Stock Indices:

| Dow Jones | 47,562 |

| S&P 500 | 6,840 |

| Nasdaq | 23,724 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.11% |

| 10 Yr Municipal | 2.73% |

| High Yield | 6.53% |

YTD Market Returns:

| Dow Jones | 11.80% |

| S&P 500 | 16.30% |

| Nasdaq | 22.86% |

| MSCI-EAFE | 23.69% |

| MSCI-Europe | 25.44% |

| MSCI-Pacific | 25.83% |

| MSCI-Emg Mkt | 30.32% |

| US Agg Bond | 6.80% |

| US Corp Bond | 7.29% |

| US Gov’t Bond | 6.51% |

Commodity Prices:

| Gold | 4,013 |

| Silver | 48.25 |

| Oil (WTI) | 60.88 |

Currencies:

| Dollar / Euro | 1.15 |

| Dollar / Pound | 1.31 |

| Yen / Dollar | 153.64 |

| Canadian /Dollar | 0.71 |

Macro Overview

The aftermath of Hurricanes Harvey, Irma, and Maria are expected to have uncertain affects on government data and continued ambiguity on economic activity. The hurricanes will distort economic reports quite possibly for months, as labor and material costs weigh on employment and inflation numbers, clouding actual economic results.

Despite major disruptions caused by the storms, equity markets managed to post gains in September as the prospect of rebuilding efforts fueled growth estimates across various industry sectors.

Tax reform proposals spurred discussion and anticipation about their impact on the economy and the markets. Among the plan’s primary particulars are: reduce the number of tax brackets from seven to three, double the standard deduction amount, eliminate state and local tax deductions, tax “pass through businesses” at a 25% rate, eliminate the estate tax and the alternative minimum tax (AMT).

From the perspective of the equity markets, the tax proposals include a generous cut in the corporate rate from 35% to 20%. The corporate tax proposals also include a penalty for companies taking advantage of foreign tax havens, where U.S. companies earning profits overseas will have to pay a minimum 10% tax on foreign income even if it isn’t brought home.

Since the tax plan is still only based on proposals, not an actual bill, market reaction to the proposals may change as to what actual details may pass and are eventually enacted. Economists believe that the Federal Reserve will continue to find it difficult to normalize monetary policy until an appropriate fiscal policy is in place.

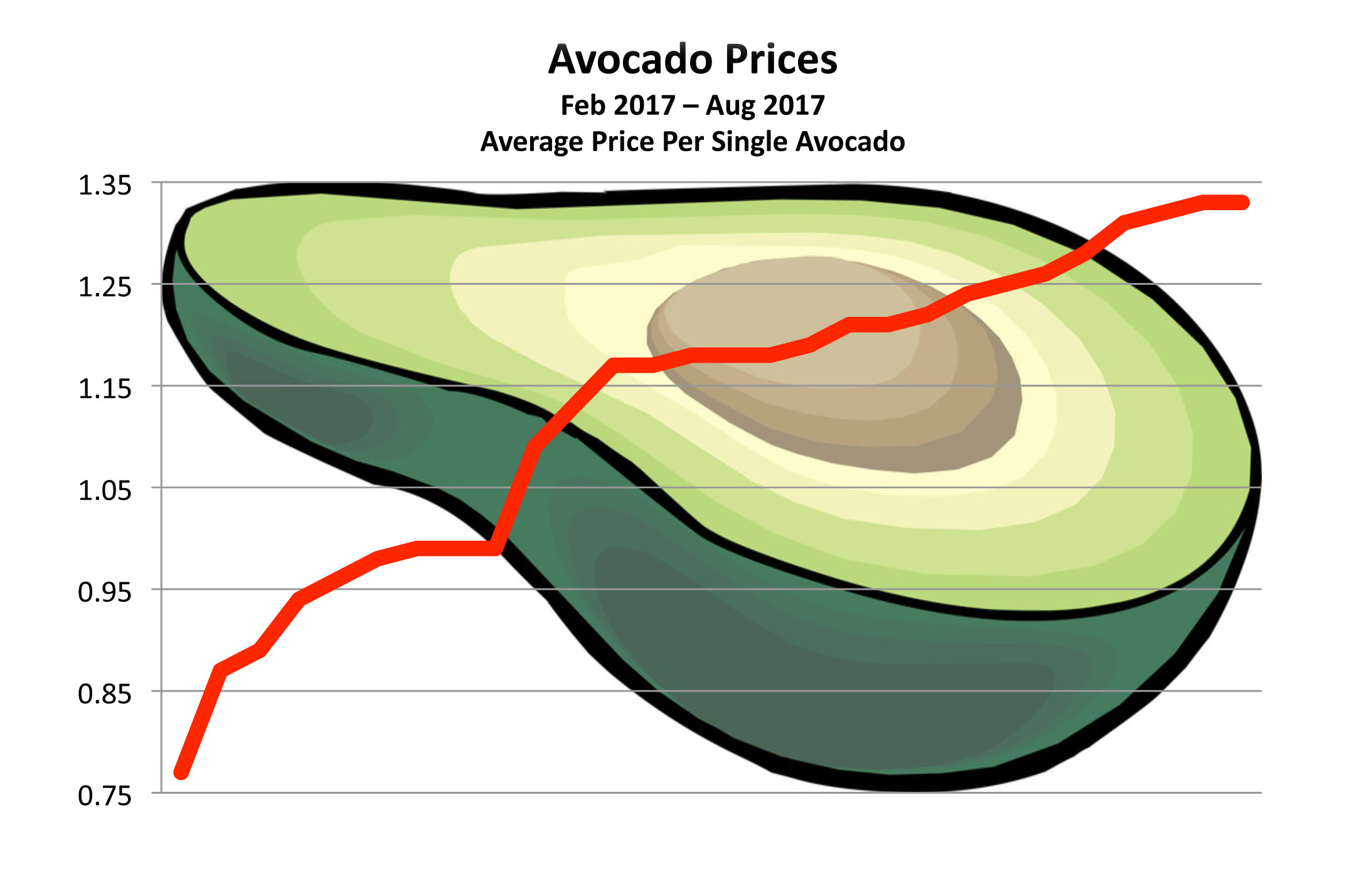

The most recent median household income data revealed a 3.2% rise over the past year, net of inflation, according to the U.S. Census Bureau. The larger than expected increase helped stoke support for a Fed rate hike later in the year. Overall indicators of inflation are mixed, with rent and gasoline accounting for the primary rise in inflation while grocery costs and service related fees fell.

Puerto Rico, which earlier this year filed the largest bankruptcy in U.S. municipal history, is struggling to regain economic stability in the face of a $72 billion debt load and near insolvent public health and pension systems. Eleven days after the devastating storm wiped out power, water and communications systems, about half of the 3.4 million people on the island did not have access to drinking water, and 95 percent remained without power, according to the U.S. Defense Department.

The Equifax data breach affecting 143 million consumers has led to numerous investigations and actions taken by various governmental entities including the FBI, Federal Trade Commission, House Financial Services Committee, and the Consumer Financial Protection Bureau. Compromised information included Social Security numbers, birthdates, names, addresses, and driver’s license numbers. A data breach of this magnitude has never occurred, infuriating the public as well as congressional leaders. (Sources: U.S. Treasury, WhiteHouse.gov, FTC, U.S. Defense Dept., myFlorida.com)

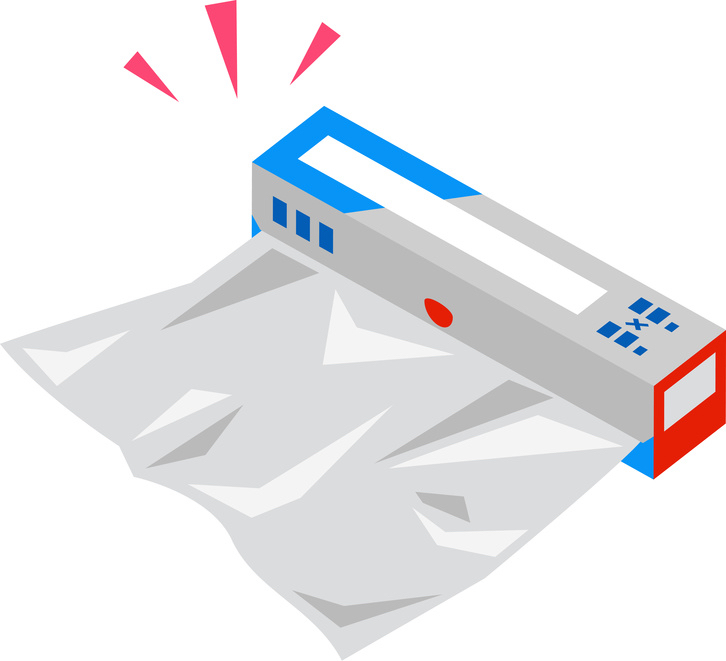

ted $389 million in 2016, according to Commerce Department data. The tax, considered a punitive import tariff, will levy a duty of 16.5% to 81% on all imported aluminum foil products from China. Steel and other metal manufacturers in the Unites States claim that China’s excess capacity is being dumped onto the U.S. market. Dumping is a trade tactic where countries and companies price their exports at a lower price than domestic manufacturers, thus threatening their financial livelihood and stability. Aluminum has become a focus metal because of its use in aerospace and defense, thus posing a possible threat to national security because of its use by the U.S. military. (Source: U.S. Commerce Department)

ted $389 million in 2016, according to Commerce Department data. The tax, considered a punitive import tariff, will levy a duty of 16.5% to 81% on all imported aluminum foil products from China. Steel and other metal manufacturers in the Unites States claim that China’s excess capacity is being dumped onto the U.S. market. Dumping is a trade tactic where countries and companies price their exports at a lower price than domestic manufacturers, thus threatening their financial livelihood and stability. Aluminum has become a focus metal because of its use in aerospace and defense, thus posing a possible threat to national security because of its use by the U.S. military. (Source: U.S. Commerce Department) The FTC acknowledges that there were 143 million consumers affected, with the breach occurring between mid-May and July end. Social Security numbers, birthdates, addresses, and some driver’s license numbers were stolen.

The FTC acknowledges that there were 143 million consumers affected, with the breach occurring between mid-May and July end. Social Security numbers, birthdates, addresses, and some driver’s license numbers were stolen.