W.P. "Bill" Atkinson, III

Certified Financial Planner TM / Attorney

Access Financial Resources, Inc.

3621 NW 63rd Street, Suite A1

Oklahoma City, OK 73116

(405) 848-9826

Stock Indices:

| Dow Jones | 44,094 |

| S&P 500 | 6,204 |

| Nasdaq | 20,369 |

Bond Sector Yields:

| 2 Yr Treasury | 3.72% |

| 10 Yr Treasury | 4.24% |

| 10 Yr Municipal | 3.21% |

| High Yield | 6.80% |

YTD Market Returns:

| Dow Jones | 3.64% |

| S&P 500 | 5.50% |

| Nasdaq | 5.48% |

| MSCI-EAFE | 17.37% |

| MSCI-Europe | 20.67% |

| MSCI-Pacific | 11.15% |

| MSCI-Emg Mkt | 13.70% |

| US Agg Bond | 4.02% |

| US Corp Bond | 4.17% |

| US Gov’t Bond | 3.95% |

Commodity Prices:

| Gold | 3,319 |

| Silver | 36.32 |

| Oil (WTI) | 64.98 |

Currencies:

| Dollar / Euro | 1.17 |

| Dollar / Pound | 1.37 |

| Yen / Dollar | 144.61 |

| Canadian /Dollar | 0.73 |

Macro Overview

The Fed raised rates for the third time this year, signaling it was on track for further hikes over the next few months. Rates moved higher across the fixed-income spectrum, with the 10-year Treasury bond piercing the 3% mark, a level last reached in May of this year. The Federal Reserve also revised its estimates for GDP growth from 2.8% to 3.1% for 2018, with an eventual slowing to 1.8% by 2021. Newly imposed tariffs by the Department of Commerce on Chinese imports became effective in late September. The $200 billion worth of tariffs – which the American people pay, not the Chinese – will begin at a 10% rate and increase to 25% by year end should the two countries not come to an agreement. Moreover, the Department of Commerce is incentivizing U.S. companies to shift production of goods in China to the U.S. by allowing companies to redirect production prior to year end before tariffs are scheduled to reach 25% on Chinese made products. However, a tariff on imported goods curtails the supply of less costly goods and encourages the supply to the domestic market of more costly, inefficient domestically produced goods – which could very well undermine the U.S. economy in the long run.

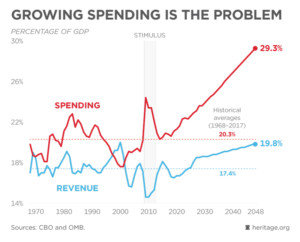

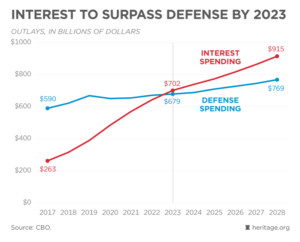

For example, according to the Department of the Treasury, corporate tax receipts during the first nine months of fiscal year 2018 fell by 28 percent — from $223 billion in 2017 to $162 billion this year. An analysis published in June by the Tax Policy Center highlights my concerns: “[the new tax law] will stimulate the economy in the near term. But, most models indicate that the long-term impact on GDP will be small…. It will make the distribution of after-tax income more unequal, raise federal debt, and impose burdens on future generations.” See the projected spending vs. revenue chart.

In any event, oil prices headed higher in September topping levels not reached since 2014. Global energy markets reacted to limited production from OPEC, Saudi Arabia, Russia, and the United States. The price for a barrel of Brent oil, which is priced internationally, reached $80 while the price of domestic oil priced as WTI surpassed $72. Adding to the supply strain were recently imposed sanctions on Iranian oil exports along with production constraints in the U.S.

(Sources: Fed, Dept. of Commerce, Heritage Foundation, Moody’s, Mises Institute, Peter G. Peterson Foundation)

another rate increase anticipated in December and three more to follow in 2019. The Fed’s key policy rate, the Federal Funds Rate, now stands at a range of 2% – 2.25%, the highest in ten years. Of the various fixed income sectors, U.S. corporate high-yield bonds had the least amount of price declines in September, outperforming both government and investment grade debt. Some analysts view this as a validation of improving financial conditions for U.S. companies and their ability to repay debt (remember their tax rate was reduced). Moreover, borrowing rates are increasing in various consumer sectors including autos, appliances, and home mortgages. Higher interest rates, however, is a result of inflation as it is the direct “cost” to borrow money.

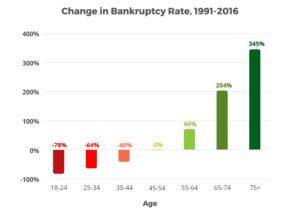

another rate increase anticipated in December and three more to follow in 2019. The Fed’s key policy rate, the Federal Funds Rate, now stands at a range of 2% – 2.25%, the highest in ten years. Of the various fixed income sectors, U.S. corporate high-yield bonds had the least amount of price declines in September, outperforming both government and investment grade debt. Some analysts view this as a validation of improving financial conditions for U.S. companies and their ability to repay debt (remember their tax rate was reduced). Moreover, borrowing rates are increasing in various consumer sectors including autos, appliances, and home mortgages. Higher interest rates, however, is a result of inflation as it is the direct “cost” to borrow money. Chapter 7 bankruptcy allows one to discharge most if not all debts and turn over nonexempt assets to the court. Determining whether or not Chapter 7 is an option is based on income. On the other hand, chapter 13 bankruptcy allows one to keep assets, such as a home, and repay debt via a court approved payment schedule.

Chapter 7 bankruptcy allows one to discharge most if not all debts and turn over nonexempt assets to the court. Determining whether or not Chapter 7 is an option is based on income. On the other hand, chapter 13 bankruptcy allows one to keep assets, such as a home, and repay debt via a court approved payment schedule. IRS Scams

IRS Scams