MINNESOTA

15600 Wayzata Blvd | Suite 304 | Wayzata, MN 55391

952.681.7254

FLORIDA

375 Park Avenue | Suite 1 | Boca Grande, FL 33921

941.964.2434

Stock Indices:

| Dow Jones | 39,118 |

| S&P 500 | 5,460 |

| Nasdaq | 17,732 |

Bond Sector Yields:

| 2 Yr Treasury | 4.71% |

| 10 Yr Treasury | 4.36% |

| 10 Yr Municipal | 2.86% |

| High Yield | 7.58% |

YTD Market Returns:

| Dow Jones | 3.79% |

| S&P 500 | 14.48% |

| Nasdaq | 18.13% |

| MSCI-EAFE | 3.51% |

| MSCI-Europe | 3.72% |

| MSCI-Pacific | 3.05% |

| MSCI-Emg Mkt | 6.11% |

| US Agg Bond | -0.71% |

| US Corp Bond | -0.49% |

| US Gov’t Bond | -0.68% |

Commodity Prices:

| Gold | 2,336 |

| Silver | 29.43 |

| Oil (WTI) | 81.46 |

Currencies:

| Dollar / Euro | 1.06 |

| Dollar / Pound | 1.26 |

| Yen / Dollar | 160.56 |

| Canadian /Dollar | 0.73 |

Macro Overview

The Fed raised rates for the third time this year, signaling it was on track for further hikes over the next few months. Rates moved higher across the fixed income spectrum, with the 10-year Treasury bond piercing the 3% mark, a level last reached in May of this year. The Federal Reserve also revised its estimates for GDP growth from 2.8% to 3.1% for 2018, with an eventual slowing to1.8% by 2021.

Newly imposed tariffs by the Department of Commerce on Chinese imports became effective in late September. The $200 billion worth of tariffs will begin at a 10% rate and increase to 25% by year end should the two countries not come to an agreement.

The Department of Commerce is incentivizing U.S. companies to shift production of goods in China to the U.S. by allowing companies to redirect production prior to year end before tariffs are scheduled to reach 25% on Chinese made products.

Equity markets brushed aside ongoing concerns over escalating international trade tensions and instead focused on economic expansion in the United States. Analysts are seeing the benefits of the recent tax cuts and deregulation translate into expanding earnings for U.S. companies. Economists are also citing the tax cuts as a monumental factor in economic expansion.

Preliminary damage estimates following the destruction caused by hurricane Florence are expected to reach between $38 billion and $50 billion.The cost of Florence is not expected to be anywhere near the cost of hurricanes Harvey, Maria, or Irma, yet will impose additional strain on an all ready straddled insurance industry. Damage estimates are compiled by Moody’s which tracks the claims paying ability of insurance companies, especially during periods of significant payment of claims. The Federal Emergency Management Agency (FEMA) has thus far received over 8,000 claims for flood damage which allows for a $5,000 payment without an adjuster visit.

Oil prices headed higher in September topping levels not reached since 2014. Global energy markets reacted to limited production from OPEC, Saudi Arabia, Russia and the United States. The price for a barrel of Brent oil, which is priced internationally, reached $80 while the price of domestic oil priced as WTI surpassed $72. Adding to the supply strain were recently imposed sanctions on Iranian oil exports along with production constraints in the U.S.

Consumer sentiment reached its second highest level since 2004, as tracked by the University of Michigan’s Consumer Sentiment Index. Sentiment among consumers improved across all income categories with the expectation of higher wages and continued job growth. Modest levels of inflation also propelled confidence among consumers.

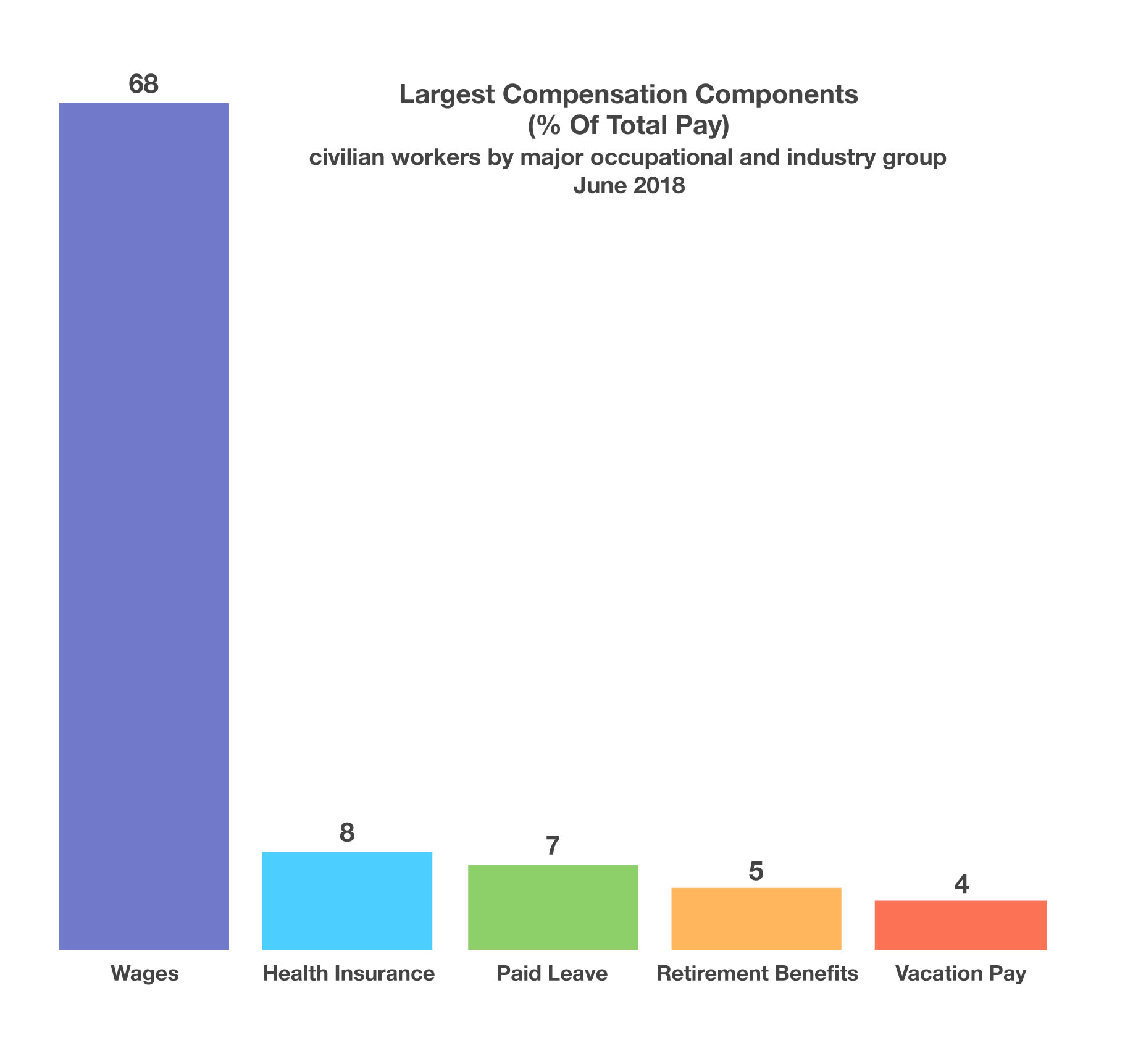

The White House Council of Economic Advisers reported that 623 companies this past month announced bonuses, pay increases, and better benefits as a result of the recent tax cuts. The council also estimates that over 6 million American workers have so far directly benefited from the tax law changes. (Sources: Fed, Dept. of Commerce, Moody’s, EIA, White House Council of Economic Advisers)