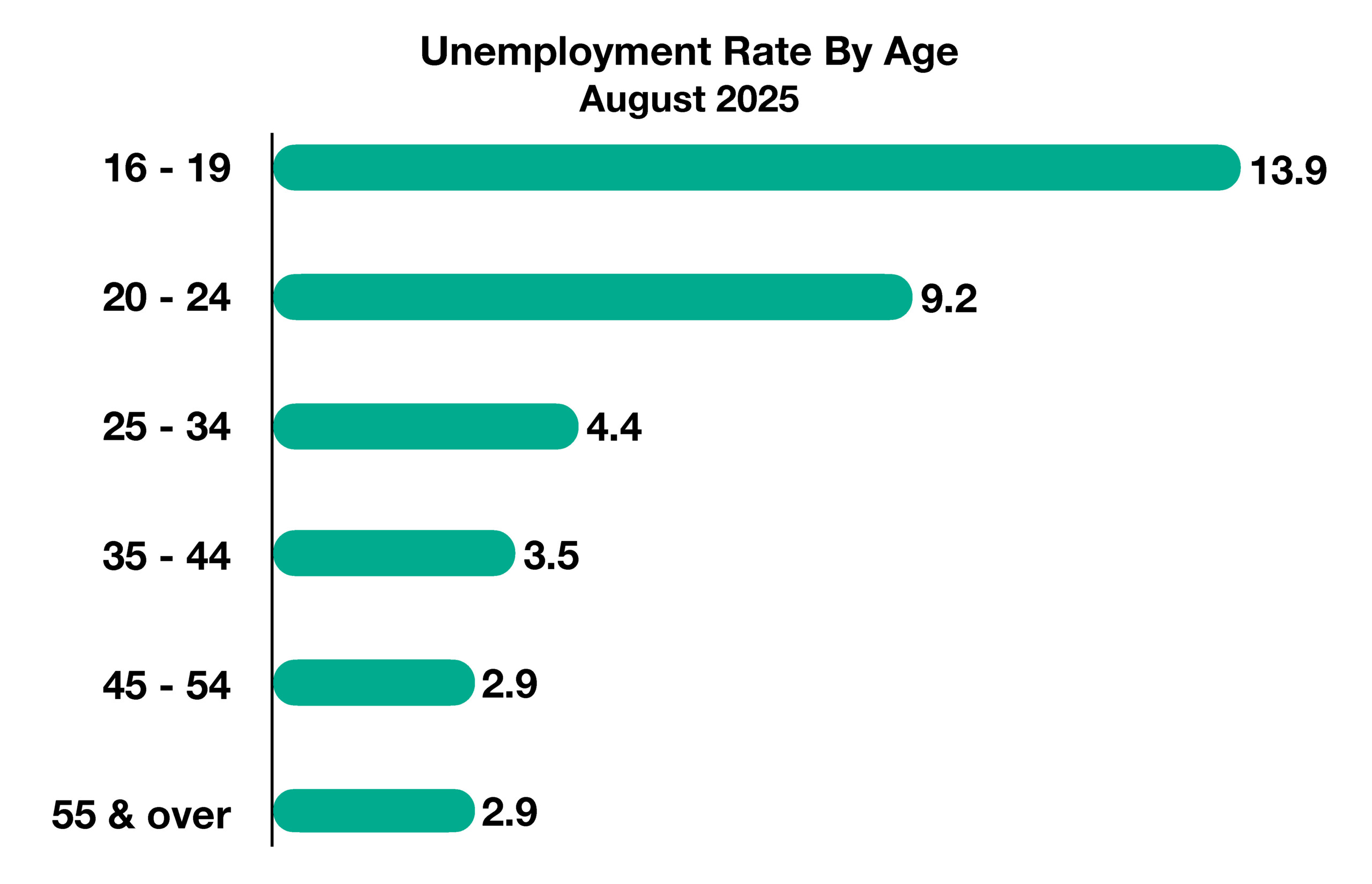

Unemployment is highest among those aged 16-24, more than double the overall rate for all workers. Younger applicants are increasingly having a difficult time finding jobs as more companies are initiating layoffs and reducing the number of new hires.

Inflation rose less than expected in the most recent data release, signaling that lessening inflation data may help entice the Fed to continue forward with its rate reduction trajectory. The Fed hinted at a possible pause in rate reduction in December should inflation data not warrant another rate cut. The inflation rate, as measured by the CPI rose 3% year over year increase as of September 2025, a steep drop from June 2022 when inflation was running at 9.1%.

Sources: Dept. of Labor, Federal Reserve, Bureau of Labor Statistics, Treasury Department

Technology is what has driven the cost of televisions dramatically lower over the past few decades, as resistors, semiconductors, and screens became lighter, better, and less expensive to manufacture.TVs are one of the few products that have seen dramatic deflation in price relative to overall inflation trends.

Technology is what has driven the cost of televisions dramatically lower over the past few decades, as resistors, semiconductors, and screens became lighter, better, and less expensive to manufacture.TVs are one of the few products that have seen dramatic deflation in price relative to overall inflation trends.

In it’s most recent release this past month, the Beige Book indicated sluggish economic and labor market conditions across the country, with three districts reporting slight/modest growth, five reporting no change, and four a slight softening. The report found that a weakening labor market was ensuing pressure on consumers, with discretionary expenditures off from prior periods. Employers have been actively reducing head count across various industries, with layoffs and attrition increasing.

In it’s most recent release this past month, the Beige Book indicated sluggish economic and labor market conditions across the country, with three districts reporting slight/modest growth, five reporting no change, and four a slight softening. The report found that a weakening labor market was ensuing pressure on consumers, with discretionary expenditures off from prior periods. Employers have been actively reducing head count across various industries, with layoffs and attrition increasing. Since the federal government sees a tremendous tax revenue opportunity in taxing digital currency transactions, the IRS has already started to issue tax ramification guidelines applicable to such transactions. The U.S. government expects to raise about $28 billion over the next ten years by tracking and taxing transactions. Digital wallets, which hold crypto currencies, may be required to report holdings and transactions to the IRS, similar to traditional financial institutions. The IRS also plans to crack down on taxpayers not reporting gains from crypto transactions, as noted on the most recent IRS tax return forms. Some crypto trading platforms intend to start issuing 1099-Misc and 1099-K forms in order to comply with IRS reporting requirements. As consumers become more comfortable with making payments with digital currencies, each transaction may become a taxable event. The ability to store cryptocurrency in a digital wallet, then use it for a purchase, may trigger a tax consequence if the currency is sold at a gain in order to make the purchase. The IRS is expected to require platforms providing digital wallets to maintain the cost basis on all currency transactions. Should a 1099 form not be issued by the digital currency platform used, then the IRS is suggesting that taxpayers maintain a record of all purchases and sells in order to properly report any taxable gains or losses. (Source: IRS)

Since the federal government sees a tremendous tax revenue opportunity in taxing digital currency transactions, the IRS has already started to issue tax ramification guidelines applicable to such transactions. The U.S. government expects to raise about $28 billion over the next ten years by tracking and taxing transactions. Digital wallets, which hold crypto currencies, may be required to report holdings and transactions to the IRS, similar to traditional financial institutions. The IRS also plans to crack down on taxpayers not reporting gains from crypto transactions, as noted on the most recent IRS tax return forms. Some crypto trading platforms intend to start issuing 1099-Misc and 1099-K forms in order to comply with IRS reporting requirements. As consumers become more comfortable with making payments with digital currencies, each transaction may become a taxable event. The ability to store cryptocurrency in a digital wallet, then use it for a purchase, may trigger a tax consequence if the currency is sold at a gain in order to make the purchase. The IRS is expected to require platforms providing digital wallets to maintain the cost basis on all currency transactions. Should a 1099 form not be issued by the digital currency platform used, then the IRS is suggesting that taxpayers maintain a record of all purchases and sells in order to properly report any taxable gains or losses. (Source: IRS)