Stock Indices:

| Dow Jones | 47,562 |

| S&P 500 | 6,840 |

| Nasdaq | 23,724 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.11% |

| 10 Yr Municipal | 2.73% |

| High Yield | 6.53% |

YTD Market Returns:

| Dow Jones | 11.80% |

| S&P 500 | 16.30% |

| Nasdaq | 22.86% |

| MSCI-EAFE | 23.69% |

| MSCI-Europe | 25.44% |

| MSCI-Pacific | 25.83% |

| MSCI-Emg Mkt | 30.32% |

| US Agg Bond | 6.80% |

| US Corp Bond | 7.29% |

| US Gov’t Bond | 6.51% |

Commodity Prices:

| Gold | 4,013 |

| Silver | 48.25 |

| Oil (WTI) | 60.88 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.31 |

| Yen / Dollar | 153.64 |

| Canadian /Dollar | 0.71 |

Macro Overview

The Federal Reserve reduced the federal funds rate by a quarter point in late October but signaled uncertainty about more cuts this year. Persistent inflation concerns remain central to the Fed’s outlook, alongside signs of a softening labor market and rising layoffs across several industries.

The U.S. government shutdown, driven by a congressional stalemate, has now surpassed the previous record of 34 days set in 2019, making it the longest in history. The disruption has affected air traffic control, national parks, and federal benefit programs such as food stamps and small business loans. On Monday, November 10, the Senate approved a spending package to end the shutdown.

An increasing number of companies are reporting higher profits following the adoption of artificial intelligence and workforce reductions. Firms are investing heavily in AI infrastructure—from data centers to semiconductor chips and utilities—while layoffs mount in sectors where AI is proving most effective.

A growing chorus of analysts and economists warns that the Fed’s current pace of easing may be too little, too late, as consumer loan delinquencies continue to climb. Commercial real estate loans also remain under pressure from elevated variable rates, a lingering effect of the rapid tightening cycle in 2022 and 2023.

Japan’s new Prime Minister, Sanae Takaichi, the country’s first female leader, enjoys broad support for her ambitious fiscal and economic agenda. Japan, now the world’s fourth-largest economy after Germany, China, and the United States, remains a linchpin of global trade through its extensive manufacturing base and key partnerships with neighboring nations and the U.S.

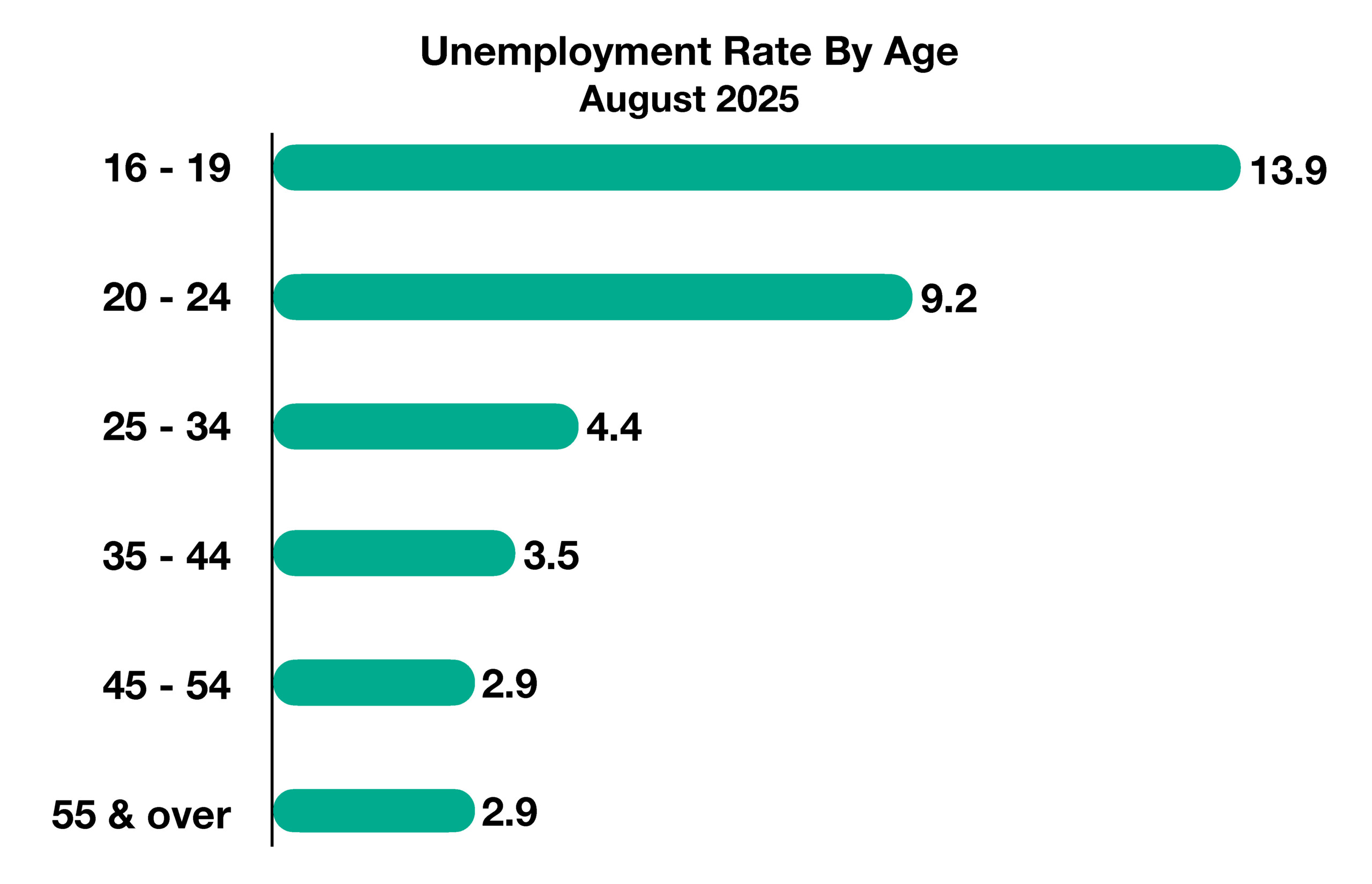

Unemployment is highest among workers aged 16 to 24—more than twice the overall jobless rate. Younger applicants are finding it increasingly difficult to secure employment as more firms initiate layoffs and scale back hiring.

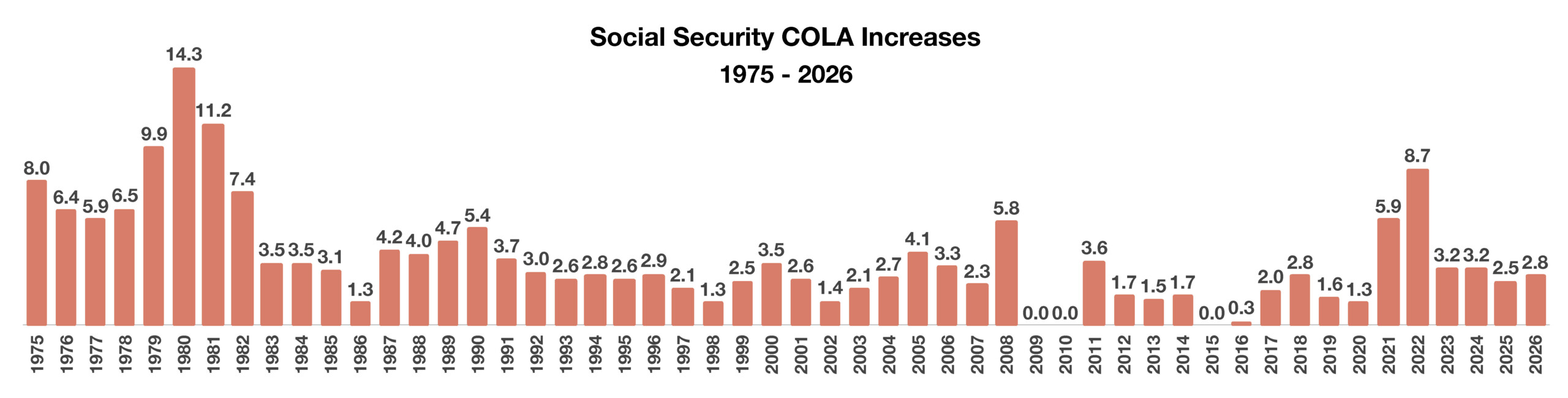

Inflation rose less than expected recently, suggesting moderating price pressures could encourage the Fed to continue its rate-cutting trajectory. The central bank, however, has hinted it may pause in December if data do not justify further easing. Consumer prices increased 3% year over year as of September 2025—a sharp decline from the 9.1% peak reached in June 2022.

Sources: Dept. of Labor, Federal Reserve, Bureau of Labor Statistics, Treasury Department

Recognizing a major source of potential revenue, the federal government expects to collect roughly $28 billion over the next decade through enhanced crypto tax enforcement. The IRS has begun issuing detailed guidance on how these transactions will be taxed. Digital wallets that store cryptocurrencies may soon be required to report holdings and activity to the IRS, similar to traditional financial institutions. The agency also plans to pursue taxpayers who fail to disclose gains, a point reinforced by new language on the latest tax forms.

Recognizing a major source of potential revenue, the federal government expects to collect roughly $28 billion over the next decade through enhanced crypto tax enforcement. The IRS has begun issuing detailed guidance on how these transactions will be taxed. Digital wallets that store cryptocurrencies may soon be required to report holdings and activity to the IRS, similar to traditional financial institutions. The agency also plans to pursue taxpayers who fail to disclose gains, a point reinforced by new language on the latest tax forms.