Stock Indices:

| Dow Jones | 40,669 |

| S&P 500 | 5,569 |

| Nasdaq | 17,446 |

Bond Sector Yields:

| 2 Yr Treasury | 3.60% |

| 10 Yr Treasury | 4.17% |

| 10 Yr Municipal | 3.36% |

| High Yield | 7.69% |

YTD Market Returns:

| Dow Jones | -4.41% |

| S&P 500 | -5.31% |

| Nasdaq | -9.65% |

| MSCI-EAFE | 12.00% |

| MSCI-Europe | 15.70% |

| MSCI-Pacific | 5.80% |

| MSCI-Emg Mkt | 4.40% |

| US Agg Bond | 3.18% |

| US Corp Bond | 2.27% |

| US Gov’t Bond | 3.13% |

Commodity Prices:

| Gold | 3,298 |

| Silver | 32.78 |

| Oil (WTI) | 58.22 |

Currencies:

| Dollar / Euro | 1.13 |

| Dollar / Pound | 1.34 |

| Yen / Dollar | 142.35 |

| Canadian /Dollar | 0.72 |

Profit: “The idea that this expansion will continue has been predicated on manufacturing weakness remaining contained, but this dynamic is increasingly being called into question.” That said, these numbers are seriously skewed by the GM strike and the Boeing 737 MAX accidents. “The data in aggregate suggest that U.S. economic growth is slowing, but not stalling. However, this is not necessarily true for the rest of the world. The risk of recession outside of the U.S. has been rising.” (Source: David Lebovitz, Tyler Voigt, J.P.Morgan Asset Management)

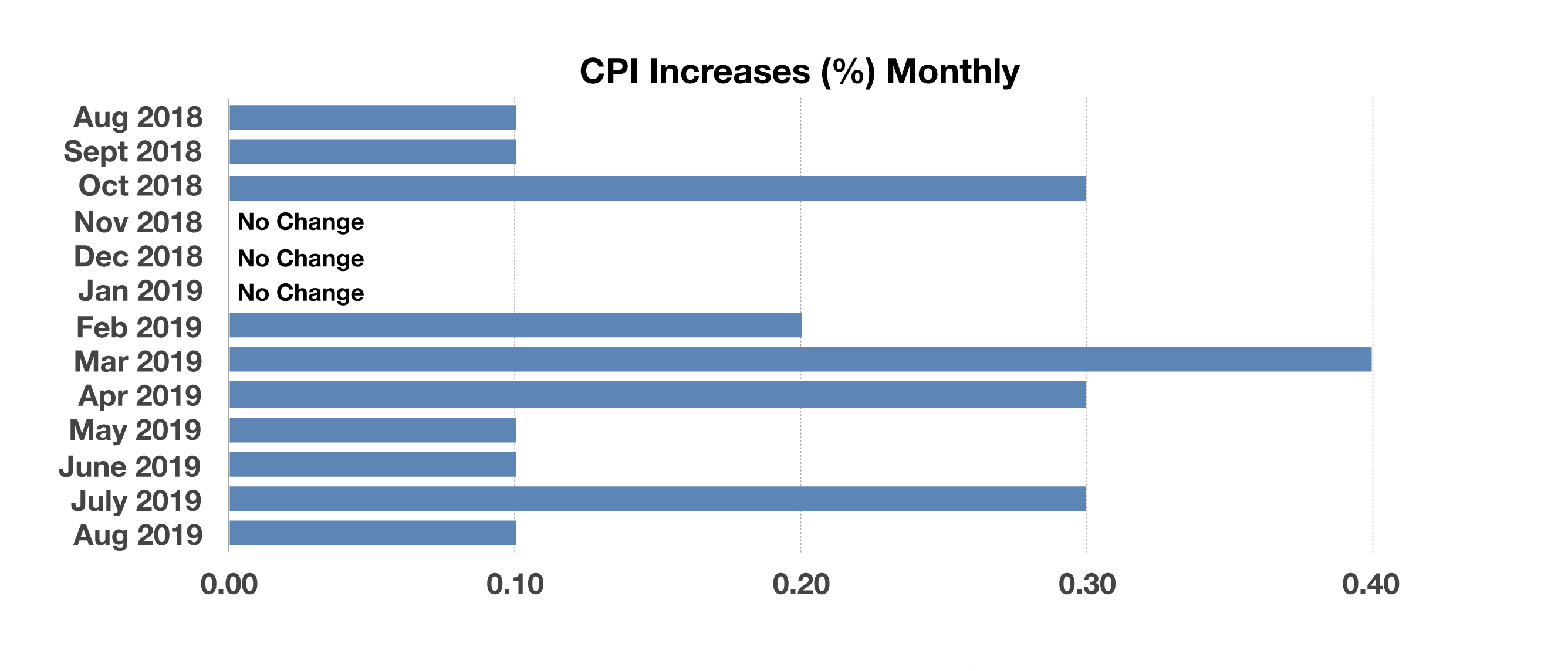

Liquidity: Inflation Picks Up – Consumer Trends

A measure of inflation as gauged by the Consumer Price Index (CPI) accelerated by more than forecast over the past year. The CPI, which excludes food and energy, rose 2.4% from a year earlier as reported by the Department of Labor. These statistics are tracked by the Labor Department since they affect all U.S. workers throughout the country. The latest reading of 2.4% may be considered inflationary by some economists.

Sentiment: Survey data has been weak relative to expectations, while hard data has fared better (Bloomberg U.S. Economic Surprise Index)

Sentiment has been a key driver of recent volatility, but fundamentals have not disappointed to the same extent as the surveys. Uncertainty continues to drive market volatility and Gold values are highly correlated to volatility.

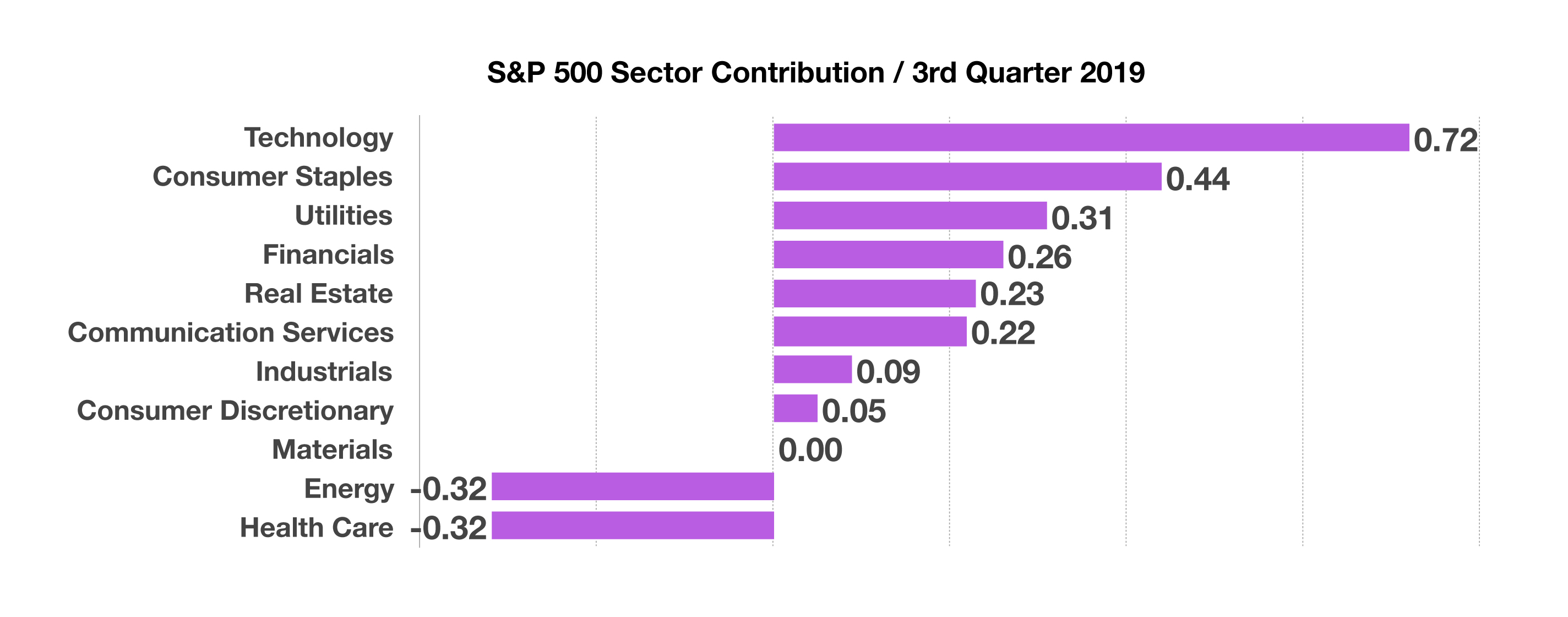

After multiple quarters of the same trends in momentum, September saw significant changes. While Large-caps continued to out-perform Small and Mid-caps, Value overtook Growth for the first time in a long time. Technology remains a favored sector while Healthcare has disappointed. KCG Sector Models are over-weight Real Estate and Consumer Discretionary. Interest rates swung from an upward trend to falling precipitously, making bond yields scarce and requiring a much more immediate response by KCG when an opportunity becomes available.