Macro Overview

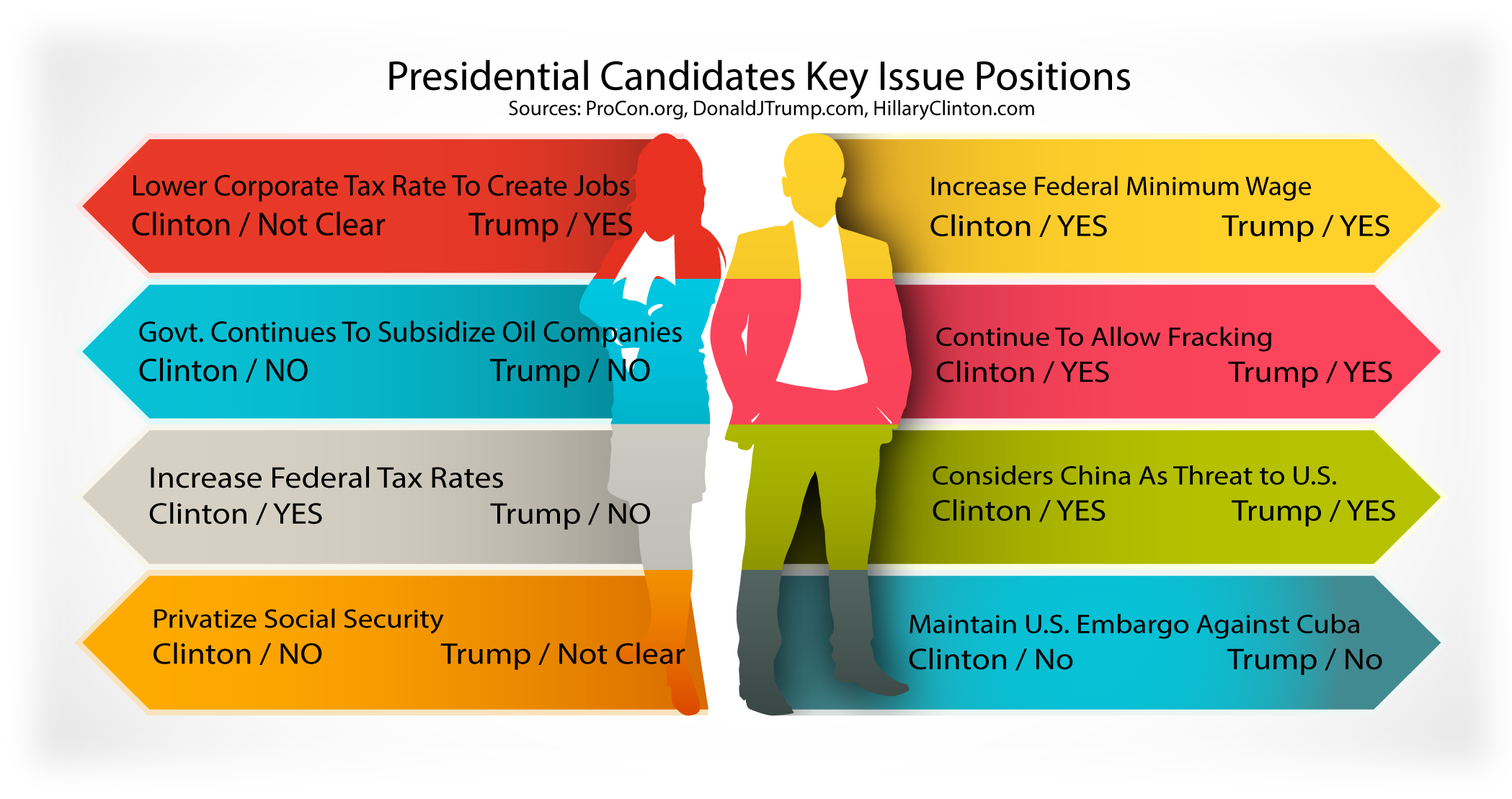

A tightening of presidential polls added to market ambivalence as uncertainty regarding what fiscal and regulatory policy changes might affect the economy and markets. The outcome of the U.S. elections is considered by many to be a primary determinant of how the rest of the year could evolve.

Fiscal policy is still a central concern as monetary policy, which is dictated by the Federal Reserve, has become less effective and predictable. A reduction in federal income tax rates could lead to higher deficit spending, yet may contribute to a rise in GDP and consumer spending.

During its September meeting, the Fed decided to leave rates unchanged but strongly implied that an increase was on the horizon. The Bank of Japan kept its key rate unchanged at negative .10% with a target for its 10-year government yield at zero, a stark contrast to U.S. government bond yields. Lagging retail sales and stagnant industrial production reports possibly encouraged the Fed to hold off on a rate rise during its September meeting. The Fed has two more meetings before the end of the year, one the week before the presidential election and another in December. Most market analysts believe that the Fed won’t raise rates in November, but is a possibility in December as it did in 2015. We believe there is only a small chance the Fed will raise rates in December as Yellen referred to our economy as a “Pressured Economy”.

The Atlanta Federal Reserve said its forecast of third-quarter real consumer spending growth fell from 3.0 percent to 2.7 percent, influenced by stagnant personal income and spending data for August. U.S. consumer spending fell in August for the first time in seven months while inflation showed signs of accelerating, mixed signals that could also keep the Federal Reserve cautious about raising interest rates.

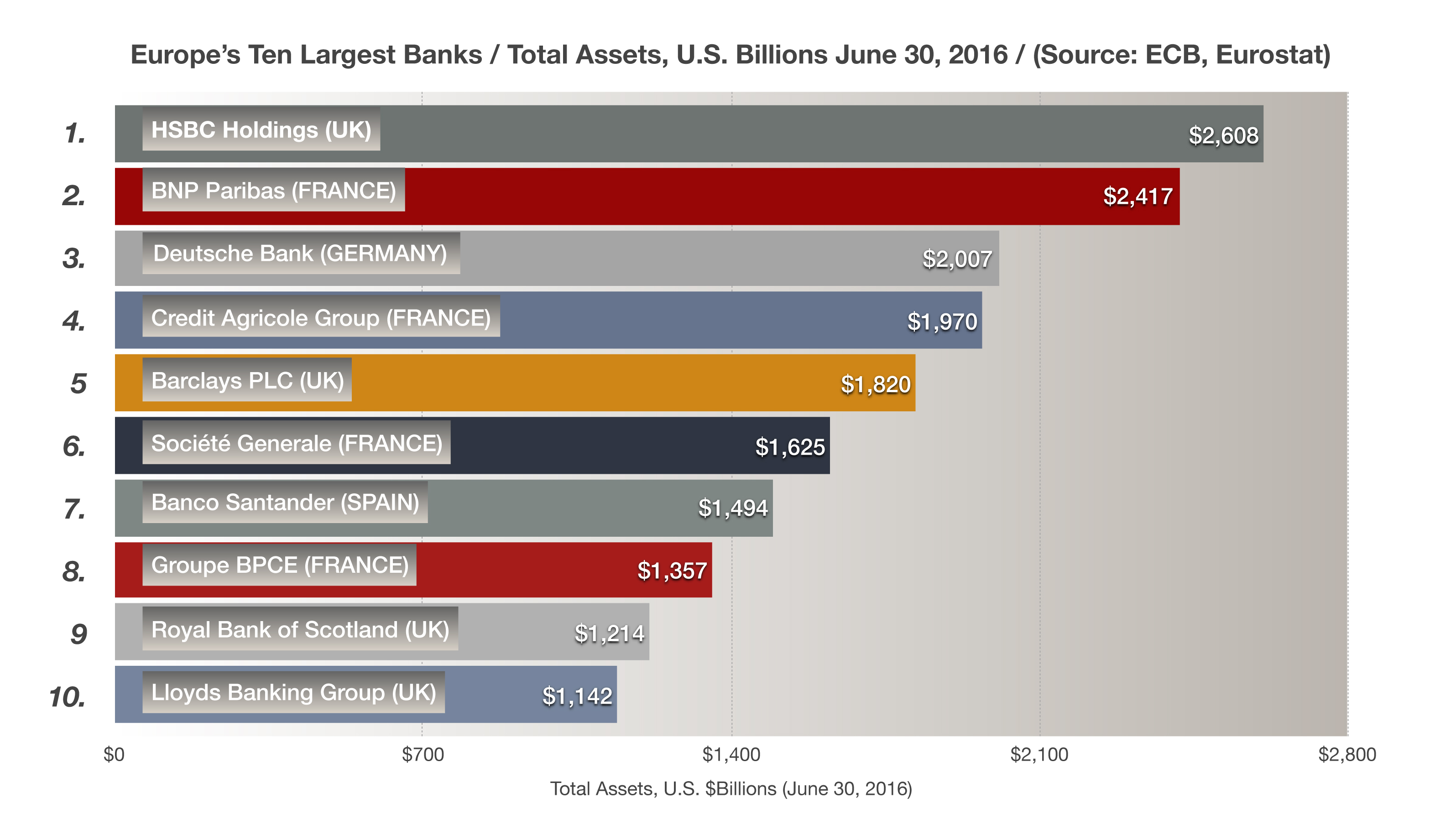

Anxiety over European banks has risen since the British voted to exit the EU. At first only smaller peripheral banks in Italy, Spain and Greece were of concern, but now larger banks in Germany have become focal points. Pressures are mounting for European banks as the low rate environment set by the ECB is starting to take its toll on bank earnings. An assemblance of dynamics has propelled Germany’s largest bank into a precarious position. (Sources: Fed, OPEC, Eurostat, Reuters, ECB)